This is why Ethereum 2.0 stands to be the greatest HODL incentive for ETH investors

Ethereum [ETH] surged by more than 60% in just 10 days, and spiked from just above $1,000 to roughly $1,650. This strong uptrend highlights the strong demand for ETH and it places the next major price target at $2,000 but will it recover above this level by the end of the month?

The sharp recovery came after the market confirmed that the risk of downside had subsided. Such a rapid recovery confirms that investors have been eager for the market to recover so that they can ride the bulls. However, this is not the only reason why ETH registered such a strong recovery.

The upcoming “Merge”

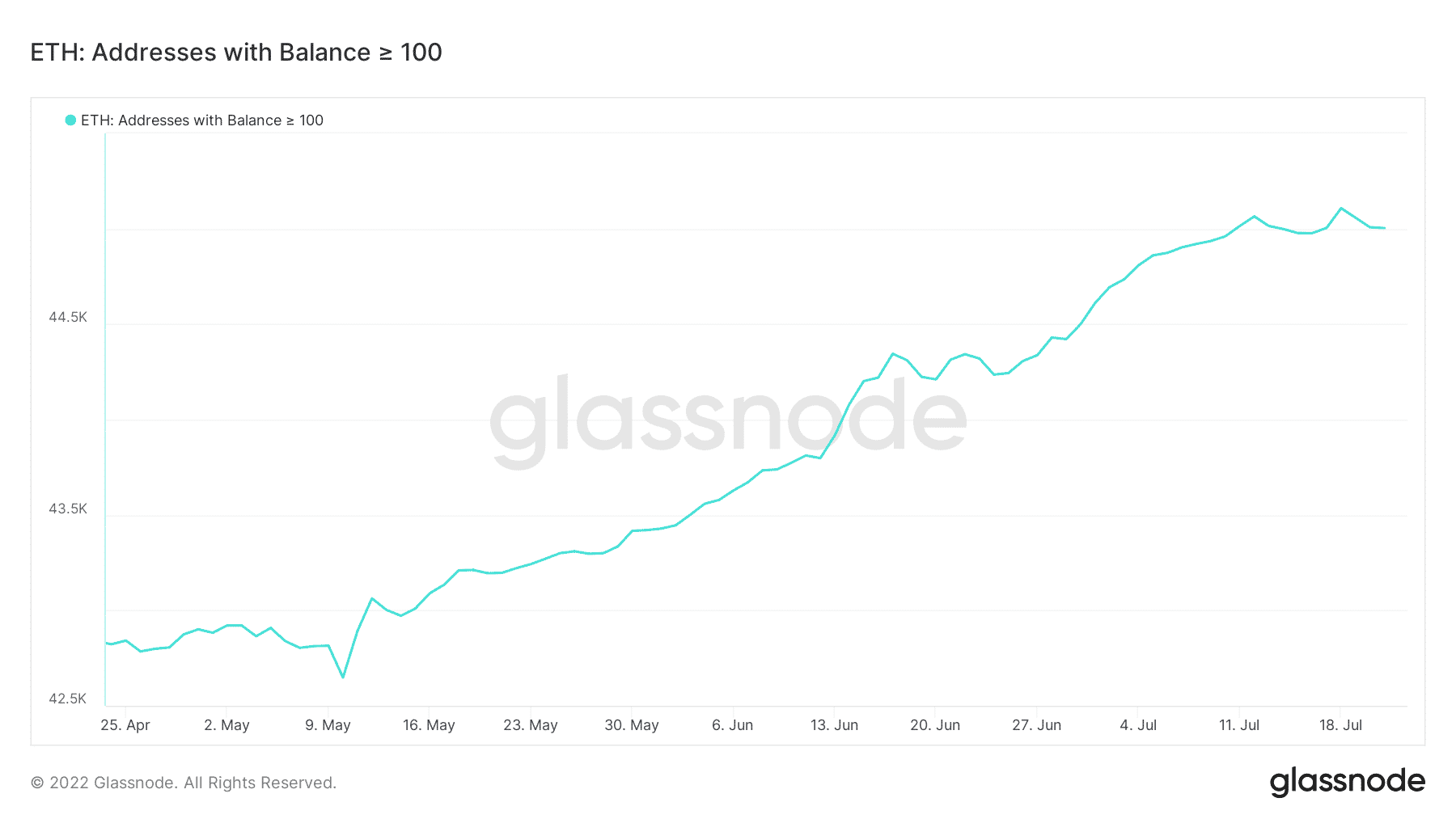

The Ethereum community has been preparing for Ethereum 2.0 transition for months now. The merge will take place soon and a major update will be released in August. Furthermore, market recovery means many investors may invest in ETH due to the fear of missing out on the lower prices. In fact, addresses with more than 100 ETH have been growing steadily in the last three months, adding to the bullish pressure.

