The chances of TRX taking Tron’s lead are…

- Tron’s TVL and fee growth underscore the reasons for TRX’s strong performance.

- TRX sees a resurgence of sell pressure but holders retain some optimism.

The crypto market managed to pull off a bullish performance during the weekend. Unfortunately, Tron’s TRX showed signs of slowing down which wasn’t surprising considering its previous bullish performance. But will we see a new wave of profit-taking or will TRX retain its May gains?

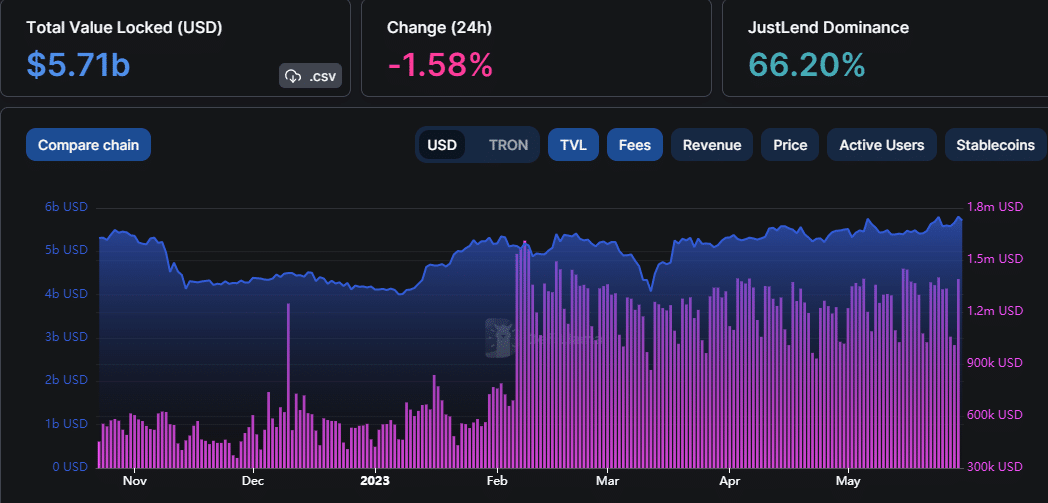

Perhaps answers to the above questions might be found within the very reasons for TRX’s bullish run. We saw a sizable uptick in Tron’s TVL which has held steadily above $5 billion at least in the last three months.

Is your portfolio green? Check out the Tron Profit Calculator

Similarly, the amount of fees that the network generated grew substantially in the last five months.

The growth registered in TVL and fees indicated that the network unlocked more utility during the last few months. In addition, the higher TVL suggested that investors were now more confident than ever. Hence, most TRX holders have a long-term focus. As such, many have decided to stake their TRX.

Can TRX bulls put up a good fight against the bears?

