Unique addresses in DeFi increase 10X, here’s why that matters

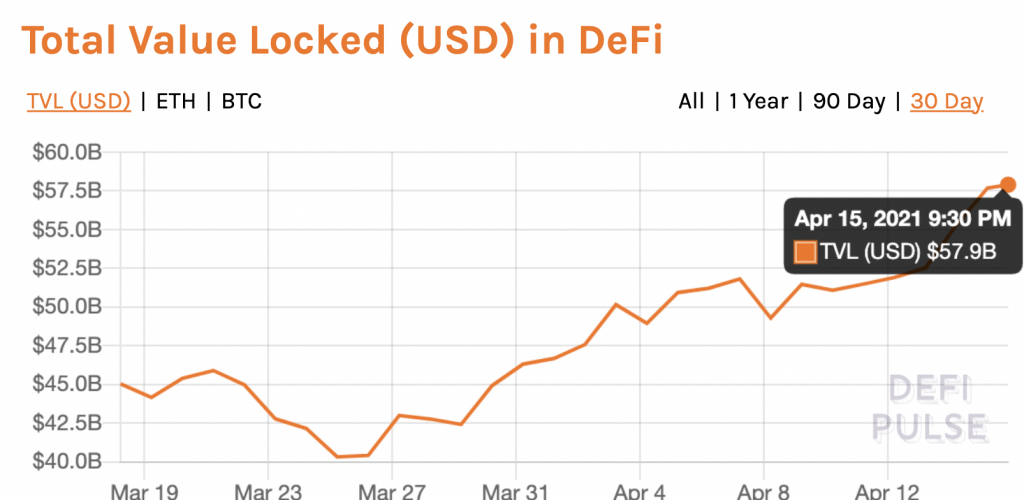

With the launch of new DeFi ETFs, DeFi tokens are seeing a surge in interest even in comparison with NFT marketplace tokens and top altcoins. Though gas fees were considered as a hindrance to institutional adoption of DeFi, ETFs have increased investment inflow, both retail and institutional. DeFi’s TVL has increased to $57.9 Billion, the growth is nearly vertical in the past 30-days.

DeFi’s TVL || Source: DeFiPulse

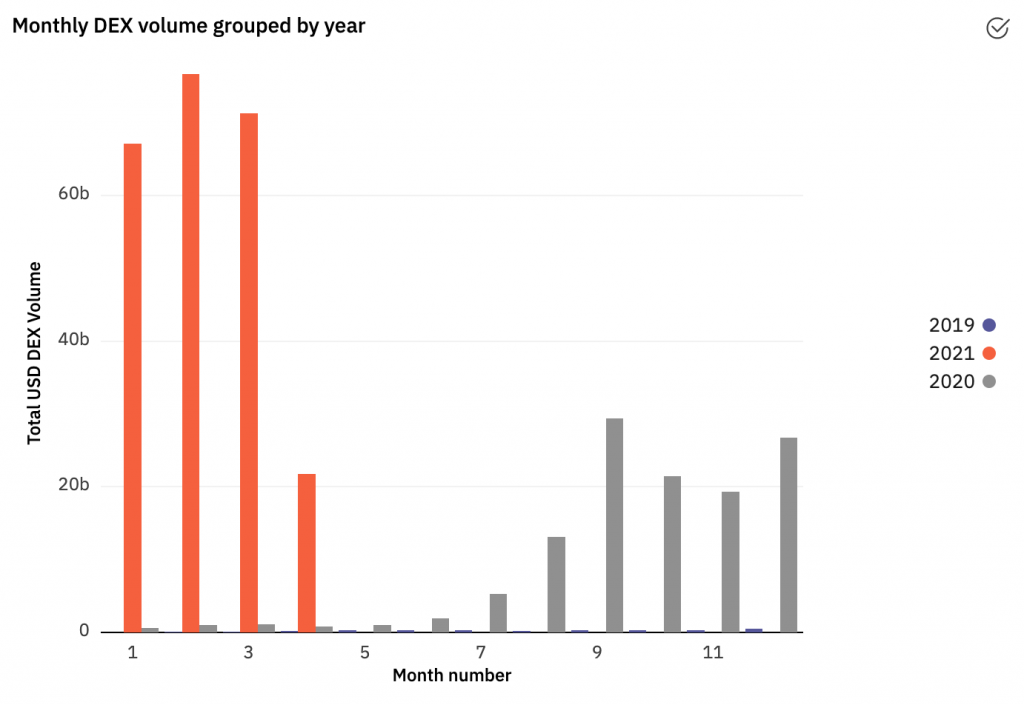

The TVL dropped a few times in between, in the first week of April, however, post that, the growth was nearly vertical. Trade volume on DEXes denominated in USD is over 50 times what it was in 2020. Taking this into account, the global crypto market capitalization has increased over 10 times since then. The adjusted growth rate for DeFi is down from 10x between 2019 and 2020.

