These metrics paint a two-faced picture of what’s next for Litecoin

Over the year, the crypto-verse has seen some major pumps and dumps driven by FUDs which have severely affected the prices of tokens. Heck, even Bitcoin was not spared the wrath of FUDs, let alone meme coins like Dogecoin and Shiba Inu. However, one alt that has shown some resistance to the same is Litecoin.

The price of Litecoin spiked swiftly early on Monday, before falling back, after a news release touting a partnership with retail giant Walmart Inc. turned out to be fake. Nonetheless, despite the rest of the market being fairly lukewarm at press time, LTC was notably holding up better than the rest.

What has helped hold this currency’s price?

LTC’s OG coin club status

Litecoin, at one point, was valued at $240, up by almost 40%, after the issuance of a press release that touted a Litecoin-Walmart partnership. The altcoin’s trade volumes also saw their highest peak since 19 May. Alas, these numbers quickly fell after Walmart clarified that the news release was fraudulent.

While this definitely came as a blow, it was notable that LTC’s price didn’t drastically fall post the FUD.

For Litecoin, however, some good news followed a couple of days later. AMC made headlines by announcing it will support Bitcoin Cash, Ethereum, and Litecoin. While ETH and BCH’s prices didn’t note much of an impact, LTC’s price has strongly held on to the $170-support level.

It is possible then that Litecoin has held on so well since it is part of the OG coins’ club that has been around for a long time. Apart from that, the constant support by institutions has enabled its growth.

Even so, LTC’s metrics seemed to be painting a two-sided picture for the altcoin.

Here’s the metrics’ verdict…

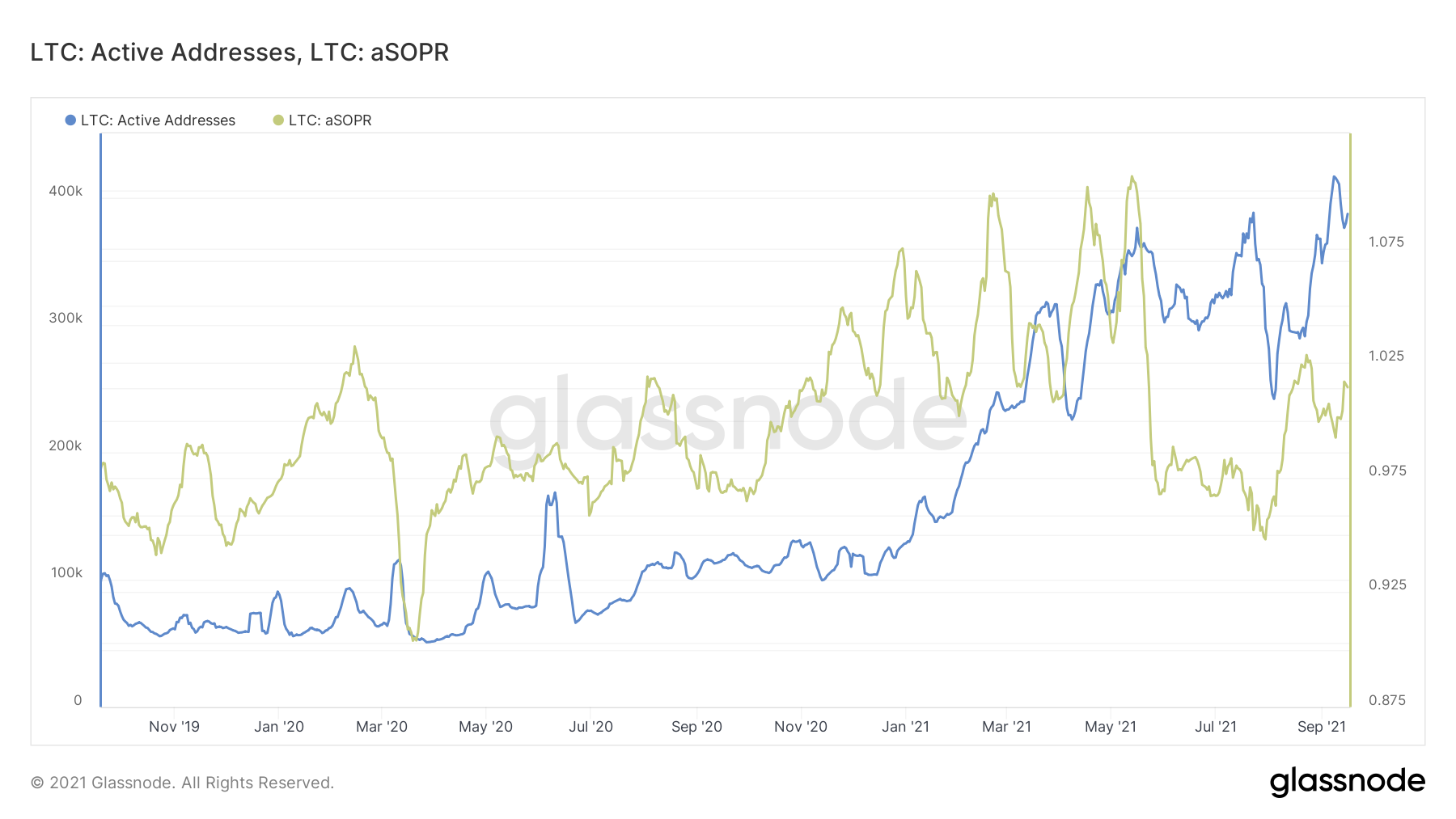

While active addresses for LTC were at an ATH on 8 September, they took a downturn soon after. The after-effects of the FUD weren’t as evident as active addresses were still higher than the numbers seen last year. The downtick in active addresses also saw signs of reversal post the FUD news as they were seen forming a V-shaped recovery curve.

Further, the aSOPR and dormancy highlighted contrasting patterns. Dormancy showed that older coins were in circulation – A bad sign for the price. What’s more, the aSOPR on different averages highlighted that profits are being realized.

Even with Litecoin’s price dropping at press time, its aSOPR was trending higher. This implied that profits are being realized with potential for previously illiquid supply being returned to liquid circulation.

Thus, while LTC’s mid-short-term trajectory looks like it may face certain bumps due to the larger market going down, long-term prospects look good. Further, LTC’s resistance from the FUD was proof of Litecoin’s market strength.

![Solana [SOL] gains on Ethereum [ETH] but faces sell-off risks](https://ambcrypto.com/wp-content/uploads/2025/04/5B92B32E-5F8B-49F6-94A3-D0086EF6CCA2-400x240.webp)