Uniswap: Could this new update be a game changer for UNI holders?

- Uniswap introduces the option to allow users to make purchases with debit cards, credit cards, and bank transfers.

- It continues to remain one of the largest DeXs by transaction volume.

By forming this relationship, prominent decentralized exchange Uniswap may have made it easier for its customers to convert between fiat and cryptocurrency.

The most popular DEX recently made a statement that could encourage more people to use the protocol. A rise in user engagement may also have a favorable effect on the value of the UNI, its native cryptocurrency.

UniSwap, MoonPay partner up

On 20 December, Uniswap Labs announced a partnership with MoonPay, a cryptocurrency payments provider. Users of Uniswap would be able to make purchases of assets using various banking options, including debit and credit cards.

Users in most U.S. states, Brazil, the United Kingdom, and the Single Euro Payments Area (SEPA) would also soon have the option to pay via a bank transfer.

Read Uniswap’s (UNI) Price Prediction 2022-2023

Uniswap asserts that this latest action would significantly lower the entry barrier into the Decentralized Finance (DeFi) industry and boost the number of participants.

The low number of users in the DeFi area compared to its centralized counterpart may be due to the difficulty of the DeFi sector, both in usage and entry. However, UniSwap’s action may affect the game and increase the number of DEX transactions on DEXs.

Uniswap’s volume dominance could expand

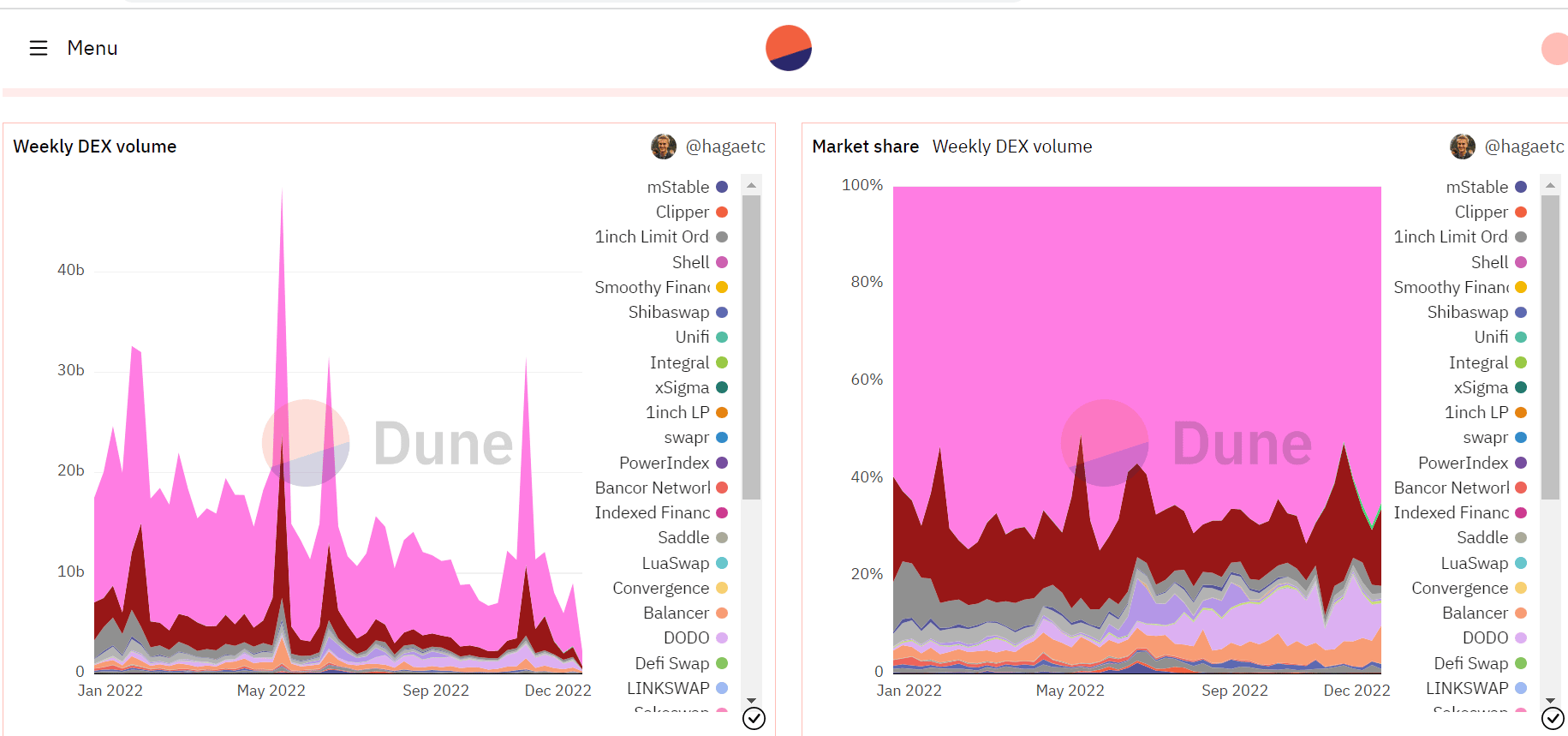

Uniswap has a monopoly on the number of transactions on a daily, weekly, and monthly basis, according to statistics from Dune Analytics. As per the most recent daily volume data, the protocol had the greatest volume among the other ranking protocols, with about $688 million.

