What next after Ethereum breaches the $2000-mark?

Ethereum’s price has been rising steadily since the start of February, with ETH closing in on the $2000-mark, at press time. However, every time the market moves steadily in the bullish direction, traders are keen on knowing whether a price correction will set in once the said momentum fades.

In the case of Ethereum, it is important to understand how the market’s participants have reacted to this bull run in order to get a clearer understanding of what will happen to the price once an ATH above $2000 is established for the coin.

During any bull run, there is generally a lot of speculation regarding whether traders are in it for the long run or the short. When there is a hike in traders looking to capitalize on short-term gains, post-ATH, the market is likely to see a correction. While this has happened in the past to Ethereum, will the same be repeated after ETH finally breaches $2k?

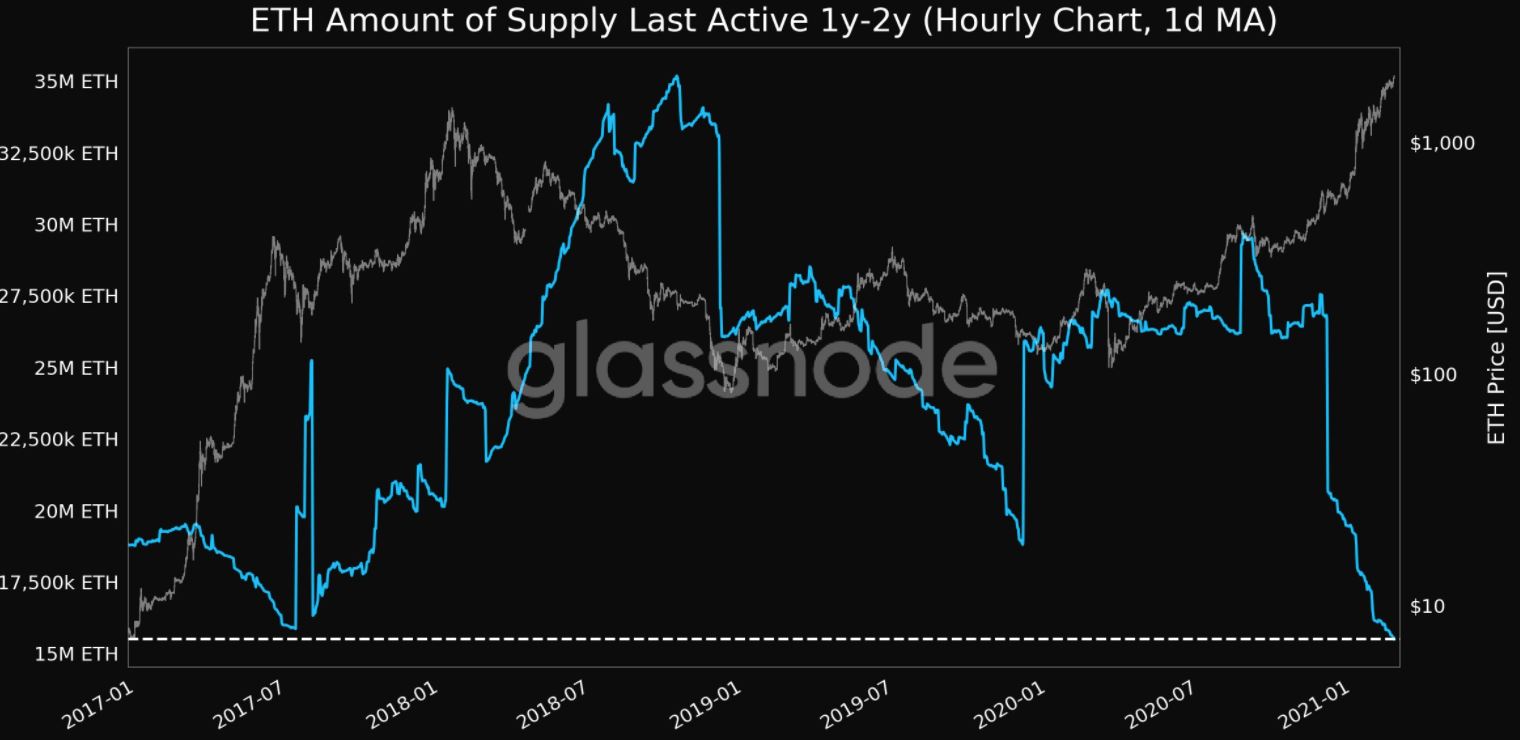

Source: Glassnode

Interestingly, a look at a few market indicators can prove to be useful when determining the nature of the present Ethereum market. According to data provided by Glassnode, the active supply (1 year – 2 year) fell to a 4-year low, with the same foreshadowing a price hike, signaling the consistent presence of strong bullish sentiment in the present case.

However, while this only pertains to the continuation of the trend the price has been on, there may be subtle changes happening within Ethereum’s diverse investor and trader demographic.