Many believe that the merge will contribute more value to ETH’s price and that the latest dip in the last few months might be the last time it will be that low. The same metric indicates that there have been some outflows from those addresses after the recent rally.

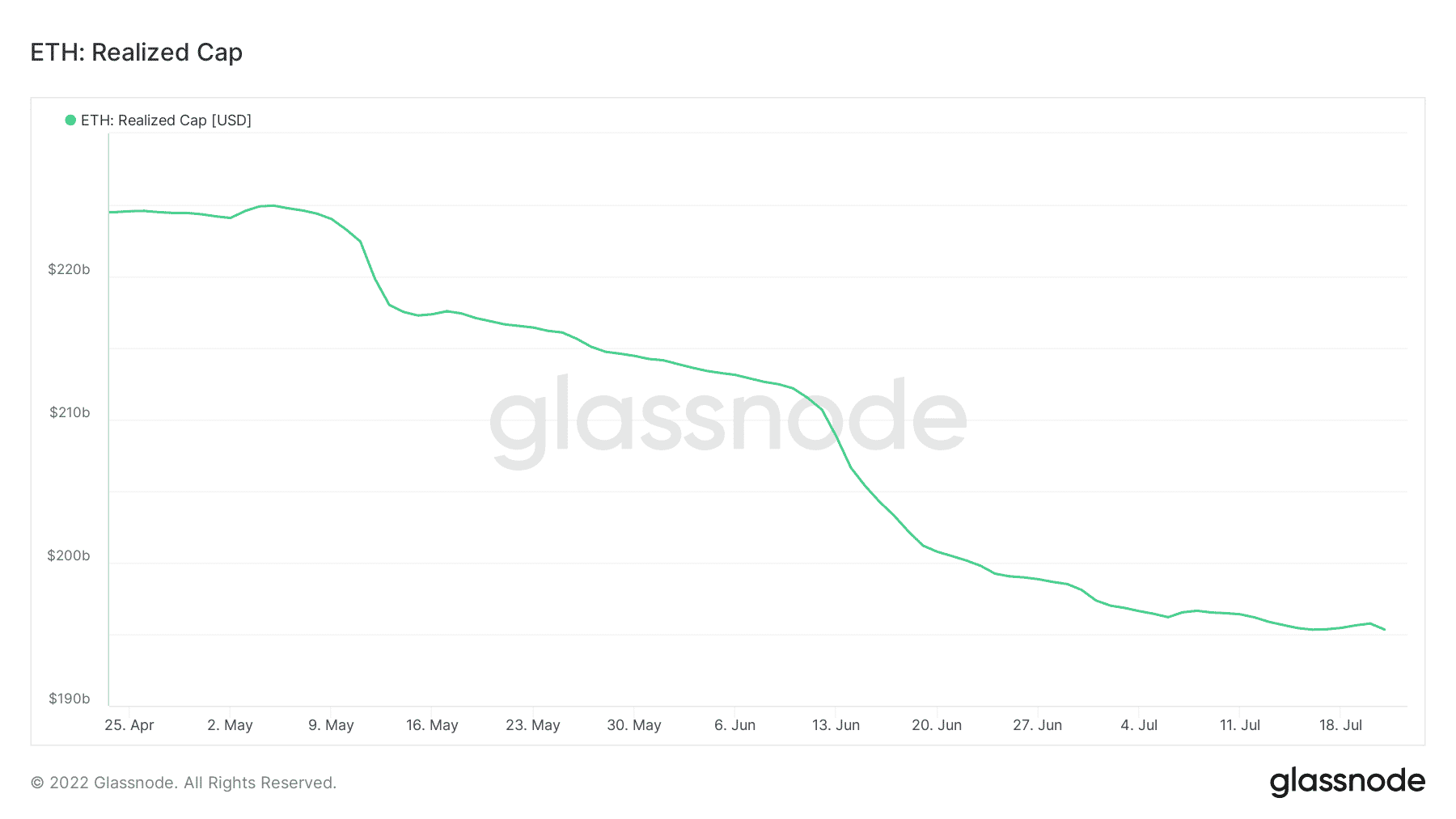

ETH’s realized capitalization has steadily declined during the month. This confirms that most of the buyers paid a lower purchase price than ETH’s current market price. Many of the buyers in the last three months are thus in profit.

