How has Uniswap [UNI] benefitted from the Arbitrum AirDrop? Analyzing…

- Many ARB recipients moved to Uniswap to swap their tokens.

- The UNI token saw bullish signs as UNI activity rose.

The Arbitrum [ARB] AirDrop has been advantageous for the protocol and its users, but other protocols like Uniswap [UNI] have also reaped benefits from it.

Is your portfolio green? Check out the Uniswap Profit Calculator

It’s a win-win

Based on Uniswap’s 28 March tweet, a staggering 92% of all ARB holders used Uniswap to swap their received token instead of other DEXs. This indicated that most users in the crypto community had a preference for the Uniswap protocol.

Hey @arbitrum, big week last week, huh? ?

DYK 92% of $ARB swappers used Uniswap 24 hrs after the airdrop ? pic.twitter.com/ZYr1iPgf72

— Uniswap Labs ? (@Uniswap) March 28, 2023

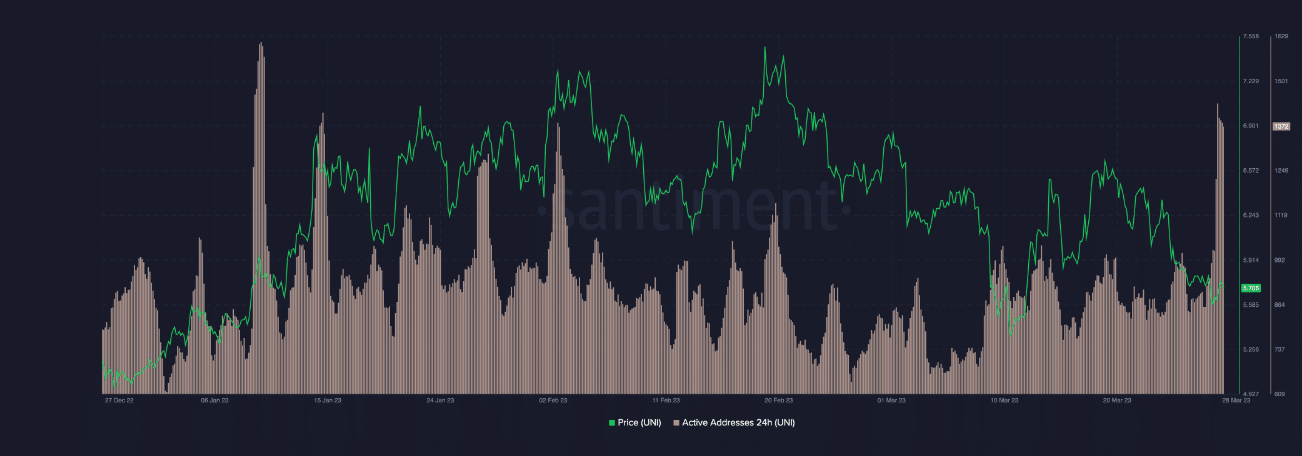

UNI also witnessed a similar surge in activity. According to Santiment’s data, the number of active addresses using UNI spiked over the last few days, while its price continued to decline. Santiment stated that this was a bullish divergence and the prices of the token could be expected to rise.

