Traders might have missed these spikes and dips on WBTC, WETH’s charts

When the larger crypto-market faced the brunt of Bitcoin’s southbound rally, Wrapped Bitcoin (WBTC) and Wrapped Ethereum (WETH) didn’t do any better. Even though these alts mirrored more or less the same price action as the top two coins, Bitcoin and Ethereum, respectively, certain alarming spikes and dips in their metrics pointed to investor actions and patterns that were notable amid this bloodbath.

What do new addresses patterns point to?

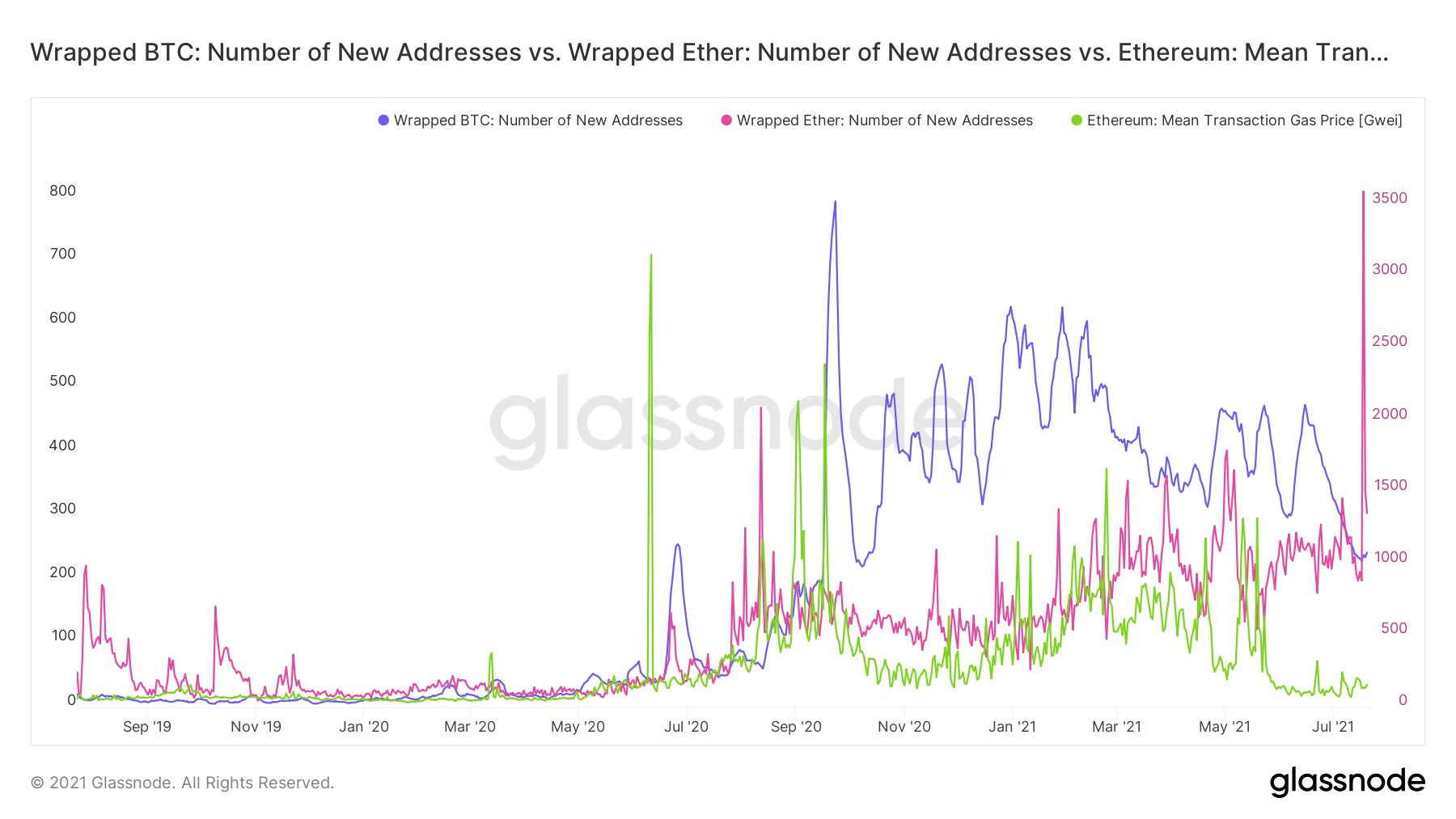

A rather unusual spike in new addresses for WETH was noted on 18 July, one which took the total number of new addresses to a staggering 3596. This number was almost double the previous high on 01 May this year. While several factors may have contributed to the same, one which stands out and might have been the largest contributor was the drop in gas prices.

In fact, the chart below clearly highlights a correlation between low gas prices and the uptick in new addresses for WETH.

