What you must know about DeFi, NFTs as possible investment vehicles

Ethereum and Bitcoin have long been the market’s most prominent projects, with both considered to be some of the best investment options in the space. With new investors entering the market, however, new investment options are coming to the fore as well.

In the past, ICOs were the big thing. Today, DeFi and NFTs may have just taken their place. And surprisingly, their performances make it seem like DeFi and NFTs have become invulnerable to the broader market performance.

DeFi over Ethereum?

While a majority of the market is still trading in red, DeFi protocols have seen an increase in usage. Stablecoin-centric DApps are leading the ecosystem right now. While Ethereum recorded a correction of 14.1%, DeFi TVL (total value locked) across all chains only fell by 5%, over the same time period.

What this means is that of late, the DeFi space has been significantly unaffected by changes in the value of ETH.

Ethereum price down by 14.1% | Source: TradingView – AMBCrypto

However, despite the TVL going past its May ATH, the top 5 protocols by highest TVL were still far from their ATHs at press time. Most notably, AAVE by 49%, Curve (CRV) by 43.7%, Compound (COMP) by 52.86%, MakerDAO (MKR) by 51.57%, and Convex (CVX) by 38.5%.

Their overall market values are significantly lower than their levels from May.

A huge reason for some divergence from DeFi is also due to the rise in NFTs.

What impact have NFTs had?

NFTs emerged as a major trend in the space following the emergence of Cryptopunks and Apes. In fact, 8 September saw one of the largest NFT events in history.

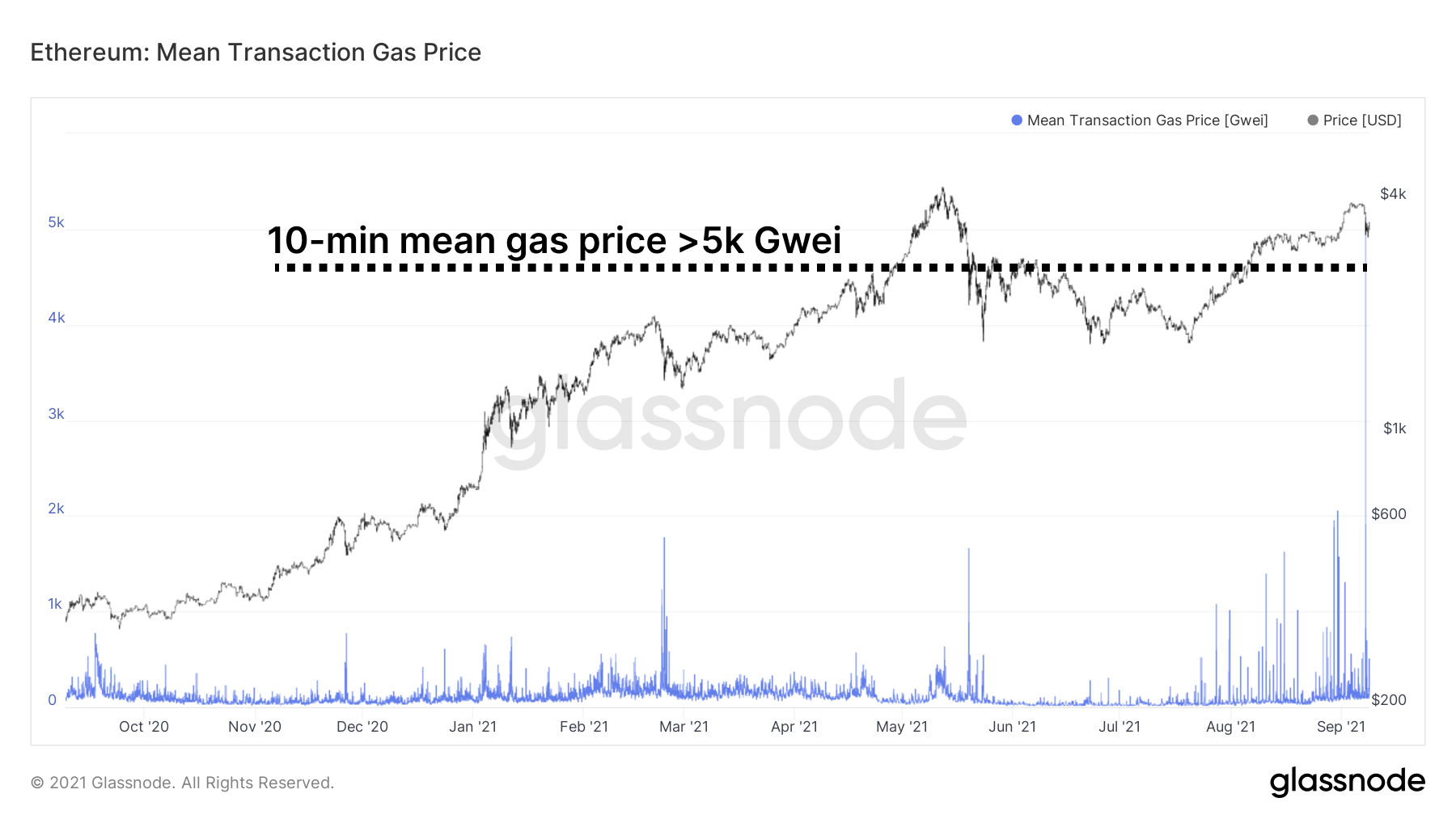

Over 18k+ addresses competed to mint 7000 NFTs from a collection called The Sevens. This resulted in the highest recorded mean gas price, touching more than 5k Gwei in merely 10 minutes.

Ethereum mean transaction gas price | Source: Glassnode – AMBCrypto

Despite the aforementioned, the broader NFT market has seen a pullback lately. In fact, daily volumes have come down to around $100 million.

One reason for the same is that top CryptoPunk and Ape (two of the biggest NFTs) holders have moved into HODLing mode, with fewer trades taking place recently.

Daily NFT volumes | Source: Dune Analytics

That being said, it is still important to remember that NFTs are still illiquid. Their value depends on the hype and as long as that hype stays, NFTs will have solid value.

Once the market interest fades, alas, their value might fall as well. Thus, investors beware.