The latest BTC crash has everyone in the market speculating ‘why’

- BTC registered a sudden crash right after the coin broke past the $30k level

- The initial speculation pinned the blame on Mt Gox but the wallets have not registered any movements

Bitcoin [BTC], the largest cryptocurrency in the market, continued on its upward trajectory in the first half of 26 April. However, this momentum came crashing down in a matter of minutes.

The coin had broken past the $30,000 barrier and reached a high of $31,050 on Coinbase. But, this gain was lost within minutes with the coin crashing to a low of $27,230 on the American exchange.

Is your portfolio green? Check out the Bitcoin Profit Calculator

According to CoinMarketCap, at press time, BTC was trading at $27,607.55 with a market cap of $543 billion. The trade volume of the king coin was over $29 billion. And, it had registered a loss of over 5% in the past hour after its dramatic crash.

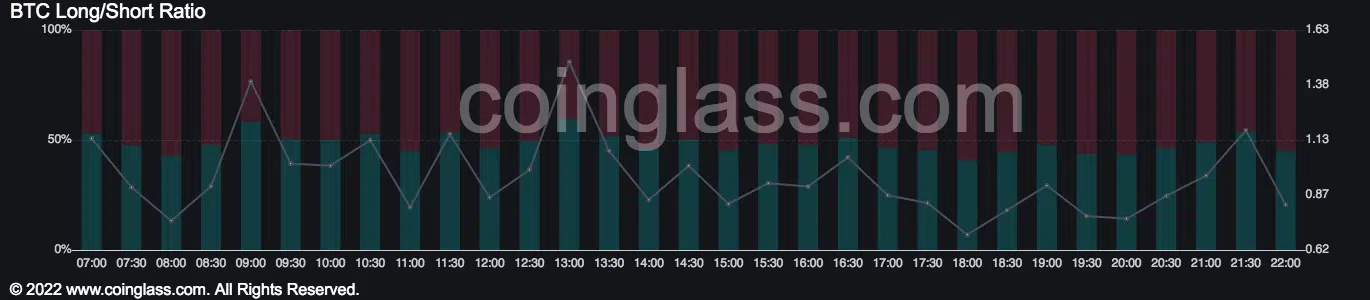

Moreover, the BTC Long/Short ratio on Coinglass shows that the short positions for the coin have overtaken the long positions. The ratio, at press time, in the 30-minute chart is 0.83:1, with the short positions making up 54.72% of the market. Meanwhile, the long positions consisted of only 45.28% of players in the market.

Source: Coinglass

BTC crash lights up the market

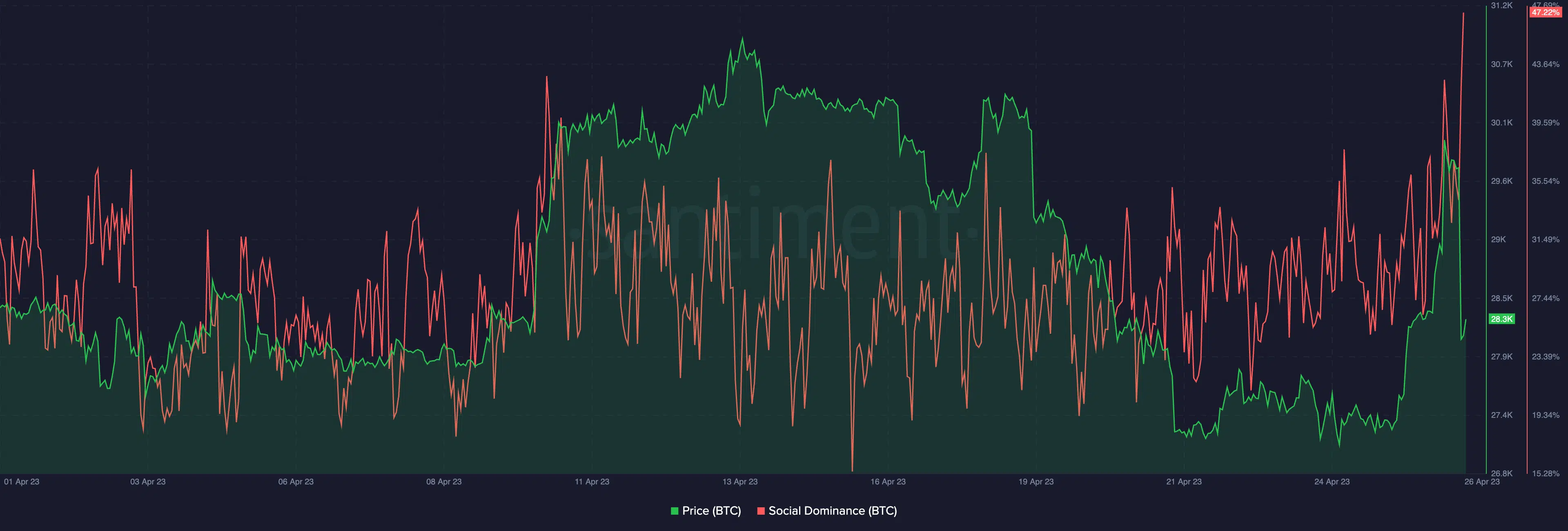

The sudden crash resulted in the market speculating on the reason behind the action. Additionally, as per the data on Santiment, the social dominance of BTC spiked right when the coin crashed. This indicates that the market was actively chatting about BTC’s latest development.

Source: Santiment

A tweet by Arkham Intelligence – a blockchain intelligence firm – pointed to a recent move made by Jump Trading. The intelligence platform stated that Jump Trading had moved $26.6 million in Bitcoin to exchanges.

A majority of the funds, amounting to $23.7 million in BTC were moved to Binance – the largest crypto exchange in the world. In addition, $2.18 million in BTC was sent to OKX, and around $720k in BTC to Bybit exchanges.

In the past hour, Jump Trading deposited a total of $26.6M of BTC to various exchange deposit addresses.

The main exchange deposited to was Binance, with Jump sending $23.7M to their BTC deposit address there.

However, they also sent $2.18M BTC to OKX and $720K BTC to Bybit. pic.twitter.com/AzoSeQMF55

— Arkham (@ArkhamIntel) April 26, 2023

Notably, a Tweet by DB – a crypto news alert Twitter handle, stated that as per Arkham Alert, the US Government and Mt Gox wallets were the ones to make these transactions. However, according to Bitinfocharts, none of the Mt Gox wallets had made any transactions.

Meanwhile, the claims on US Government making transactions also remain unconfirmed as the firm had yet not presented any transaction ids. According to the data on Dune, the US government has about 215k BTC, coins seized from Silk Road, Bitfinex hack, and James Zhong. These wallets, however, have not made any transactions this month.

Furthermore, the Twitter handle, WhaleChart claimed that reports of the U.S. government moving the seized BTC was false.

JUST IN;

Reports of US Government seized BTC being moved false.

— whalechart (@WhaleChart) April 26, 2023