Source: Glassnode

Further, it was noted that the number of new addresses for WBTC had been declining since 15 June, testing October 2020 levels at the time of writing. While the total number of addresses doesn’t necessarily point to a bearish or a bullish trend, they do point towards the possibility of increased liquidity in the DeFi space.

A blog by Consensys had recently pointed out that the rise of decentralized exchanges (DEXs) and the rise in their trade volumes could be attributed to WETH which makes it simple to swap ETH for any other ERC-20 token.

Maker DAO events: liquidation, debt creation, and repayment activities

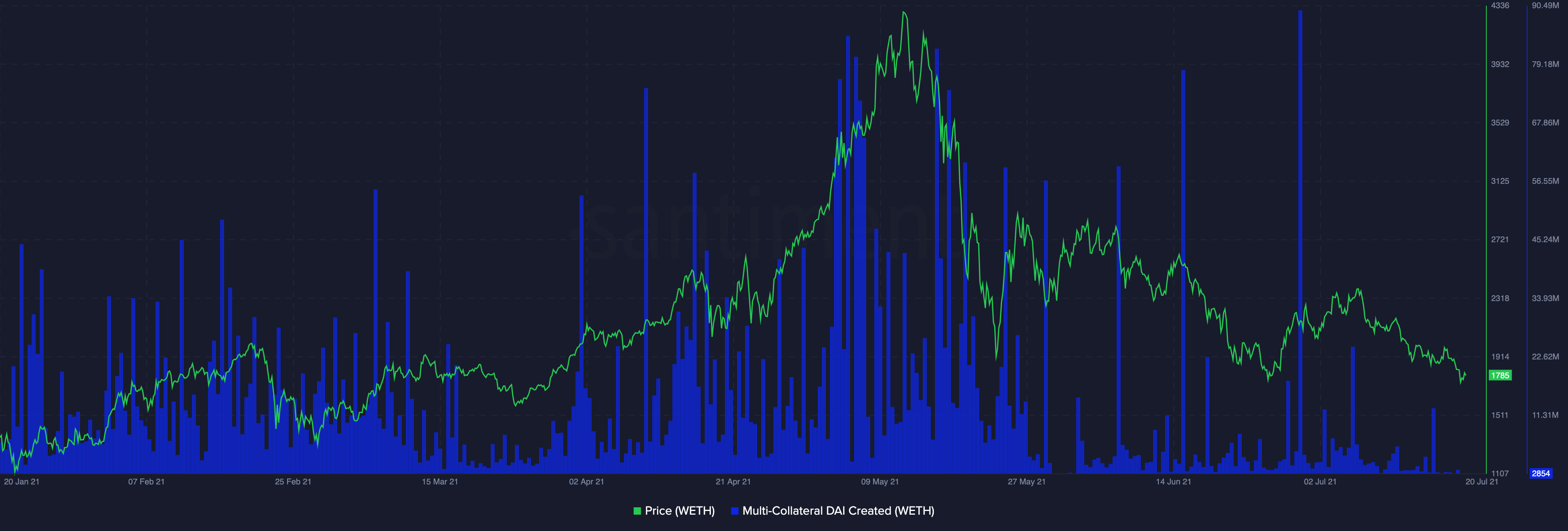

The sheer rise in WETH new addresses could also be attributed to the debt being repaid in Maker. A recent Santiment report had highlighted that the last drop in ETH’s price saw new spikes in debt repaid (collateralized by WETH) as participants got nervous about having their assets liquidated.

