Want to know the future of crypto market in 2022? Read this report

Accounting organization, KPMG, released a report that commented on the current state of the cryptocurrency market. The report stated that crypto projects will continue to stay low for the rest of 2022. The reason being the Terra debacle and the Russia-Ukraine impact.

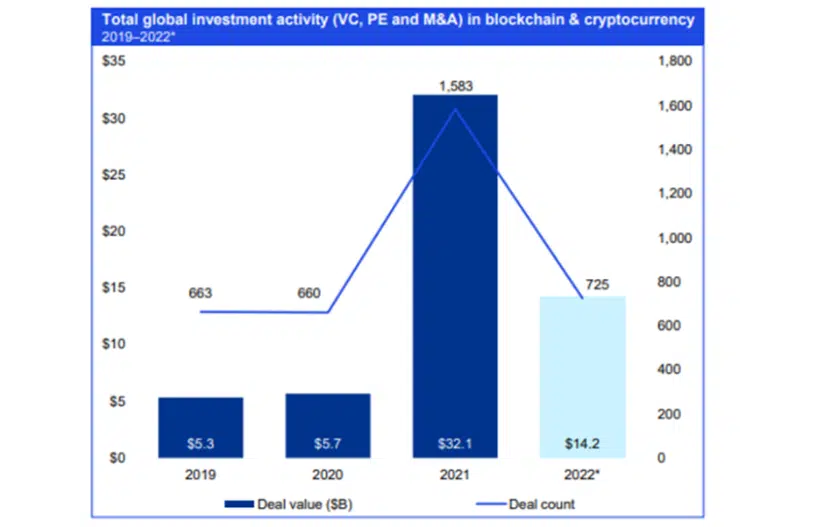

The report titled “Pulse of Fintech H1’22” stated that investors only put in $14.2 billion in crypto companies in the first half of 2022. Investors, on the other hand, had put a record $32.1 billion investment in 2021.

There has been a significant slowdown in crypto investment, particularly in retail firms offering coins, tokens, and NFTs.

The report further stated that the trend is likely to continue for the rest of the year.

“Despite the crypto space collapsing significantly since midway through Q1 22 due to the unexpected Russia-Ukraine conflict, rising inflation and the challenges experienced by the Terra crypto ecosystem, investment at midyear remained well above all years prior to 2021.”

Focus on blockchain infrastructure

The report further predicted,

“While investment in cryptocurrencies is expected to slow down further, there will likely be a continued focus on the use of blockchain in financial market modernization.”

Investors will likely move towards blockchain infrastructure projects in DeFi, instead of token and NFT marketplaces.

Reportedly, there will be a growing focus on solutions related to crypto compliance and transaction traceability as more countries begin regulating the industry. Furthermore, corporates looking for low-risk investments will also show more interest in relatively less volatile virtual assets.

The KMPG report further predicted that companies from cryptocurrency and other industries are coming together to address environmental, social, and governance (ESG) concerns. This means that as more conglomerates enter the crypto industry, ESG concerns will become even more critical.

Resilience of the crypto industry to be tested

Alexandre Stachtchenko, Director, Blockchain and Crypto Assets, KPMG France voiced his views as well.

According to him, some cryptos would witness a drop in their valuations.

The report concludes by stating that cryptocurrency organizations with sound risk- and cost-management strategies will survive the slowdown. However, the resilience of other companies valued lower will be put to test.