When’s the right time for Binance Coin, Huobi Token and FTT to rally

The broader market has already stepped into its uptrend phase. This is essentially the period when the fear of missing out sets in and the masses from the crypto-space end up engaging in an unreasonably high number of transactions.

In effect, centralized exchanges will earn more than usual through trading and financing fees. So, would the ripple effects be visible on the prices of their tokens as well?

Analyzing previous trends

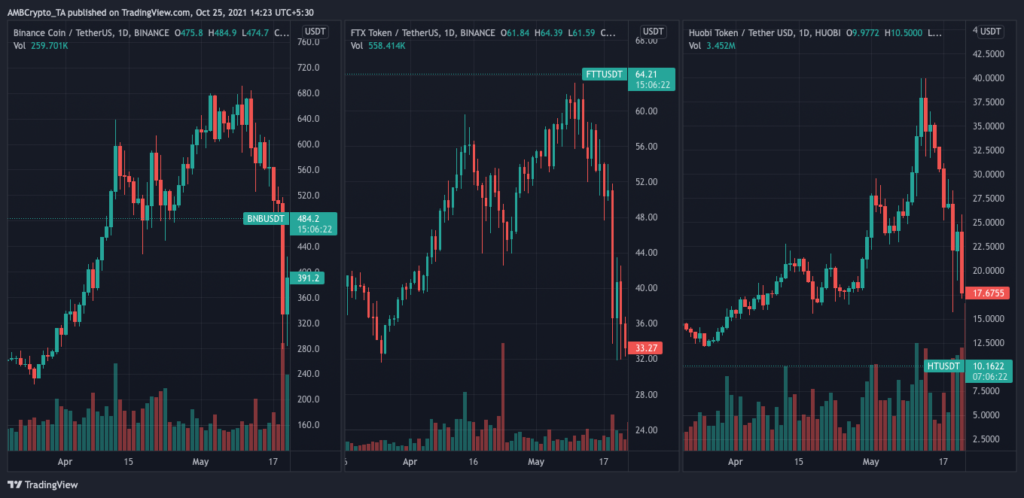

Well, during most of the previous bull run phases, exchange tokens have performed quite well. Consider this – In the period between 25 March and 12 May 2021, when both Bitcoin and Ethereum achieved new highs, Binance Coin’s value appreciated by over 205%.

Over the same period, FTX’s FTT and Huobi’s HT also rose by close to 100% and 230%, respectively.

Appreciations of similar magnitudes have been recorded on the price charts of these tokens during previous bull run phases as well. So, if the tradition is followed this time too, exchange tokens should appreciate by a reasonable percentage in the coming months.

What do the metrics say?

As far as active addresses are concerned, all the three tokens have been seeing fairly decent upticks, when compared to their respective early-October levels. This essentially means that the daily level of crowd speculation associated with these tokens has been on the rise – A good sign.

