What’s YFI’s role in DeFi tokens’ resurgence?

Yearn Finance, at the time of writing, was trading around the $36,228-level, according to CoinMarketCap. While the aforementioned price level was 20% away from its ATH, the token was observed to be rallying to close the gap. In fact, with YFI hiking by just under 10% over the last 24 hours, there’s renewed optimism among many in the community that the DeFi token will hit a new ATH soon enough.

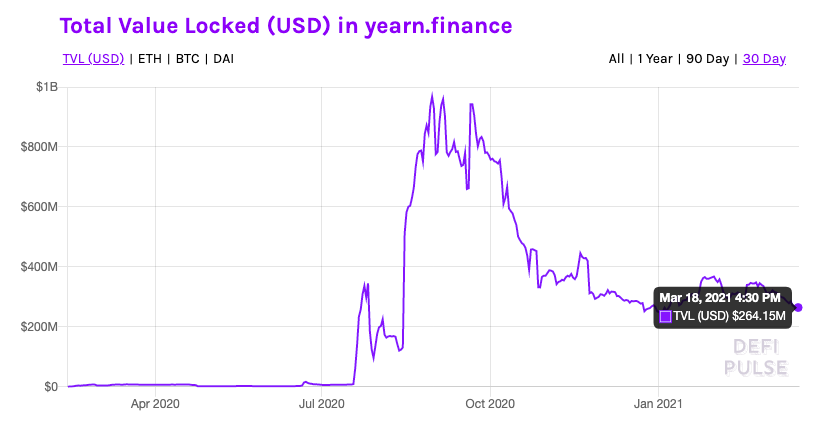

It’s worth noting, however, that the TVL in yearn.finance remains way off the levels seen in August-September 2020. Therefore, the target for the near-term would be a TVL value of $350 million.

Source: DeFiPulse

In many ways, YFI and other top DeFi tokens like Maker, Aave, SUSHI, and UNI make more sense to institutional investors than Bitcoin does at the moment. This is a bold statement, however, it is clear that Bitcoin’s “Digital Gold” narrative is not enough for sailing through a dip of 20% every few weeks in the current market cycle.

What’s more, there are several institutions that do not invest in Gold, hence, the “Digital Gold” is irrelevant to them. Instead of that, monetary assets that can be both valued and priced are more relevant, and DeFi tokens are exactly that. Unlike Bitcoin and Ethereum whose valuation is largely unclear, top DeFi tokens can be valued, can generate cash flow, and have an intrinsic value. Since they generate cash, it is easier for institutions and hedge fund managers to value them using concepts of traditional finance.

This is a game-changer, and this narrative is becoming more and more relevant with increasing investment flows from institutions. Most ETH-based DeFi tokens are performing better than altcoins, and these are the relevant ones for institutions – UNI, AAVE, SNX, SUSHI, COMP, MKR, YFI, UMA, BNT, and REN.

In 2020, for instance, the YFI/BTC trading pair was among the few markets in DeFi that offered high daily and consistent returns to retail traders. With a 24-hour price gain of nearly 10% and an over 45% increase in trade volume at press time, YFI could be leading the comeback on the price charts.

Further, with YFI’s number of exchange withdrawals hitting a new low recently, it is clear that the liquidity is there. Ergo, traders can possibly push through any prevailing selling pressure to keep the price rally going for YFI, and by extension, other top DeFi tokens.