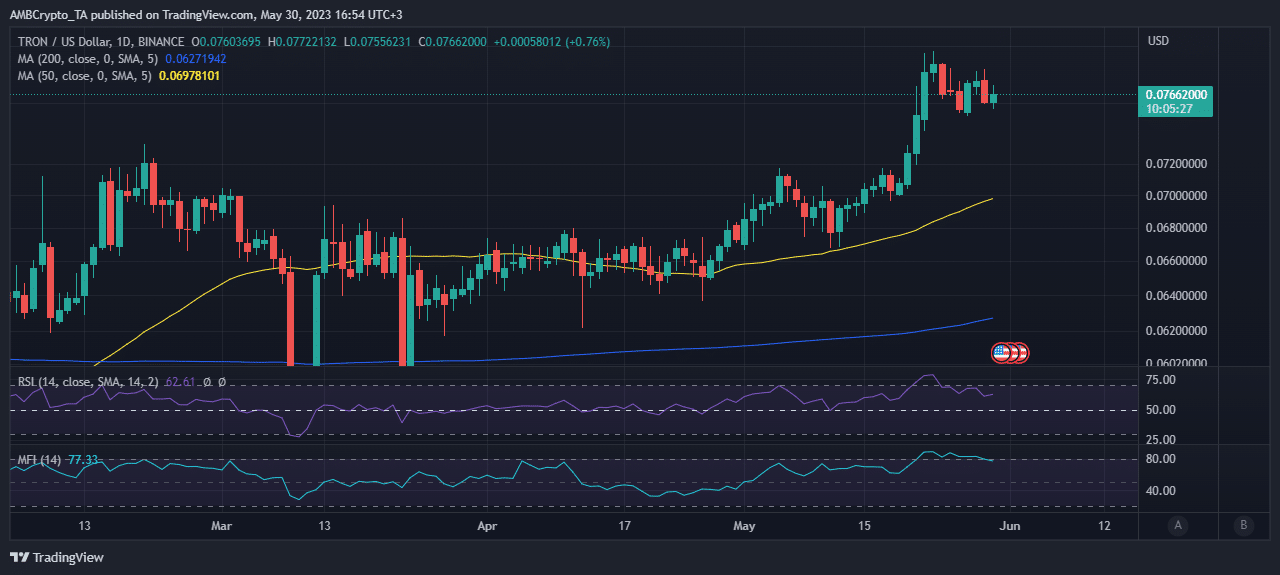

There was lower short-term sell pressure given that a substantial amount of TRX was staked. It may explain why TRX has not experienced a sizable wave of sell pressure despite its recent plateau. TRX’s $0.0763 price action, at press time, represented a 3.6% downside from its latest peak.

TRX bulls have certainly lost some momentum as indicated by the Relative Strength Index (RSI). Furthermore, there was some profit-taking after the price became oversold but it has been restricted. Hence, the lack of significant downside for now. Can on-chain metrics point to TRX’s next bias?

