Tron [TRX]: Highlights from the world of staking and metrics

![Tron [TRX]: Highlights from the world of staking and metrics](https://ambcrypto.com/wp-content/uploads/2023/05/TRX.png)

- Last week, Huboi announced the listing of sTRX and started sTRX/TRX pair spot trading.

- Long/short ratio went up while TRX’s price increased by 3% last week.

Tron [TRX] recently posted its weekly highlight on Twitter, discussing most of the notable developments that happened in its ecosystem.

The milestone of the week was the listing of sTRX on Huboi and the commencement of spot trading for the sTRX/TRX pair.

?Check out #TRON Highlights from this week (Apr 22, 2023 – Apr 28, 2023).

?We'll update you on the main news about #TRON and #TRON #Ecosystem. So stay tuned, #TRONICS! pic.twitter.com/6lb4arcVlb

— TRON DAO (@trondao) April 30, 2023

Read Tron’s [TRX] Price Prediction 2023-24

Huboi mentioned in the official announcement that STRX spot trading will open when the deposit volume meets the demand of market trading, which will be officially announced in advance.

Apart from this, another major development from last week was related to QuickNode. The blockchain development platform extended support for Tron, allowing users to access the Tron network from QuickNode.

Nothing is helping Tron Staking

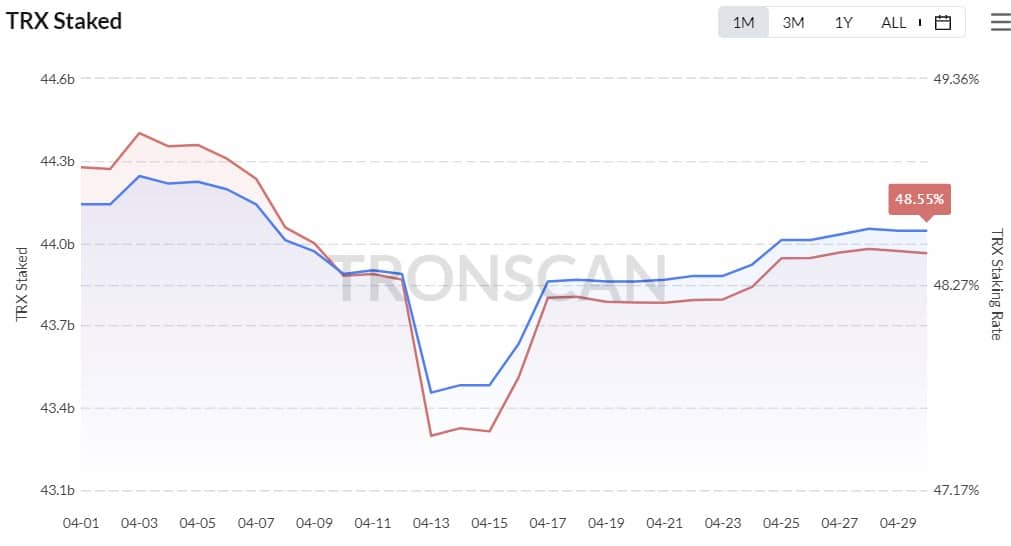

The last week was not a good one for TRX staking, as it registered a continued decline. As per Staking Rewards, the total number of TRX stakers decreased, which had already been on a declining trend for weeks.

The total amount of TRX staked, which earlier registered signs of recovery, plateaued over the last few days. These metrics suggested declining interest of stakers in TRX despite the Stake 2.0 launch.

On-chain performance was not satisfactory

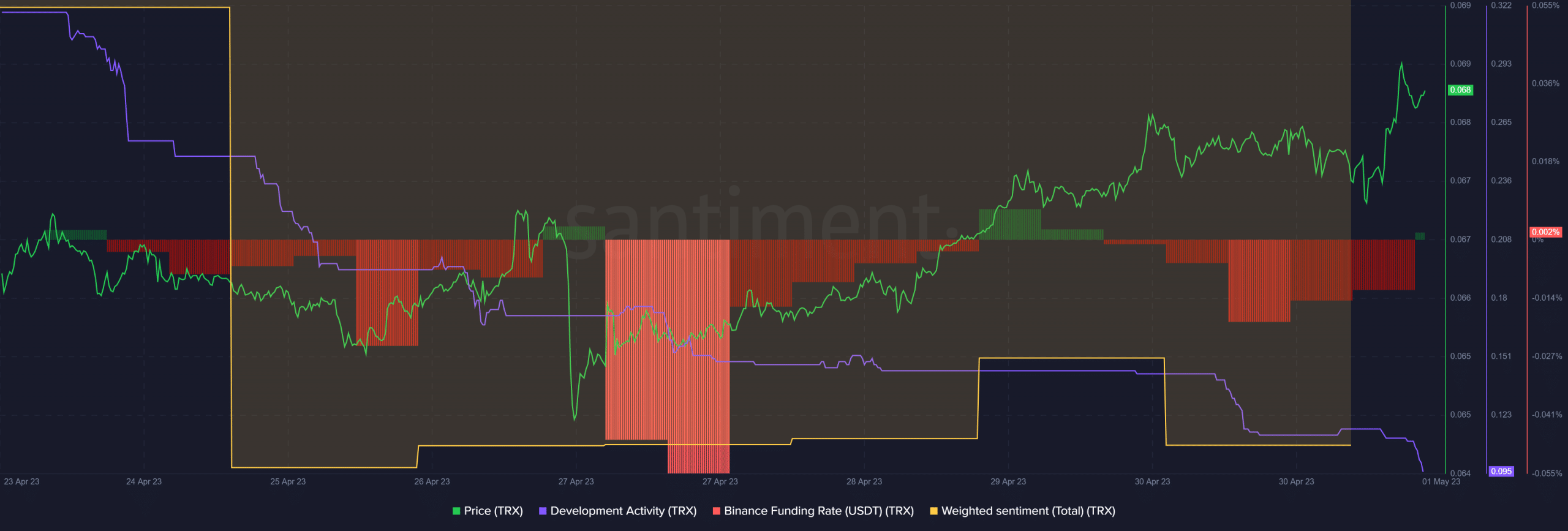

Other metrics of the Tron network were also showing signs of weakness. For instance, Tron’s development activity plummeted, which in general is a negative signal.