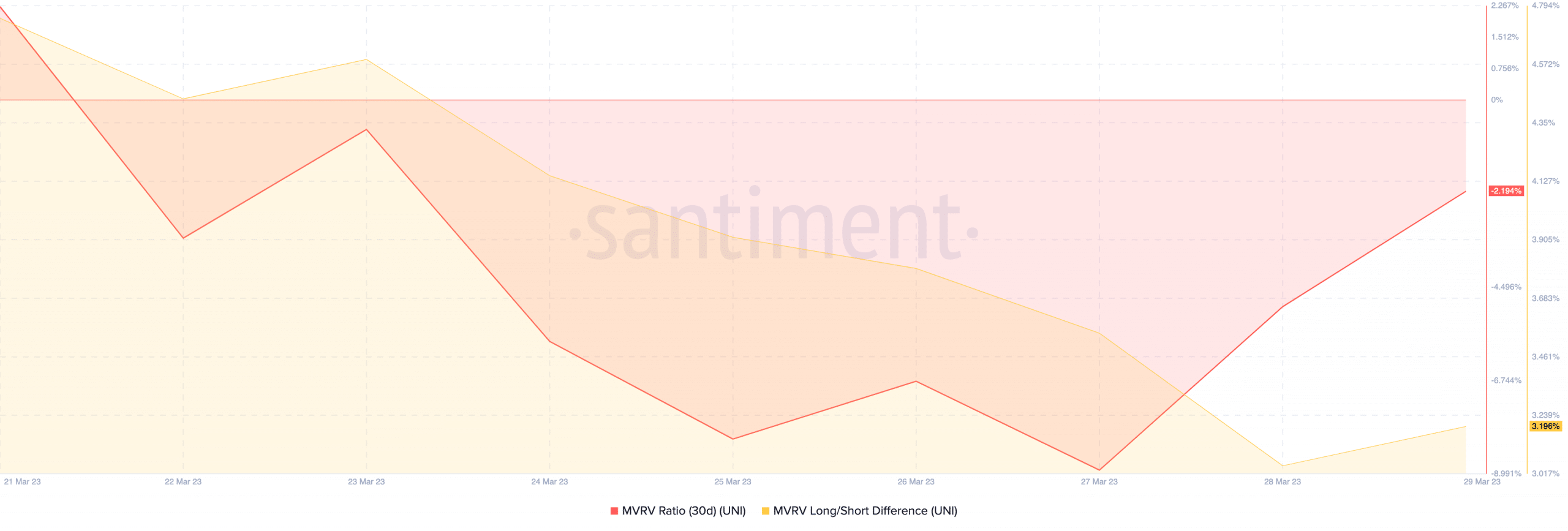

However, traders expecting the UNI price to go up should beware of the reducing number of long-term holders, as indicated by the declining long/short ratio. Short-term holders of the token are more likely to sell their positions as prices go up and can drive down the price of the token in the short term.

Additionally, the MVRV ratio of UNI also rose over the last few days, suggesting that many holders could soon turn profitable and the selling pressure on the token might increase.

Rise of the bots

Even though UNI could be looking at a bright future, the Uniswap protocol had scope for improvement.

According to Token Terminal’s data, the fees collected by Uniswap fell by 29% in the last few months, despite the spike in active users on the protocol.

Realistic or not, here’s UNI’s market cap in BTC’s terms

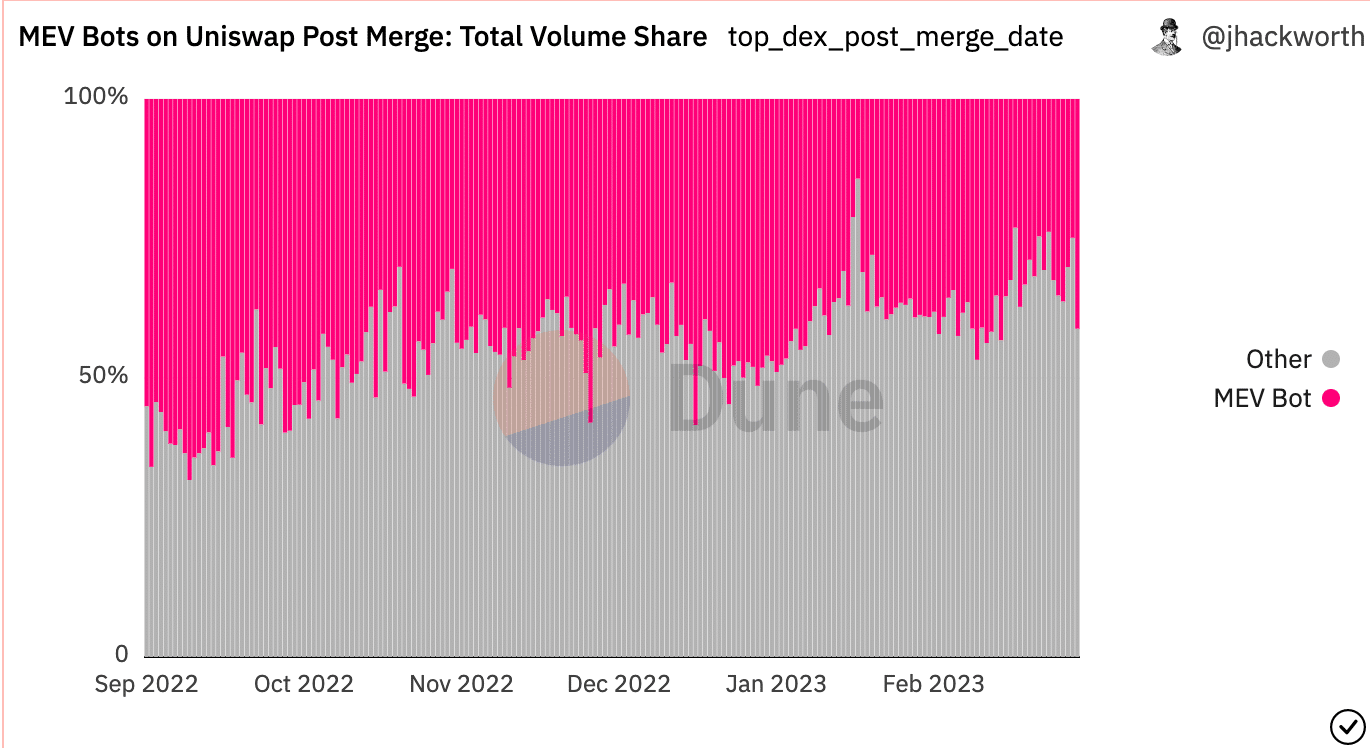

This decline in fees collected could be attributed to the high amount of bot activity on the Uniswap protocol. Dune Analytics’ data suggested that MEV bots contributed 41.1% of the overall volume on the DEX.

MEV bots can negatively impact the DEX by front-running transactions, which means they insert their own transaction before someone else’s transaction to profit from the price change.

This can cause the original transaction to fail or result in the trader receiving a worse price than expected, which can discourage trading on the DEX and harm Uniswap’s reputation.

![Zora [ZORA] crypto](https://ambcrypto.com/wp-content/uploads/2025/07/5415E117-BCDA-4A4C-A501-61A9529DDE31-400x240.webp)