Additionally, a review of the monthly volume statistics revealed that Uniswap had the greatest transaction volume among the other protocols, with over $13 billion in traffic. If this update is successfully implemented, the number of transactions on the platform may increase even more.

According to statistics from DefiLlama, Uniswap was listed as the fifth-largest network in the ranking of total value locked (TVL) of DeFis. The platform had $3.36 billion locked in it at the time of writing. As amazing as the TVL appeared, it had recently seen a significant drop, which could also be seen, and the immediate cause could not be ascertained.

Could UNI’s price be impacted?

One benefit of Uniswap’s recent action is that there might be an increase in the volume and the utility of its native token, UNI. The token’s value could rise due to an increased demand for it as a result of an increase in its utility.

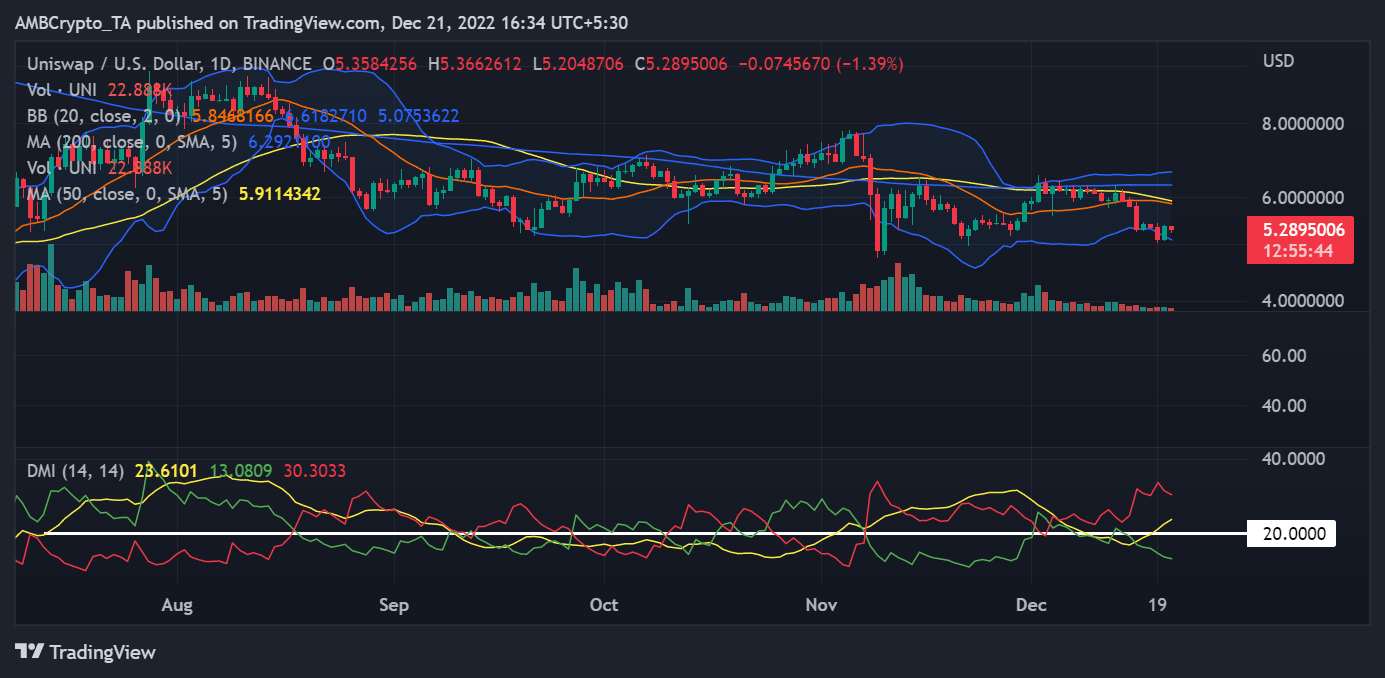

The asset was down more than 1% as of the time of writing, trading at roughly $5.2. It had increased by 5.30% in the previous trading session, but the general trend was still bearish.

Are your UNI holdings flashing green? Check the Profit Calculator

Uniswap has begun making DeFi adoption easier, which could lead to it gaining even more dominance than it already has. In addition to being advantageous to it, the entire DeFi space might experience a fresh influx of customers if it is successful.