What predictions hold for Tron as price rallies 9.49% in a day

- Tron has achieved a new milestone as a blockchain.

- TRX has posted remarkable gains recently and could continue the rally.

Tron [TRX] has traded within a range since mid-November but forced an emphatic breakout in the past two days. The price was still within a higher timeframe resistance zone, but the buyers are much stronger at the moment.

TRX has trended strongly upward in the past three days, even though Bitcoin [BTC] and the rest of the crypto market saw strong selling pressure. The blockchain also reached a new milestone after the total number of accounts crossed 206 million.

The range breakout was a huge positive

The one-day price chart of TRX showed a large volume of buying in recent days. The OBV jumped higher to showcase this fact, and the price closed a daily trading session well above the range highs at $0.1092.

It is possible that a retracement to the same area in search of liquidity would occur before the next move. Meanwhile, the momentum and market structure were firmly in favor of the buyers.

The red box that extended from $0.1028 to $0.1175 highlighted a bearish order block on the 1-week chart. In November 2021, TRX faced a strong rejection from this area to fall to $0.0514 two months later.

Hence, a weekly close above the $0.1175 mark would be immensely important. It would signal that TRX is ready for another rally to $0.142 in the coming months. However, a retest of the same resistance zone as support is possible before the rally.

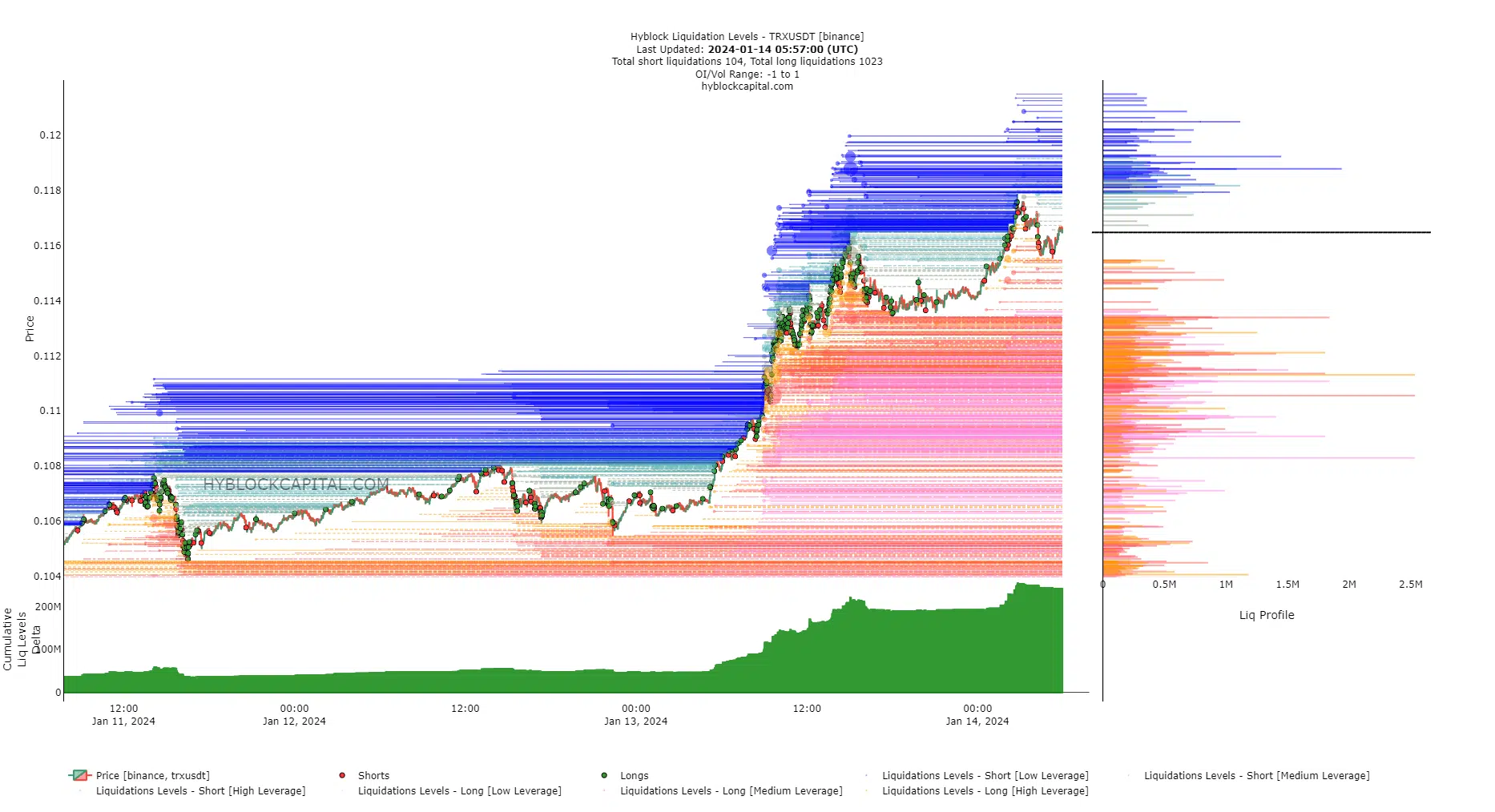

Analyzing the relevant liquidation levels on the lower timeframes

Source: Hyblock

The present bullish trajectory of TRX was not yet at an end. More gains were possible. AMBCrypto looked at the liquidation levels of the past seven days to understand where TRX is likely to move next.

The highly positive cumulative liq levels delta meant the number of long liquidation levels vastly outnumbered the shorts.

In turn, this hinted that a drop in prices would be more lucrative to hunt liquidity. That doesn’t guarantee an immediate price drop. To the north, a significant number of liquidation levels measuring $1.5 million or more were present at $0.118 and $0.12.

Read Tron’s [TRX] Price Prediction 2024-25

TRX could climb to these levels and higher before a reversal. Meanwhile, a drop to the $0.113, $0.11, and $0.1 levels would likely present a juicy buying opportunity.

It would also be a retest of the range highs, reinforcing the chances of a bullish reaction.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.