What picture do these metrics paint for Bitcoin investors right now

Bitcoin is always an attractive asset for investors looking to make some profits. However, the volatility of the crypto market has and will continue to make investments in any asset here risky.

But when it comes to Bitcoin fortunately there are a couple of ways to understand and counter this risk. Some of them are highlighted below, understanding which can help you make this process safer.

How risky is Bitcoin?

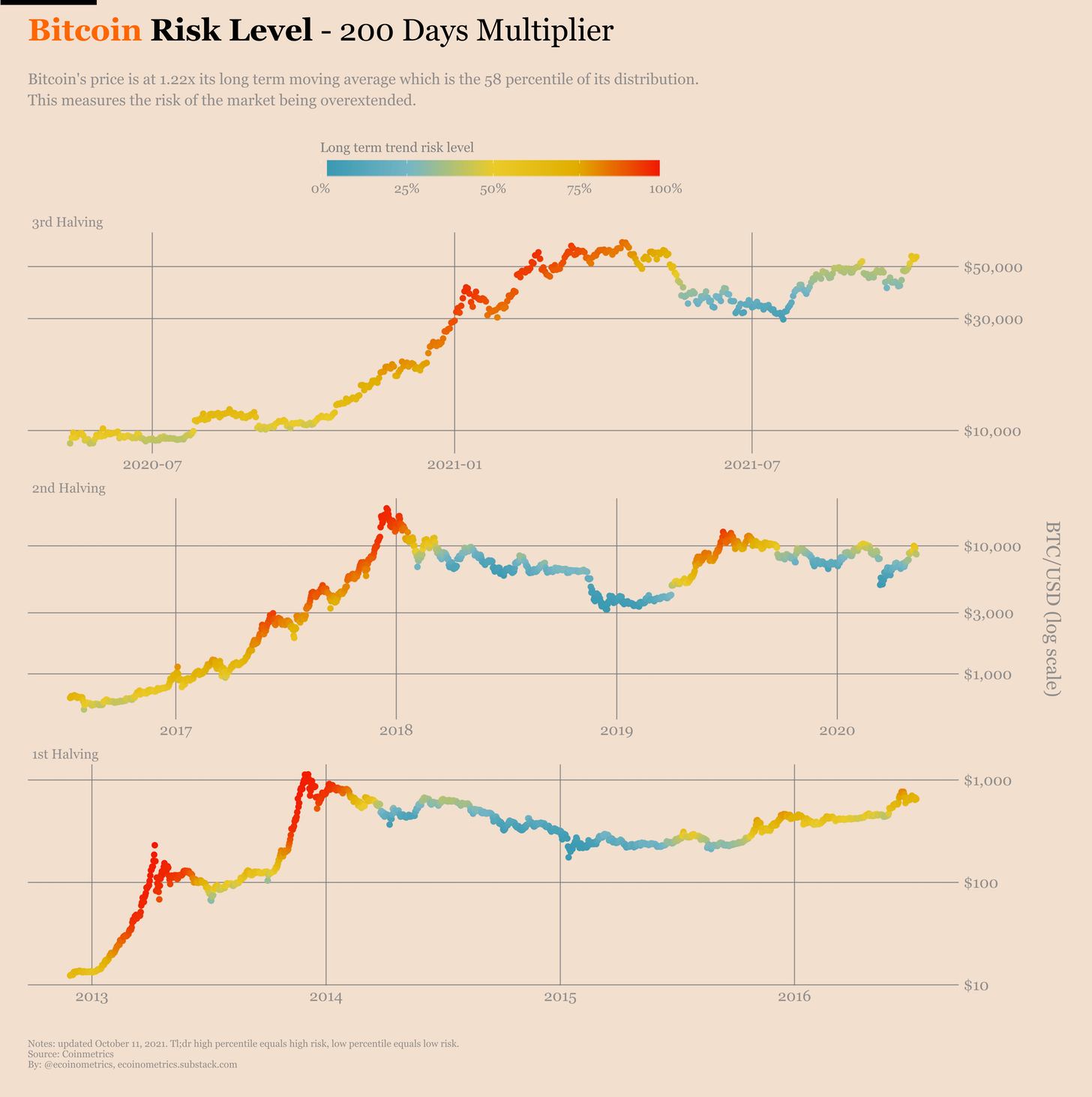

The 200-day moving average, also known as the Mayer Multiple is the first signal here which shows us if or not the market is overextended. An overextended market shows us just how far the price is from its long-term trend.

Looking at the chart we can understand that the current value of the 200 day moving average – 1.22 falls in the middle zone, indicating everything is fine. If the values had been higher, it could be said that the market is running hot.