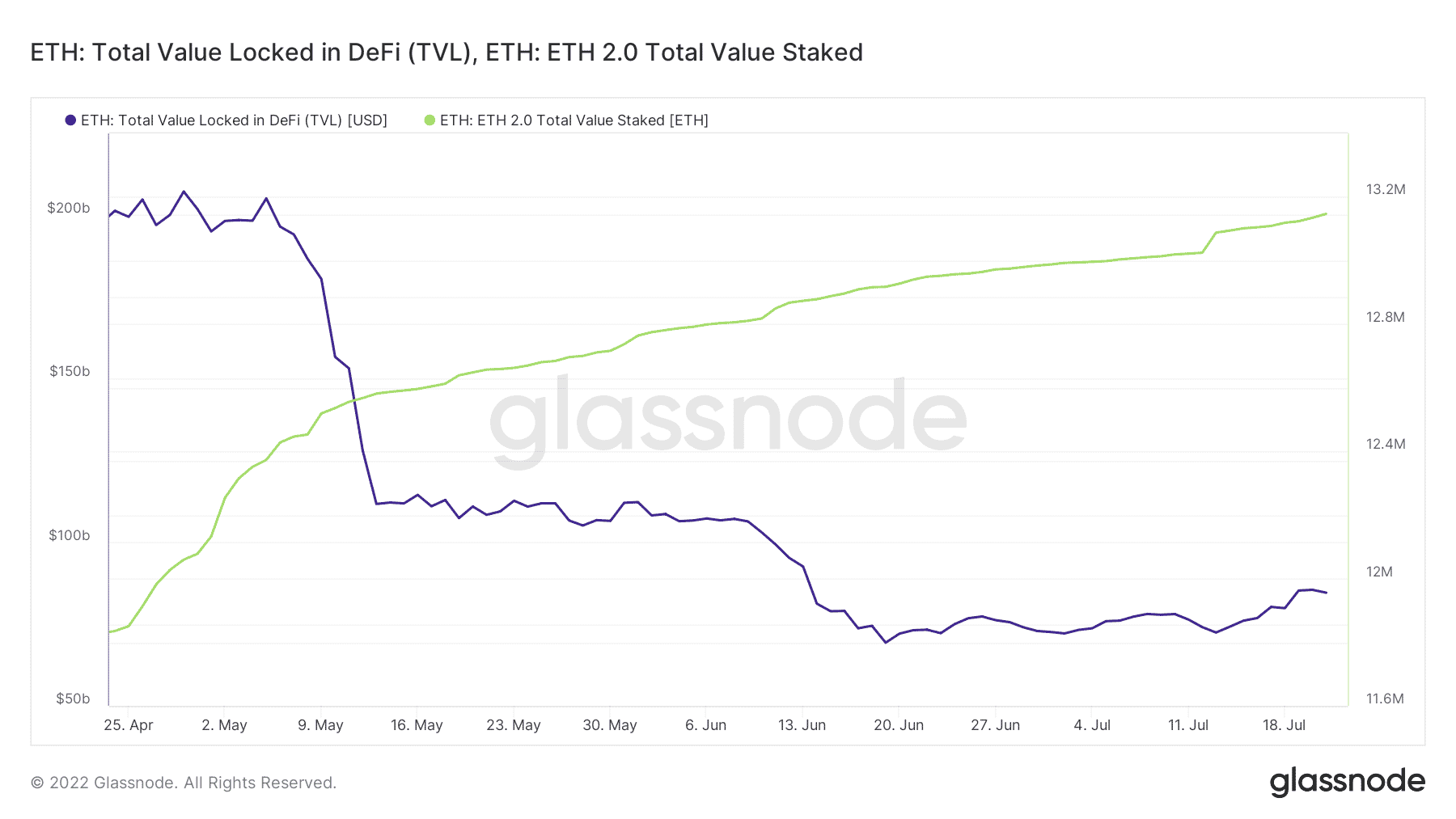

These metrics confirm that investors have been heavily accumulating ETH ahead of the merge. The lack of a subsequent sharp selloff confirms that many of them are looking for mid-to-long term gains. Many ETH holders have also opted to stake their ETH ahead of the merge. Outflows from DeFi staking facilities also highlight the extent of the merge’s impact ETH movements.

The great exodus

ETH’s latest price movement has confirmed a certain level of demand. It makes little sense for holders to sell their ETH and forego more potential upside in the days leading up to the merge. In summary, the migration to ETH 2.0 is the currently greatest HODL incentive for ETH holders.

ETH’s current level is still relatively low and demand at current levels might contribute to recovery above $2,000 before the end of July. If not, the intense demand will likely manifest in August. However, investors should still watch out for unexpected pullbacks which will offer opportunities to investors at lower prices.