Three reasons why BTC may correct despite the recent bullish uptick

Bitcoin price saw a massive uptick in bullish momentum in the last week, causing it to surge and retest crucial resistance barriers. The optimism stems from the fact that Terra Labs has been buying up BTC to back its stablecoin reserves.

Regardless, the uptick in price seems to have hit a dead-end and is likely to reverse its direction soon.

At wits’ end

Bitcoin price rallied 18% since 14 March and tagged the $44,439 resistance barrier for the third time. This uptrend comes after BTC set up the fourth higher low since 22 January. Connecting trend lines across these swing points results in an ascending triangle.

This technical formation forecasts a 21% upswing, obtained by adding the distance between the first swing high and low to the breakout point at $44,439. This measurement puts the target at $53,829.

Interestingly, this target is present just above the equal highs formed at $51,993, making this outlook more appealing.

However, the uptrend is not as easy as it looks and BTC bulls need to break through multiple barriers to get to the endpoint. The daily demand zone, stretching from $45,666 to $47,758 is the first barrier BTC needs to face. Clearing this hurdle will exhaust the bullish momentum, making a further uptrend more unlikely.

A rejection at the ascending triangle’s upper trend line will indicate a weak bull camp and knock BTC down to the $41,888 support level. Failing to hold this footing will lead to a further retracement to the $37,033 barrier.

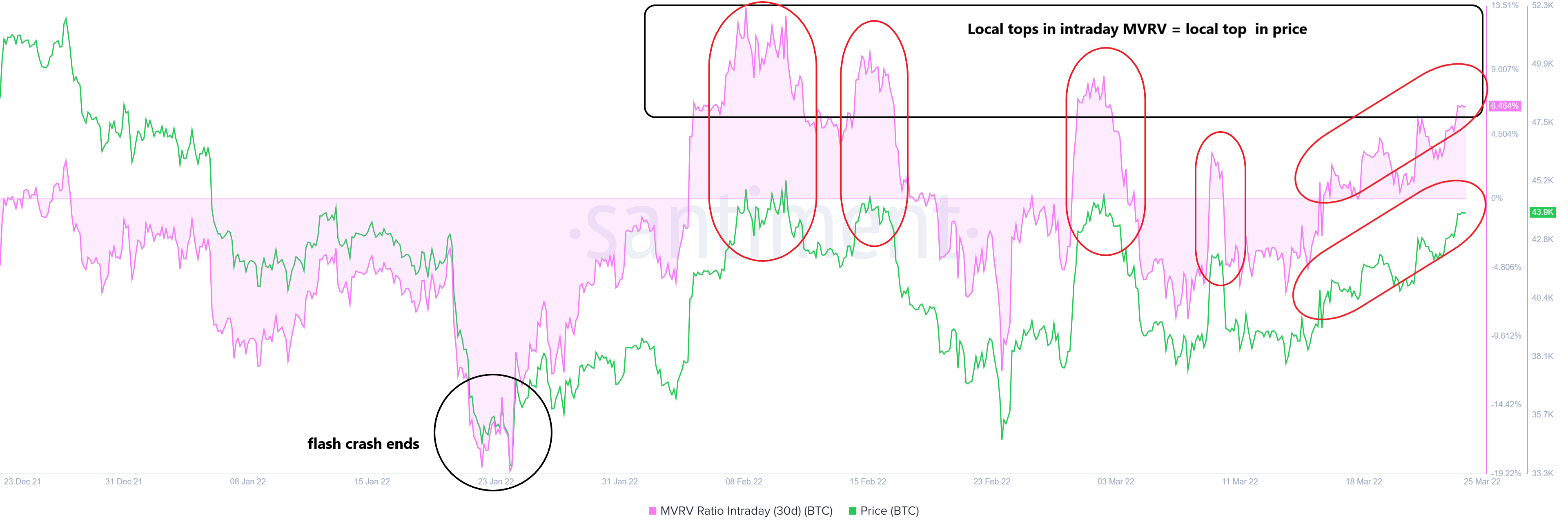

Supporting this correction outlook for Bitcoin price is the 30-day intra-day Market Value to Realized Value (MVRV) model. This indicator is used to assess the average profit/loss of investors that purchased BTC tokens over the past month.

A positive value suggests that the short-term holders are in profit and are likely to sell to realize their gains causing a retracement. Judging from the two-month history, the intra-day MVRV has topped off anywhere from 6% to 14%, predicting the local tops.

Therefore, the recent uptick in intra-day MVRV to 6% indicates that a retracement is around the corner, supporting the technical outlook.

If Bitcoin price produces a daily close below $37,000, it will invalidate the bullish thesis. This development could potentially trigger a crash to $35,000, which is the last line of defense, preventing BTC from crash to $30,000 or lower.