Looking at the general market sentiment through this metric further represented that it is a good sign of confidence waning. A close observation of the times when this behavior occurred (repaying debt) on the chart, often marked the bottom for a bounce.

DAI repaid; Source: Sanbase

Further, another recent report highlighted that no new debt was created, pointing to a lack of confidence from traders to mint new DAI. About liquidations, strong spikes indicate a strong pain level, and a look at liquidations historically has shown that liquidations “tend to pinpoint the bottoms. ” It means we might see something similar for a bounceback.

Liquidations historically; Source: Sanbase

Further, strong debt creation spikes indicated the potential to cause a further drop in prices. A six-month-long time range showed how many debts we might want to see for another dip and it underlined that there are definitely more than we can see now.

Source: Sanbase

What about WBTC?

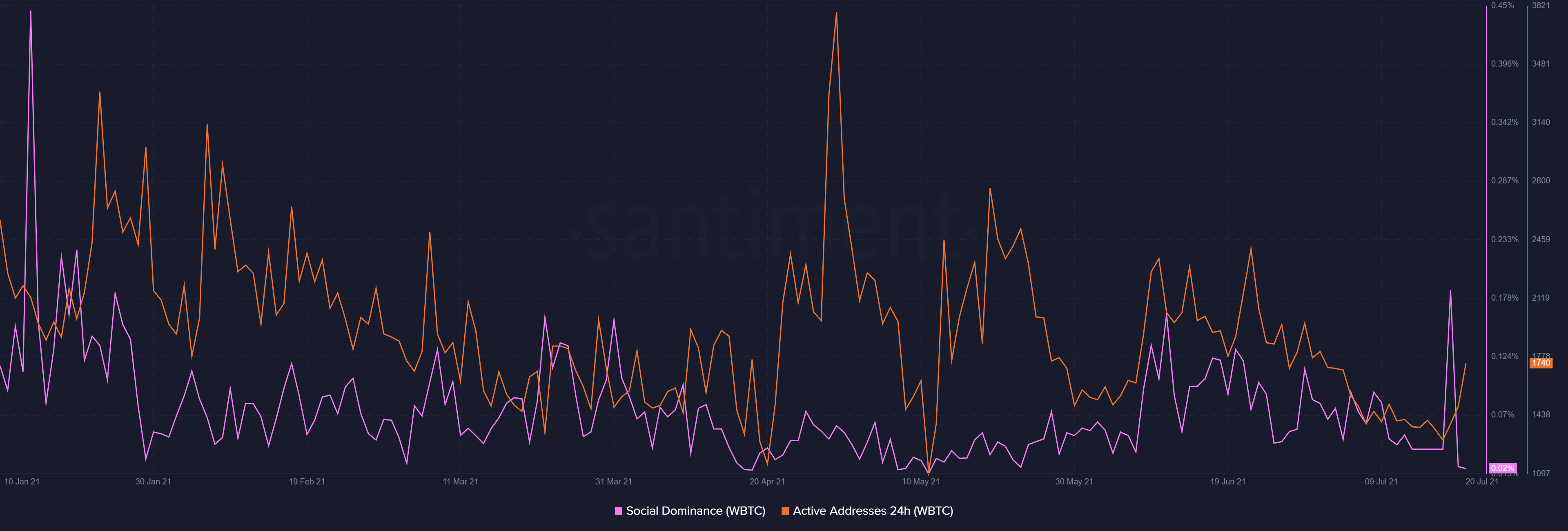

WBTC, had fewer new addresses when compared to WETH. However, looking at its 1-day chart, it was evident that active addresses for WBTC touched monthly highs recently. Furthermore, social dominance for the token also spiked to high levels last seen in January this year. This pointed to increased interest and traction for the token.

However, that spike in social dominance didn’t last long and fell sharply soon after.

Source: Sanbase