Glassnode’s data also highlighted two interesting developments. First of all, the number of addresses holding over 1000 coins climbed to a 3-year low, while in the case of smaller addresses (i.e. over 0.01 ETH), the opposite took place. Further, according to data, the number of addresses holding 0.01+ coins reached an ATH of 12,195,952.

This is an interesting development, one suggesting that if large accounts initiate sell-offs in the very profitable market that Ethereum currently finds itself in at the moment, ETH will once again be subject to price corrections that tend to hamper its uptrend.

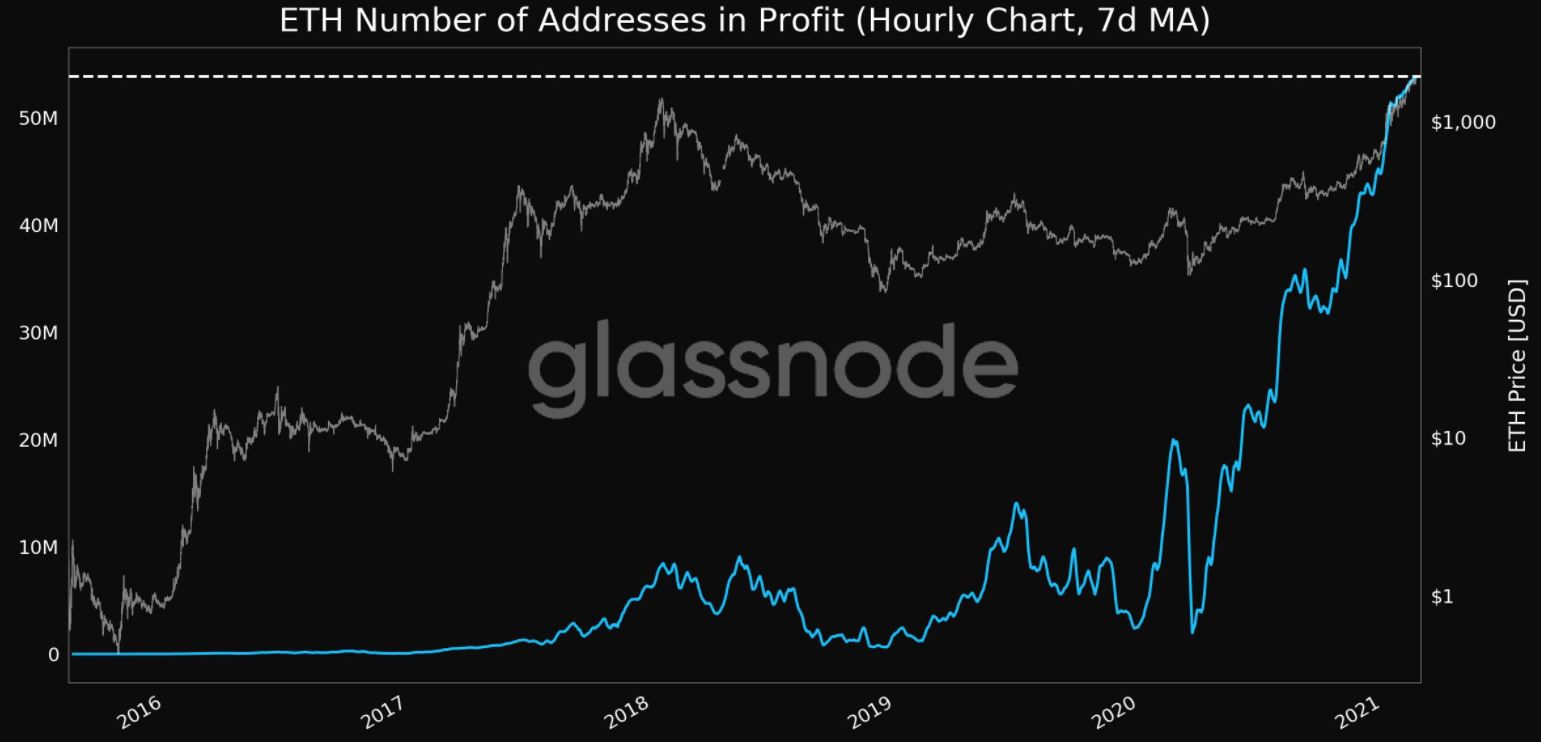

Source: Glassnode

At the time of writing, Ethereum was priced at around $1,915, with the crypto finding a bit of support just above the $1900-mark. This has also ensured that the overall profitability of the coin is rather high. In fact, an estimated 53,848,440.762 addresses were in profit at press time – another all-time high in the history of Ethereum.

The overall profitability of the cryptocurrency and the fact that the MVRV is quite high show that the market continues to be fairly overvalued. According to data, the MVRV was observed to be at 3.123 at press time, a level last seen a month ago, following which, a price correction set in.

Will this repeat itself? Well, one can argue in the affirmative. However, if the hodlers continue to keep their coins in cold storage despite the overwhelmingly positive gains that one can acquire in ETH’s short-term market, then the cryptocurrency may soon be heading for price discovery above $2k, with ETH remaining immune to massive price drops.