VeChain reaches new milestone, but will it be enough to beat the bears?

- VeChain’s total addresses known exceeded the 2 million mark.

- On-chain performance and market indicators looked pretty bearish.

VeChain [VET] reached a new milestone on 10 February, as it crossed the 2-million mark in terms of addresses known. At the time of writing, the value stood at 2,000,435. To simplify, “addresses known” are the total number of addresses that have been seen on the VeChain network.

Great stuff, and just the beginning. #VeChain will be known the world over in the coming years.

Looking forward to onboarding the global economy, brick by brick. #Web3 #Sustainability #Blockchain #Crypto $VET https://t.co/71ioQU2kw4

— VeChain Foundation (@vechainofficial) February 10, 2023

Interestingly, VeChain achieved this just a few days after it unveiled ‘The Hive,” which is a web-3 and sustainability-focused summit. However, despite this new milestone, things on VeChain’s price front do not look good. As per CoinMarketCap, VET’s price declined by 5% in the last seven days, and at the time of writing, it was trading at $0.02345 with a market capitalization of over $1.7 billion.

A look at VeChain’s on-chain metrics revealed quite a few factors that might have restricted VeChain from climbing up the price ladder.

Read VeChain’s [VET] Price Prediction 2023-24

Not a good start to 2023?

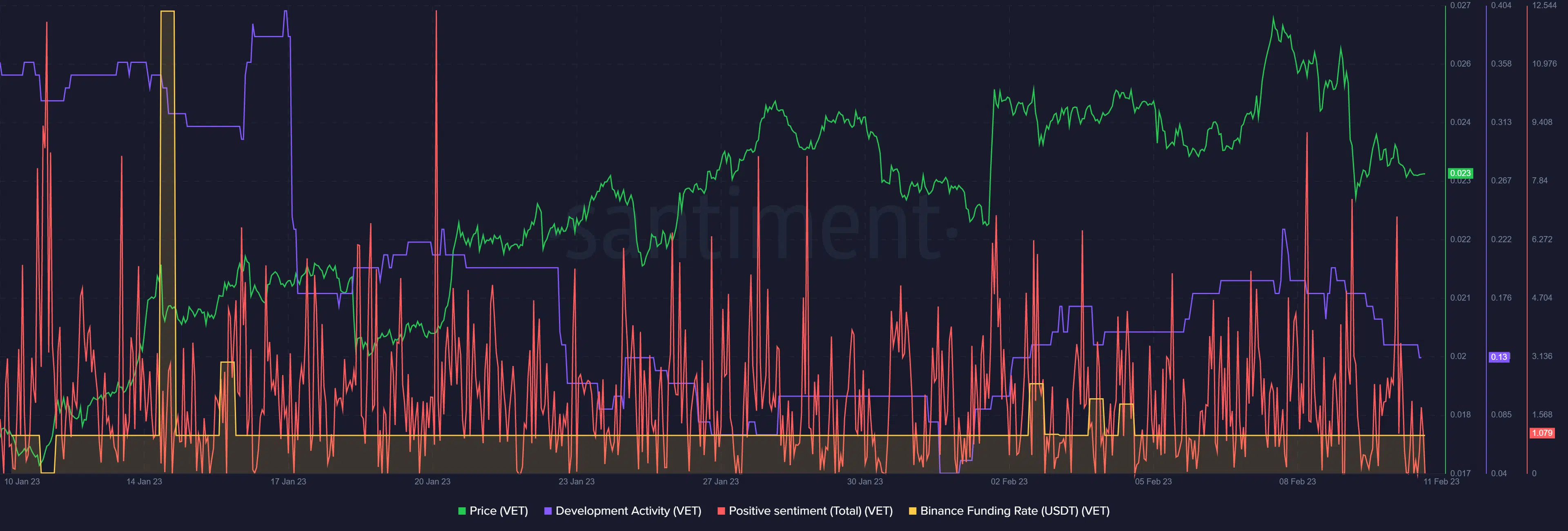

While VET’s price rallied in January 2023, thanks to the bullish market, things on the metrics front were not as promising as many would have expected. For example, after a spike in demand from the derivatives market in early January, it then dropped, as evident from VET’s Binance funding rate.

Besides that, VET’s development activity has decreased in the last 30 days, which is a negative signal because it indicates fewer efforts by developers to improve the network. LunarCrush’s data revealed that due to the decline in price, VET’s market dominance also fell by over 5% during the last week.

Surprisingly, after registering promising gains in terms of total value locked (TVL) for several weeks, DeFiLlama’s chart pointed out that the increase came to a halt.

Nonetheless, positive sentiments around VET remained relatively high throughout the last month, which reflects the crypto community’s trust in VET. Additionally, VET’s social engagement drastically increased by 83% last week, indicating VET’s increased popularity in the crypto space.

Realistic or not, here’s VET market cap in BTC’s terms

VET stuck between bulls and bears

Like most of the on-chain metrics, several of the market indicators also supported the bears. The MACD displayed a bearish crossover. VET’s Money Flow Index (MFI) registered a downtick, which increases the chances of a continued price plummet. However, the rest of the market indicators suggested otherwise.

As per the Exponential Moving Average (EMA) Ribbon, the bulls still had an edge in the market as the 20-day EMA was above the 55-day EMA. Furthermore, VET’s Chaikin Money Flow (CMF) was still above the neutral mark, which was a development in the bulls’ favor.