Web3 tokens’ utility report can help you make better investment decisions

Web 3.0, or so-called the next version of the internet enabled the emergence of the web through its value. True right? Well, a majority would agree although many have questioned the sheer aspect of Web3 tokens besides Web3 games capturing value.

Questioning your motive(s)

A data-focused venture capital firm released a report in July showing that Web3-developer interest remained strong despite the crypto bear market.

While that might hold water, many have questioned Web3 networks’ utility aspect in alliance with the respective tokens.

Additionally, Messari’s analyst had shared the same narrative in a thread posted on 30 August. While Web3 infrastructure protocols succeeded at value creation, they all face the challenge of aligning the usage of their networks with the token price.

Herein the question remains- How are Web3 tokens capturing value?

Consider the table that showcased Web3 Infra tokennomics and the value capture mechanism for leading Web3 tokens.

Despite the popular belief (if token supply is fixed, the price would increase as demand increases), investors ignore another key aspect. They don’t account for velocity, which means the longer the token is held, the higher the price.

A solution, maybe?

To counter this issue, protocols implement additional utilities, sinks, and incentives.

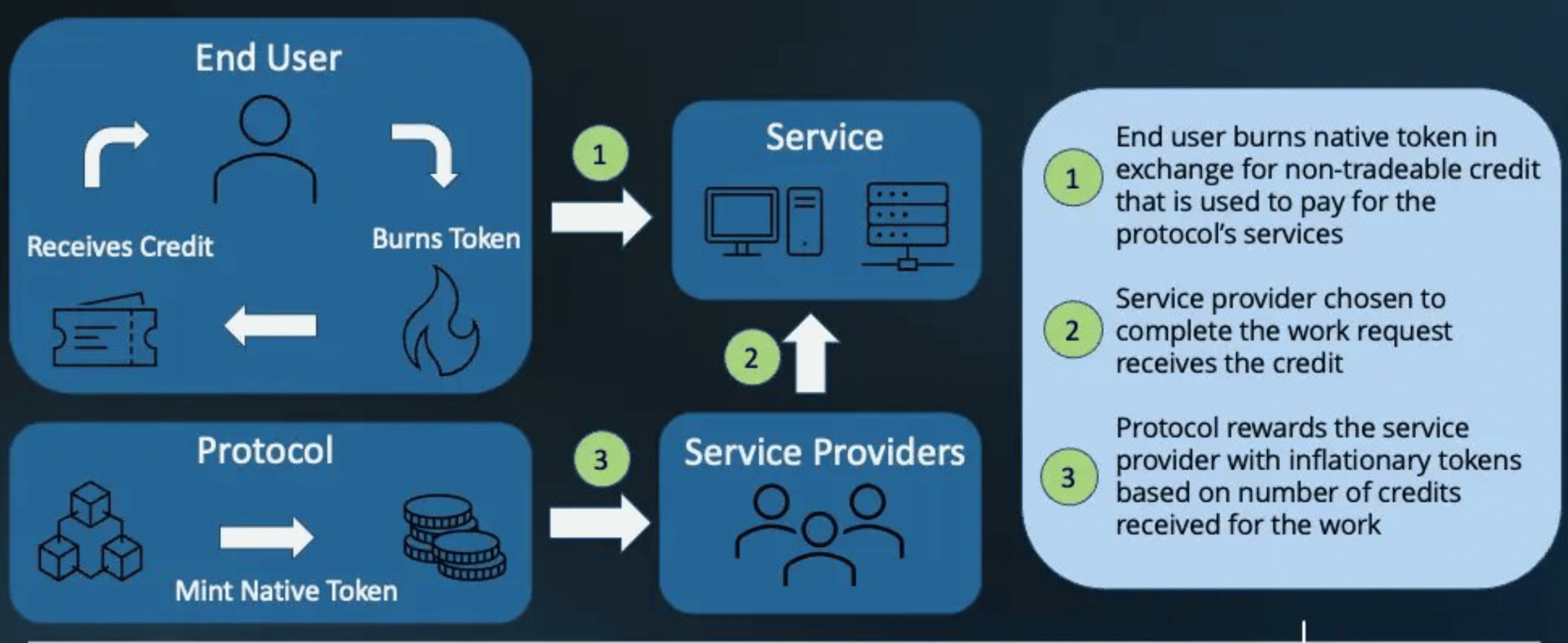