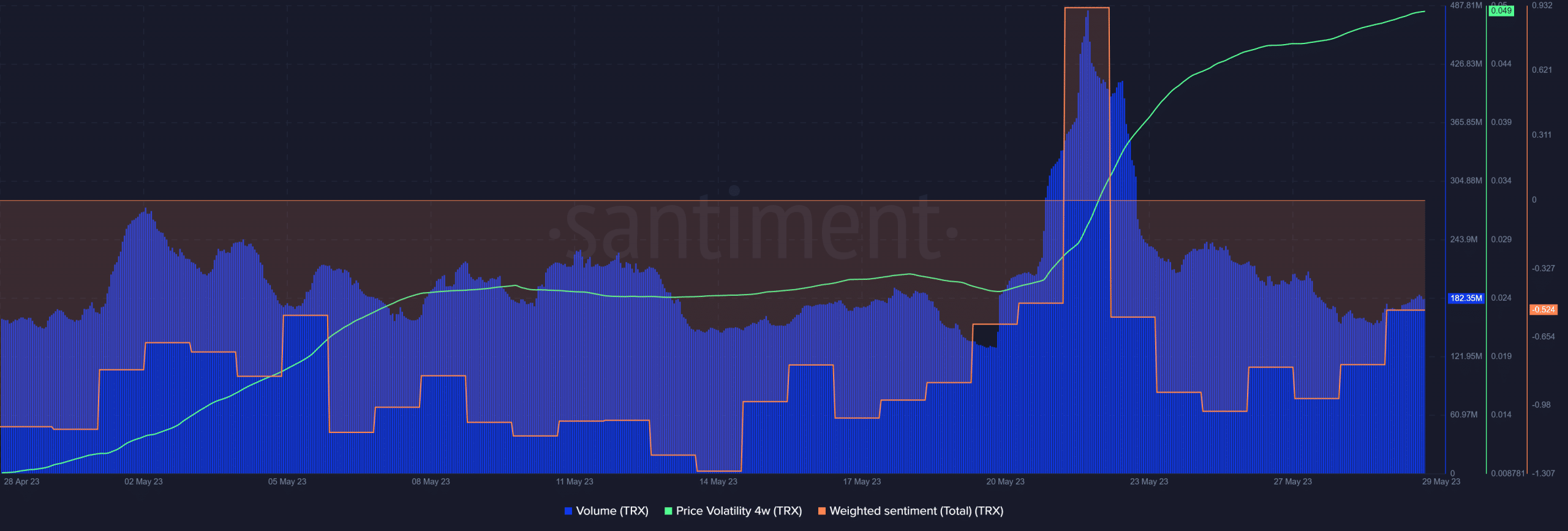

TRX volume pulled back after peaking between 22 and 23 May, marking the start of bullish weakness after the previous rally. The same applies to investor sentiment which took a dive after the peak. However, the weighted sentiment has been recovering gradually, indicating that there are investors that are still confident about TRX’s short-term prospects.

Despite these findings, TRX’s volatility maintained an upward trajectory despite the recent slowdown. Meanwhile, the derivatives segment painted a different picture.

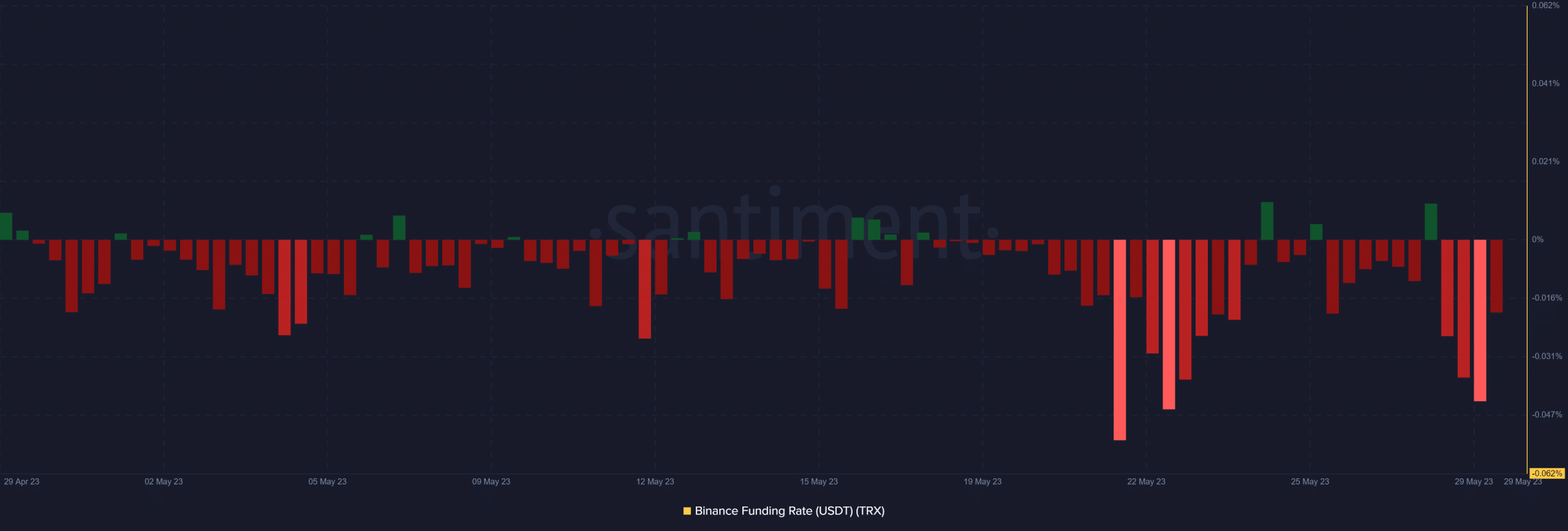

Binance’s funding registered a spike in negative funding rates at the peak of last week’s rally. It registered another spike in negative funding rates in the last four days.

The negative funding rate may be an indicator that short traders in the derivatives market anticipate more price weakness in the few days to come.