The ‘chaos’ check of UST and what lies ahead for its LUNA-tic cost

Stablecoins rose to fame following the trust factor; the value of stablecoins is based on people’s trust in the company holding the collateralized reserve asset. But, that trust may waver on occasion.

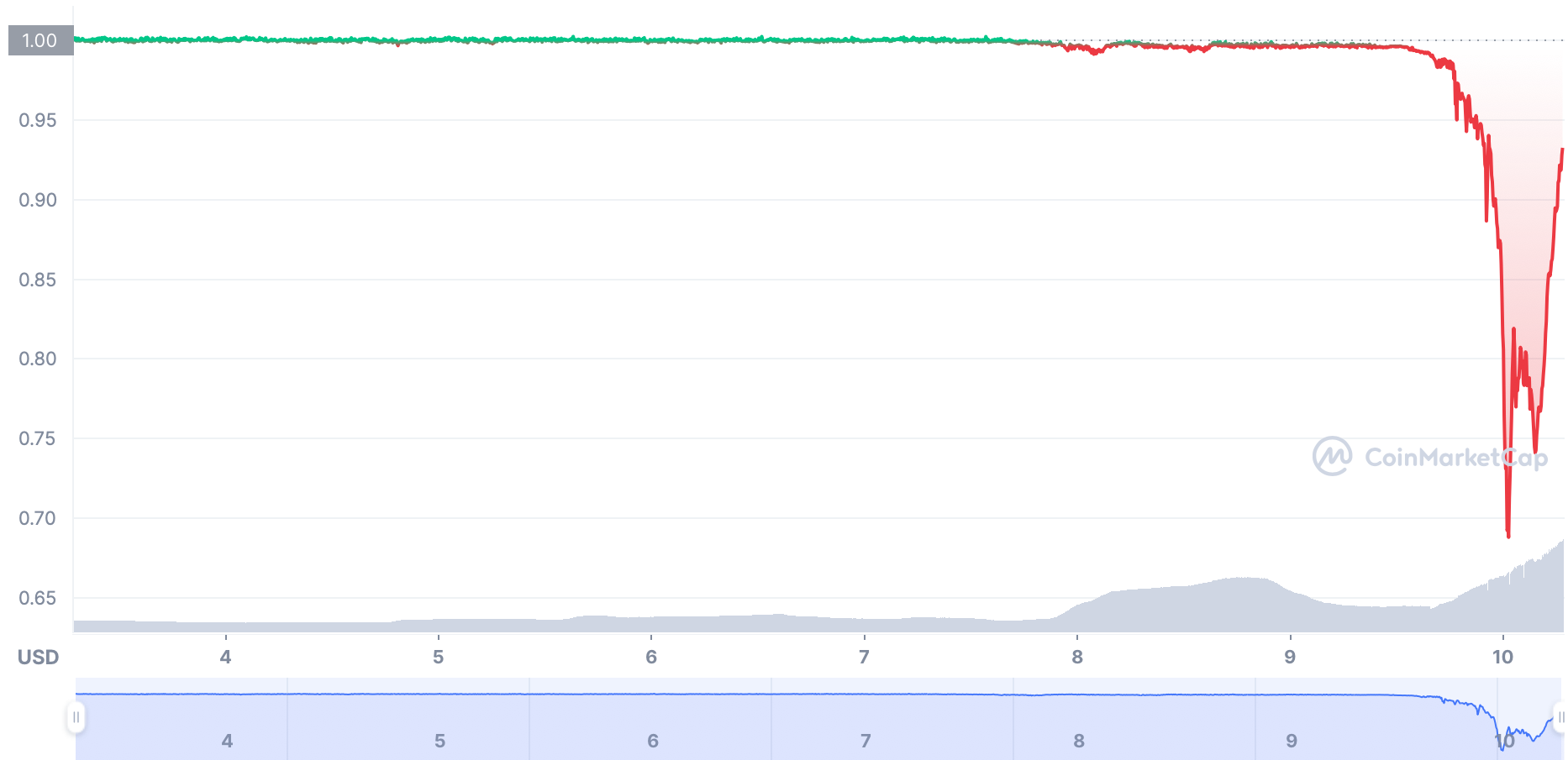

The third-largest stablecoin by market cap Terra USD (UST) appears to be in chaos as it continues to lose value against the U.S. dollar. In fact, stablecoin, TerraUSD, or UST dropped to as low as $0.67 (-7%) following a wave of speculations and censure within the crypto community.

Source: CoinMarketCap

To make things worse, the said freefall caused massive liquidations on leveraged positions. Thereby, dropping its market cap to $12.3 billion according to CoinGecko data.

Liquidated long on LUNAUSDT: Sell 225,537,000 @ 35.302 ????????????????????????????????????????????????????????????????????????????????????????????????????????????????

— REKT (@BXRekt) May 9, 2022

At press time, UST, despite the recovery phase was hovering around $0.90. The trust factor didn’t quite align with the said uptick. It’s important to note one concerning fact here. This incident invited speculations against UST’s ‘decentralization’ attribute.

No matter how this ends, I don't want people to call UST decentralized again. Even the little collateral backing it has is intransparent and controlled by a single party. Used to perform discretionary open market operations. This is like 10x worse than the Fed.

— Hasu⚡️? (@hasufl) May 9, 2022

Meanwhile, Do Kwon, founder, and CEO of Terra tweeted that he was “deploying more [capital].” And, this did happen within a gap of a few hours. As reported by Wu Blockchain, the Luna Foundation Guard did transfer a massive chunk of coins to stabilize the situation.

The Bitcoin address of the Luna Foundation Guard (LFG) has just transferred 28,205.5 Bitcoins to Binance, and the balance of the address is 0 now. The address transferred 42,530 bitcoins out earlier today and then transferred 28,205 bitcoins in. https://t.co/93L3GPcd7S pic.twitter.com/LEoUeuZshe

— Wu Blockchain (@WuBlockchain) May 10, 2022

Prior to this, the organization announced that it would lend $1.5 billion worth of Bitcoin to offset the fall. Both these transactions incorporated an aligned aim- to help TerraUSD regain its intended parity with the dollar. Post this, Terra stated that regaining the price peg “takes time… but it bounces back.”

But at a LUNA-tic cost

The market cap of LUNA (Terra blockchain’s native asset) fell lower than UST. This could signify insufficient funds in the Terra project to properly back the value of the algorithmic stablecoin and maintain its peg. Even though UST did showcase some recovery, LUNA witnessed major bloodshed.

The #14 ranked native coin shed as much as 50% in 24 hours. Primarily, because Bitcoin balance on Luna Foundation Guard (LFG) addresses fell to an all-time low.

That said, Binance, the largest crypto exchange halted withdrawals of LUNA and UST tokens on the Terra (LUNA) network. Mainly due to the high volume of pending withdrawal transactions, caused by network slowness and congestion.