This Bitcoin aspect is ‘unbelievable’ for some, while it’s ‘too much’ for others

![Bitcoin [BTC] and other cryptocurrencies are too volatile to be a good store of value, Cryptoassets Taskforce](https://ambcrypto.com/wp-content/uploads/2018/10/matt-bowden-515724-unsplash-e1540902118162.jpg)

The recent bloodbath in the cryptocurrency market has had the community segregated into two sides: the long-term HODLers and short-term sellers. Many crypto analysts took a step forward to express their confidence in the market when BTC fell below key levels of support. Well, looking at the broader narrative, this wasn’t the first time Bitcoin experienced a significant fall.

On-chain analyst, Willy Woo tweeted:

Chart: User growth on the BTC network.

No-coiners are taking this opportunity to buy the dip.

In case you're wondering, the bull market is very much intact.

Data: @glassnode pic.twitter.com/4KtlscCs43

— Willy Woo (@woonomic) May 24, 2021

A reality check?

Taking into consideration, the month of May, one cant’s help but question if the community actually did take an advantage of this dip?

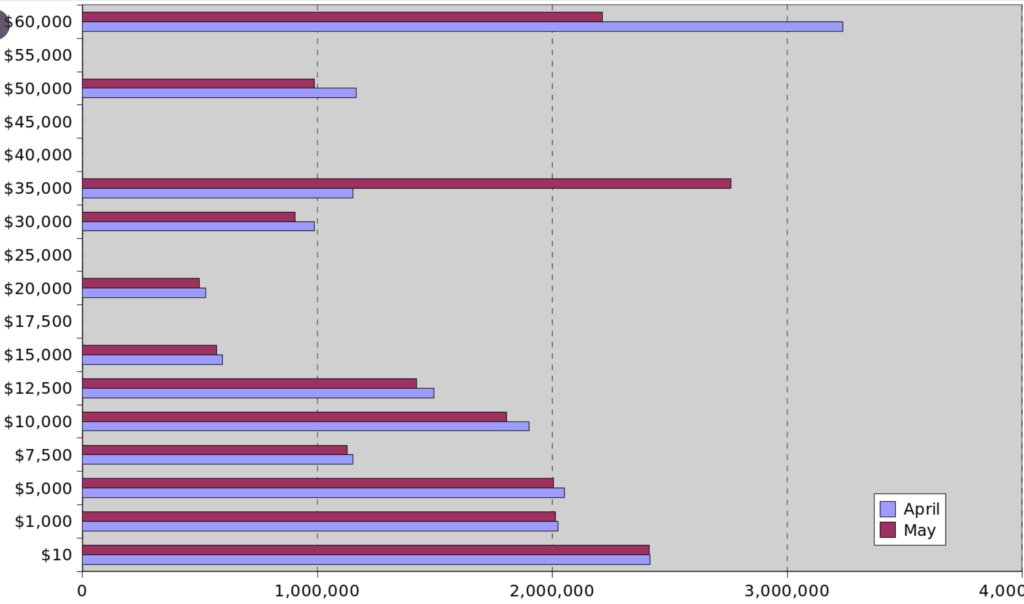

Renowned analyst who first worked on the stock-to-flow (S2F) model for bitcoin, highlighted why and how Bitcoin got to 35,000 levels and below. In a new Tweet, PlanB showcased the difference between the movement of price levels during April and May.

Source: PlanB Twitter

With reference to the graph, he further stated:

“In the chart, you see at what price level each of the total 18.7M BTC was last moved. So what happened in May? Weak hands sold ~1M BTC in May at $30k-35k .. which they bought in April at $55k-60k: a staggering ~$20B loss. The good news: these 1M are in strong hands now.”

Although, the analyst wasn’t really surprised by this development. He stated:

“For bitcoin veterans it is indeed unbelievable and embarrassing, but for noobs this volatility can be too much. we all know the kind of people that sold in May, look around you, these are always the same people.”

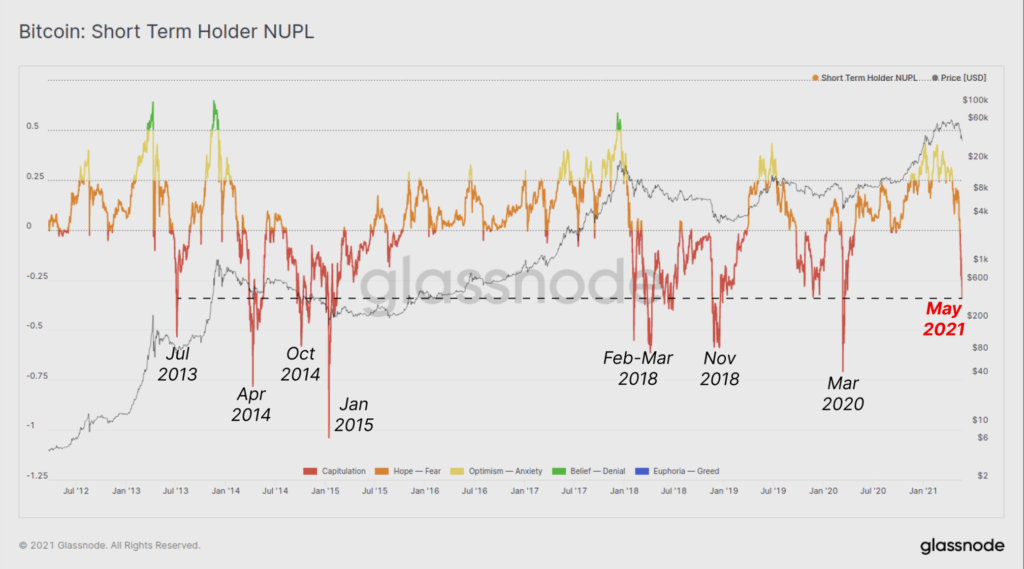

An in-depth analysis by Glassnode stated that “over $2.56B in net losses were taken on-chain on 19 May, a sum that is 185% larger than the March 2020 COVID sell-off.”

BTC still on track?

As per PlanB’s previous tweets, Bitcoin was set to reach the $100,000 level based on the stock-to-flow model and $288,000 according to the stock-to-flow cross-asset (S2FX) model.

He had further stated,

“I am less interested in $100K-$288K but focused on 2024 halving and beyond. I don’t care about volatility, asymmetric return is key ($0 vs. $1 million).”

The world’s leading crypto-coin did witness a bumpy ride over the past couple of weeks. However, at the time of writing, BTC was trading at the $38k price level with a correction of around 6% in the last 24 hours.