Bitcoin Mayer Multiple | Source: Ecoinometrics

Secondly, we can look at investors’ behavior to understand the secondary factor of a successful market. Over the past month, there had been consistent accumulation at the hand of investors.

And these weren’t small investors either. Addresses that held anywhere between 100 – 1000 Bitcoin witnessed the most growth as their figures rose by 202 addresses in a fortnight.

At an average of 101 BTC, cumulatively each of these addresses are worth almost $5.7 million. This translates to over $1.11 billion of inflows into Bitcoin.

However, the accumulation trend has since calmed down and at the moment there is a significantly lower demand for BTC.

Investing during a period of lower demand and higher supply is usually considered a high-risk situation, and should be avoided.

Addresses holding 100 – 100k BTC | Source: Glassnode – AMBCrypto

So is it really risky to invest right now?

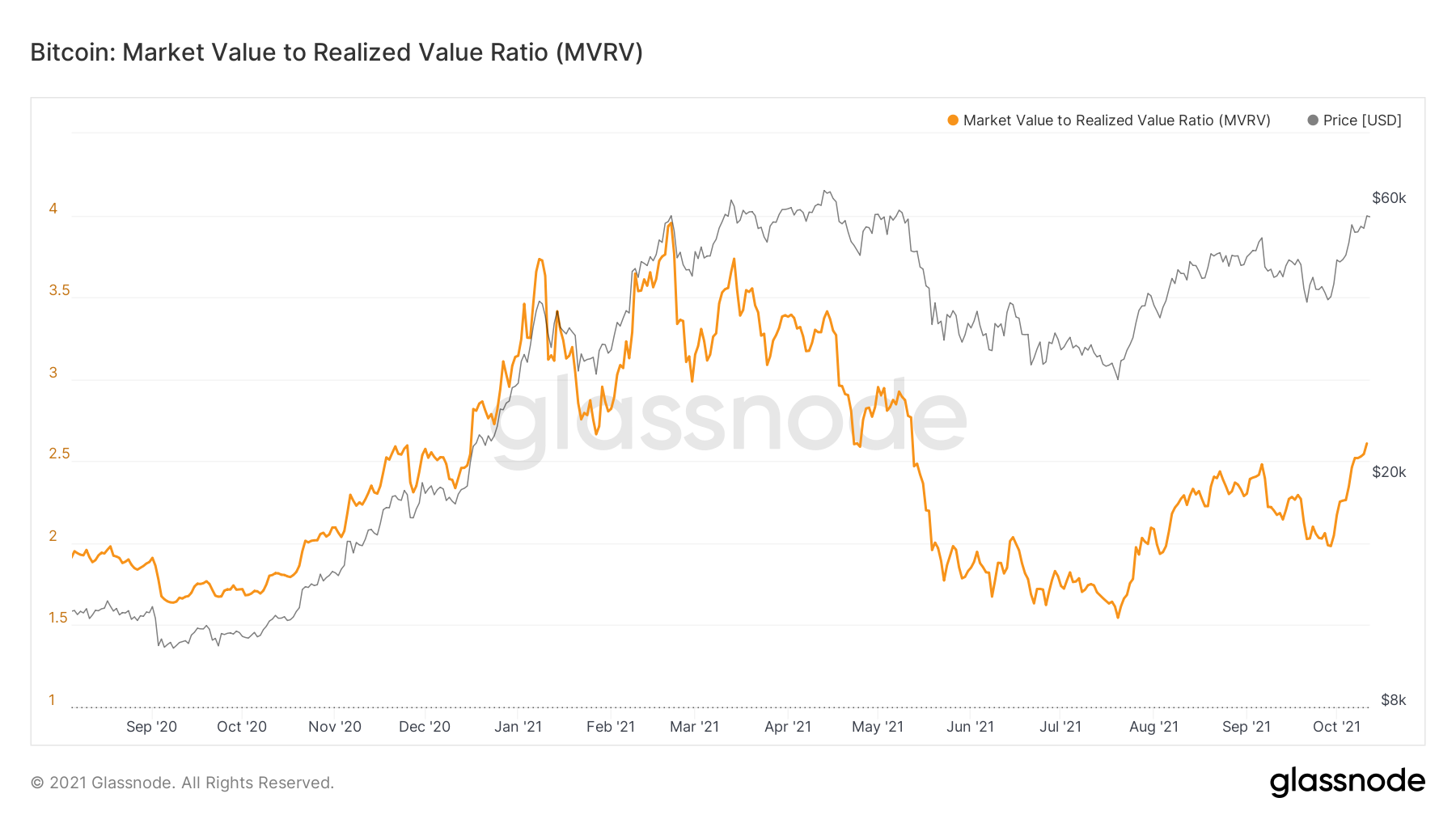

Actually, it is not, because even though there is a lower demand, holders are maintaining the ratio of demand and supply. Even though right now is a good opportunity for them to sell and take profits given MVRV is at a 5-month high, they are not going to.