In fact, TRX’s demand in the derivatives market was also low, something that was very evident from the reading of Binance funding rate.

The weighted sentiments metric remained on the negative side throughout the week, suggesting that negative sentiments were dominant in the market.

However, the good news was – TRX’s long/short ratio spiked on 1 May. A high ratio indicates bullish market sentiment. Thus, suggesting a price uptick in the coming days.

TRX’s price action remained bullish

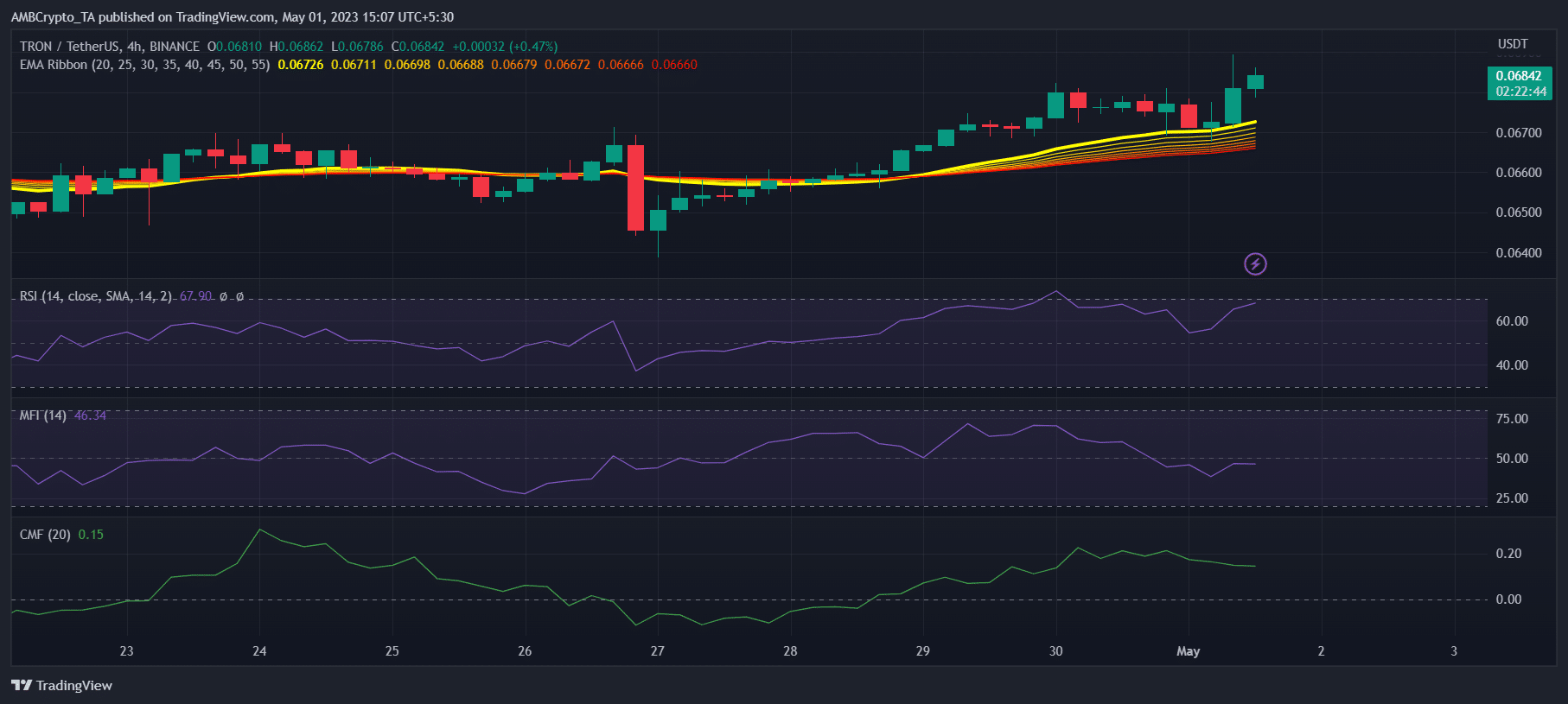

The on-chain performance was not the best, but TRX’s price action made investors happy. According to CoinMarketCap, TRX’s price increased by more than 3% in the last seven days. At the time of writing, it was trading at $0.06859 with a market capitalization of over $6 billion.

How much are 1,10,100 TRXs worth today?

Furthermore, the coin’s Exponential Moving Average (EMA) Ribbon revealed that the bulls had the upper hand as the 20-day EMA was above the 55-day EMA.

However, things might slide out of Tron’s hand as its Relative Strength Index (RSI) was about to enter the overbought zone.

Lastly, the Money Flow Index (MFI) and Chaikin Money Flow (CMF) both took a sideways path, which can restrict TRX’s price from going up further.