Uniswap, dydx, Compound on the rise, but why are there still questions

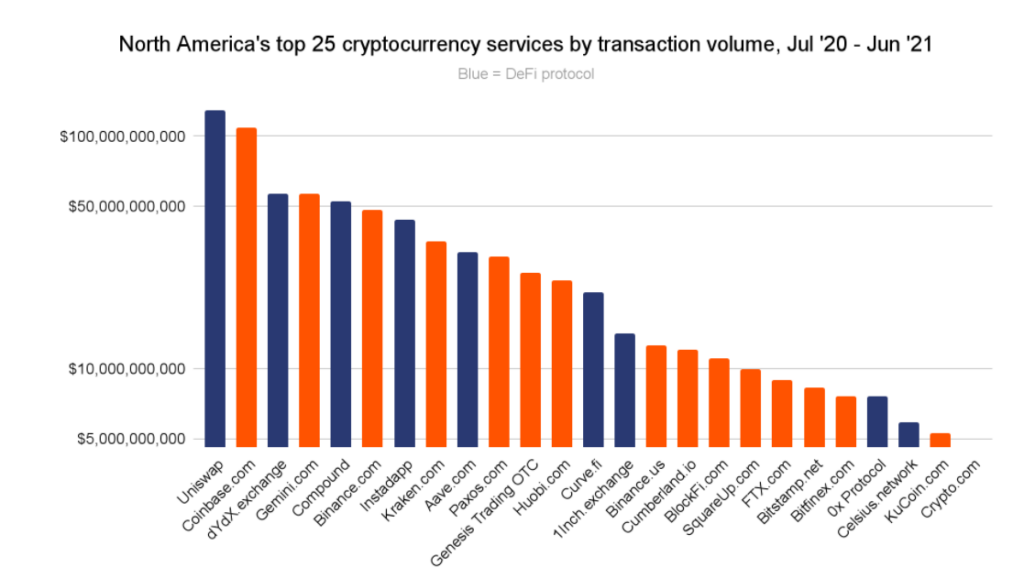

DeFi seems to be accelerating the next generation of crypto innovation. So much so that in 2021 alone, the DeFi ecosystem was reported to grow by over 20x. A recent report by Chainalysis noted that nine of the 25 biggest cryptocurrency services by transaction volume now offer DeFi protocols. Among these platforms, Uniswap, dydx, and Compound are ruling the roost.

Source: Chainalysis

DeFi opportunity has even got the Bitcoin community excited. Often considered just a store of value and medium of exchange, companies like Square Inc and StillMark are also exploring Bitcoin-focused DeFi platforms.

The report further stated that the broad interest in the DeFi category is for ‘multiple reasons,’ rather than ‘interest in just one particular DeFi use case.’

IOHK CEO Hoskinson had previously pointed out in an interview that DeFi adoption will need two catalysts. He said,

“First off, you need to have a Dapp store… The other thing is we need to start thinking about cross-chain in DeFi.”

As per the report, the DeFi space focused on new types of coins on the back of institutional interest, and use cases like lending. It stated,

“… lending would be the next logical step in the search for cryptocurrency investment gains.”

DeFi to see upwards of $1 trillion in inflows

Chainalysis had earlier found that large investors are behind the growth of DeFi adoption. According to recent estimates, DeFi could see an influx to the tune of $1 trillion in the coming years from institutional investors. However, the report made an interesting inference. While large investors drive DeFi activity, the ‘United States leads the way in retail-sized’ DeFi transactions.

The study stated that North Americans sent roughly $276 billion worth of cryptocurrency to DeFi platforms between July 2020 and June 2021. Central, Northern & Western Europe (CNWE) stood atop at $389 million during the same period.

Additionally, DeFi activity is reportedly overshadowing other centralized services. According to a recent World Economic Forum study, assets locked in DeFi smart contracts grew by a factor of 18 in just one year. At press time, the total-value-locked (TVL) in DeFi was estimated around $217.5 billion. In terms of TVL, chains like Curve, AAVE, and MakerDAO lead the list.

The DeFi popularity had made SEC Chief Gary Gensler vow to bring DeFi under the regulator’s watch. However, there are limitations to enforcing these laws. According to lawyer Jai Massari, for instance,

“DeFi may present much harder legal questions because it can represent decentralization and disintermediation in a way that regulators haven’t faced before.”

In addition, ransomware is one of the biggest threats to DeFi, as per the report. The latest victim of a DeFi hack is Indexed Finance which has suffered a $16 million loss today. Two of its indices, DEFI5 and CC10 were attacked and the platform has rebalanced the index pools after the exploit.