Bitcoin MVRV ratio | Source: Glassnode – AMBCrypto

The reason behind the lack of selling is that presently there is virtually no selling pressure whatsoever. Neither is the market vulnerable to a price fall nor has it marked any record-breaking highs. So HODLers will continue to HODL.

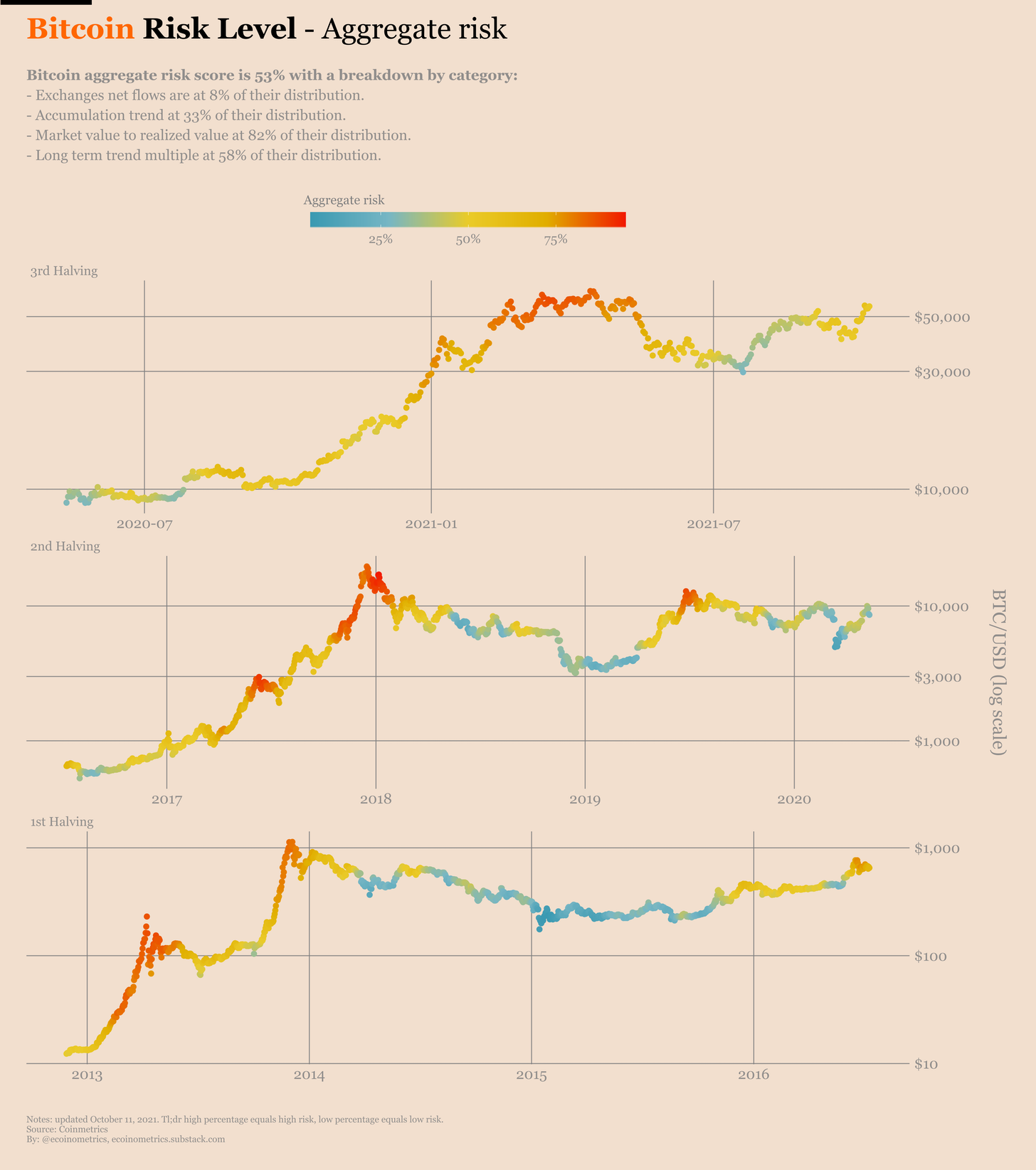

Thus considering all aspects, overall, Bitcoin is not risky for new investors at the moment.

Bitcoin aggregate risk | Source: Ecoinometrics