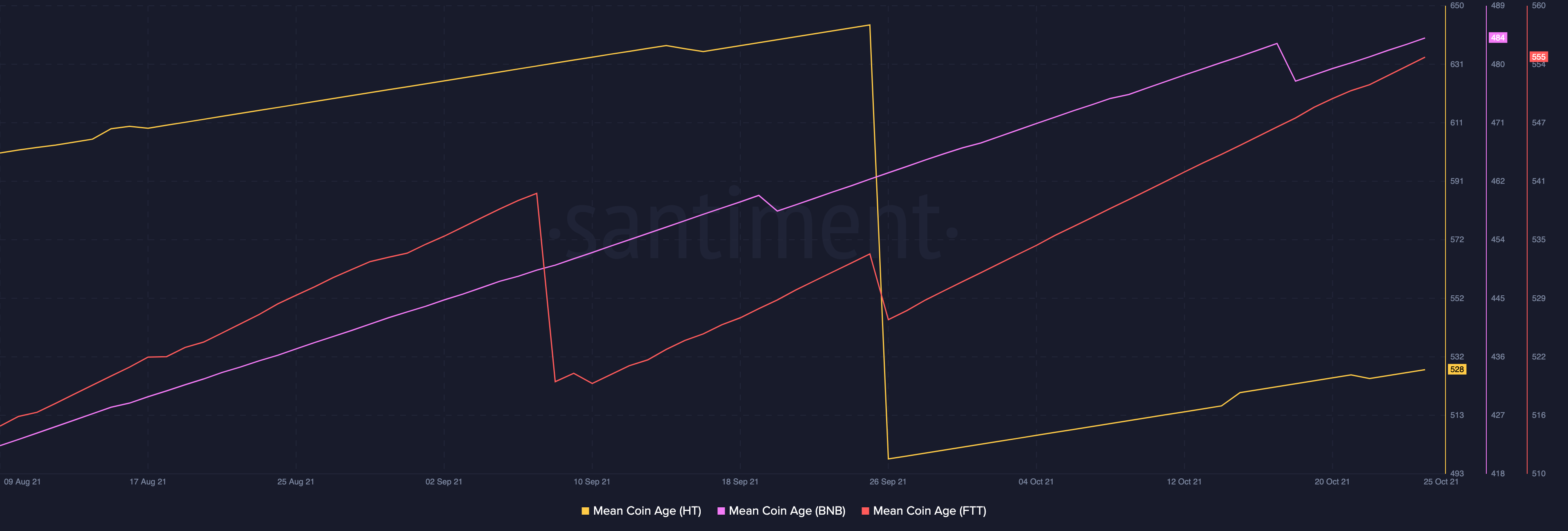

The mean coin age findings looked quite interesting as well. This metric essentially underlines the number of days the respective tokens have stayed in their current addresses. A rising slope on the chart indicates a network-wide accumulation/HODLing trend. Conversely, when the average age of dollars becomes younger [drop-offs or a downward slope], it can be argued that older tokens have started moving.

FTT and BNB’s trend seems to be quite healthy for now, but HT’s mean coin age doesn’t seem to be appealing at this point. The crypto-crackdown FUD induced by China has a lot to do with the aforementioned coin age downtrend of the Huobi token.

Source: Santiment

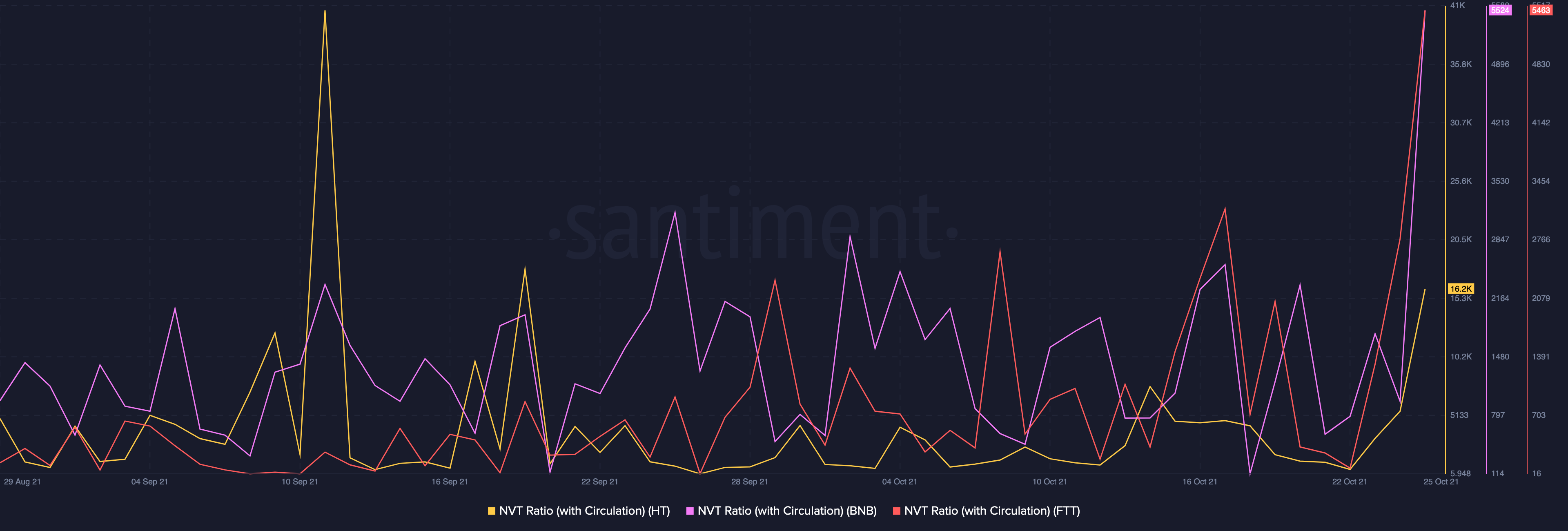

Their NVTs, on the other hand, have witnessed spikes of late, indicating that the network value has been able to outpace the value being transferred on the network.

High NVTs either indicate legitimate growth stages or a potential price bubble. Keeping the appealing state of the other metrics in mind, it can be said that the growth stage of these tokens has perhaps already begun.

Source: Santiment

So, if the broader bull phase continues without much obstruction, exchange tokens would, in all likelihood, rally. However, given the crackdown FUD scenario, nothing much can be said with surety about the Huobi token at this stage.