Source: Twitter

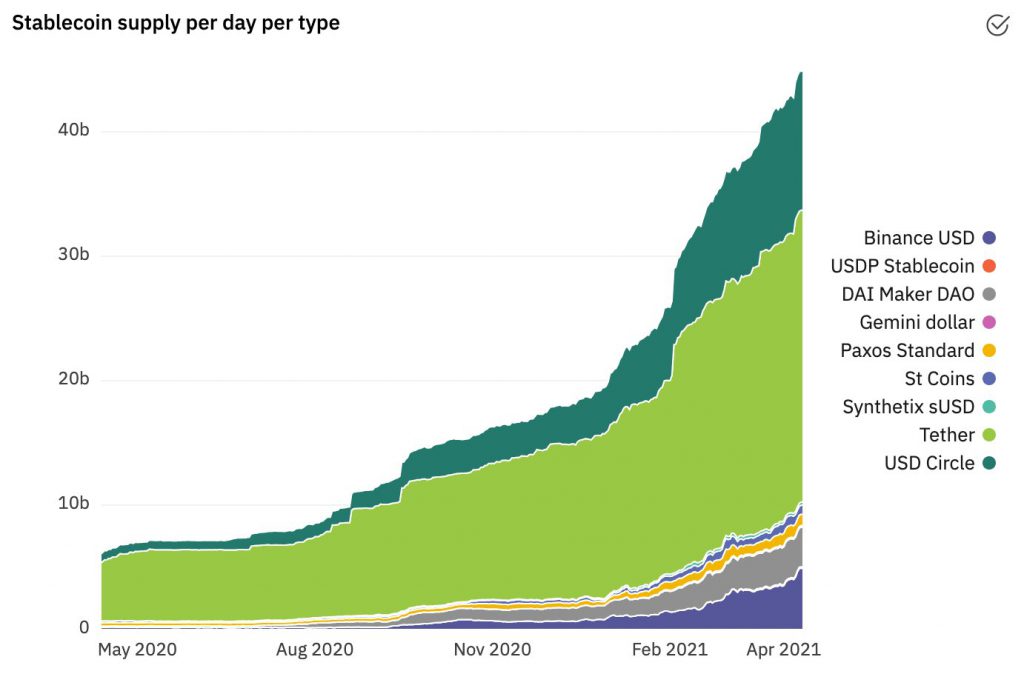

DeFi’s roaring rally is evident from more metrics like the stablecoin supply and the Ethereum network statistics. Without taking into account the token appreciation, the supply of stablecoins has increased over 10 times since 2020, of which 3 times can be accounted for YTD. The value of these tokens within the ecosystem may have largely flooded more DeFi tokens in the market, increased the liquidity, but the volatility has led to a consistent increase in price since the beginning of 2021.

Source: Twitter

Another critical piece of DeFi’s current price rally is the collateral and lending. Traders may say, it is past the “vertical” growth stage, WBTC, Bitcoin on Ethereum is breaching all-time highs. Currently at $12.5 Billion, increasing TVL in WBTC is indicative of DeFi making a comeback. Additionally, the top collateral is key to DeFi’s rally. Between DeFi’s top 3 lending protocols, the TVL is $28 Billion. However, what’s important to note is that only about a third of the collateral is being utilized.

Another popular use of that collateral is in providing liquidity since that is key to the volatility and price hikes. Several DeFi tokens have had a positive impact on price, due to the increasing demand for collateral loans.

Besides, capital inflow in DeFi is increasing, however, users and network activity are indicative of the price rally. The number of unique addresses in DeFi has increased over 10 times since 2020, and at this rate, DeFi’s network activity is substantially high.