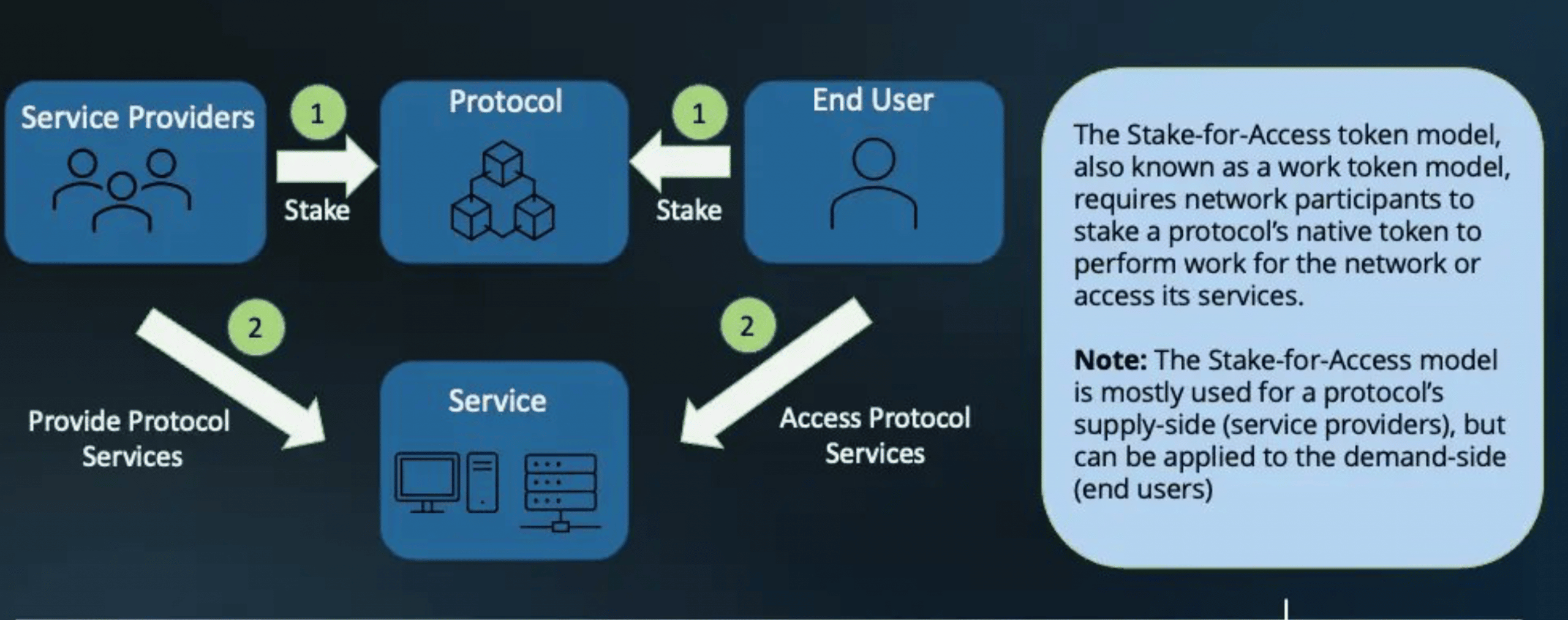

The most popular token models, Burn-and-Mint Equilibrium (BME) and the Stake-for-Access (SFA) were highlighted in the stated Messari analysis.

Essentially, the BME model worked by translating protocol usage into token buying pressure.

Whereas, the SFA model translated network participation into token buying pressure.

Both SFA and BME addressed the velocity problem and created a relationship between network usage and the token price. However, here’s the concern- the analyst noted,

“The downside to this relationship is that if network usage declines, so would the price of the token.”

But that’s not the only hole in the wall. Even Web3 games weren’t spared from a potential downfall.

Levan Kvirkvelia, the founder of Jigger, an anti-bot protection software, had shared a concerning insight. The founder released a report asserting that 40% of the player base of Web3 games were bots.

Furthermore, the study found evidence of 20,000 bots across over 60 web3 games. A screenshot from Kvirkvelia’s company Jigger presents a visualization of the interconnected accounts, shown below.

bots are everywhere! just everywhere!

here is @Biswap_Dex token graph. they introduced a referral program and voila! 13k bots.the funny thing is that we found this token by analyzing it randomly and only then realized why the bots were there. pic.twitter.com/jlegTczwdb

— Levan (@LevanKvirkvelia) August 29, 2022