Uniswap regains stable USD domination from Curve- Here’s how

The tug of war between the decentralized exchanges was long over when Uniswap [UNI] took over the market and became the biggest DEX.

However, in the field of stable USD, Curve [CRV] had an upper hand. But over the last few weeks, the second biggest DEX lost that upper hand by giving it to Uniswap.

Curve gets a curveball

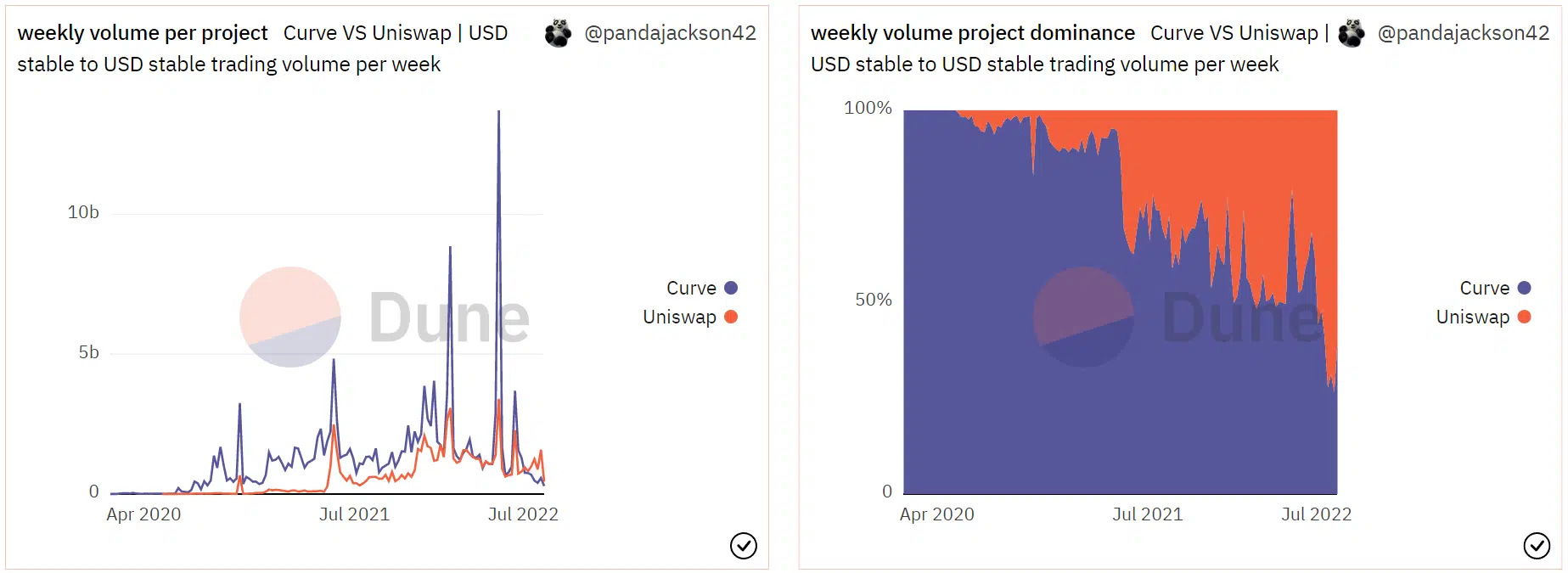

The weekly volume noted on-chain shows that week on week since October 2021, Curve had a significant dominance over Uniswap.

When Uniswap was conducting transactions worth $529 million, Curve was registering twice as much volume sitting at $1.2 billion, particular to USD stable.

Curve vs Uniswap volume and domination | Source: Dune – AMBCrypto

In terms of capturing the market, Curve at one point held almost 71% of the market, whereas Uniswap only had 29% of it.

Over the last month, the tables turned, and towards the end of July, Uniswap gained a 72.3% domination while Curve just had 27.7% of the market.

In doing so the total volume generated by both also switched places as Curve noted $572 million worth of trade, while Uniswap observed $1.58 billion of the same.

On the charts

This is despite the fact that on the charts, Curve had been noting a phenomenal growth rising by over 164% in the span of a little over a month.

In fact, this rally even superseded Uniswap’s growth, which in almost two months now only gained by 147%.

Curve price action | Source: TradingView – AMBCrypto

But going forward as Curve lost the DEX domination, it could also lose this recovery. In the last 20 days alone, a drawdown of almost 18% has been witnessed in the case of CRV, and price indicators do not look positive right now.

The Parabolic SAR is about to flip its three-week long uptrend into a downtrend and the Moving Average Convergence Divergence (MACD) has already been in a bearish crossover for the same period of time, expected to intensify over the coming days as evinced by the red bars on the indicator.

However, since broader market cues aren’t explicitly bearish, it may not fall by much. Additionally, considering the volatility of the asset, it has been hovering around levels as low as three months ago.

This may keep CRV from witnessing excessive price swings.

Curve volatility | Source: Intotheblock – AMBCrypto