The case for Bitcoin hitting $100K by November

After recording a new high last week, Bitcoin’s price has remained quite steady. if complacent. In fact, over the last couple of days, it has been hovering within the $60k-$63k territory.

Well, the aforementioned non-dramatic behavior was sort of expected from Bitcoin. Fortunately, it successfully did not violate its weekend sanctity either. Even so, a few from the community have started doubting Bitcoin’s ability to rally further.

So, is the macro-bullish setup still intact?

Despite Bitcoin’s aforementioned hesitancy, its fundamentals have been improving. The Puell Multiple, for instance, has consistently remained under 2 since the beginning of October. Whenever this metric inches higher, the odds of miners selling their HODLings intensify.

As per the press time reading, the sell-side pressure was well under control. In fact, as highlighted in a previous article, most miners have stuck to HODLing their coins.

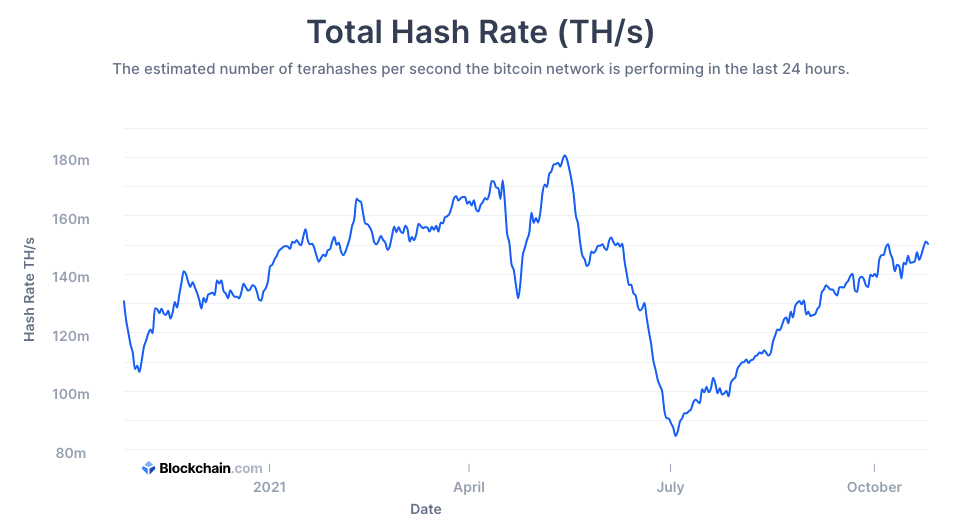

Bitcoin’s hash rate, on the other hand, has been climbing higher with every passing day. It did witness one of its deepest plunges in the May-June period, but things have improved a lot since then.

Further, on the hash ribbons chart, the 30-day MA was above the 60-day MA, implying that the worst of miner selling pressures is already over.

Source: blockchain.com

$100k in November?

Well, if the fundamentals get stronger, Bitcoin would be able to achieve the 6-digit valuation feat earlier than expected. Bitcoin’s Mayer Multiple reading reasserted the same.

This metric had a value of 1.35, at the time of writing. What this means is that its price is already trading at a 35% premium to the 200-day MA.

The MM was created to analyze BTC’s price with respect to its previous movements. Whenever investors have invested at any multiple below the 2.4-threshold, it has fetched them substantial gains.

Traditionally, whenever Bitcoin’s price has rallied, the MM’s reading has always remained above 1.5. Thus, looking at its current state, it can be said that a full-fledged uptrend phase is on the cusp of knocking at Bitcoin’s door.

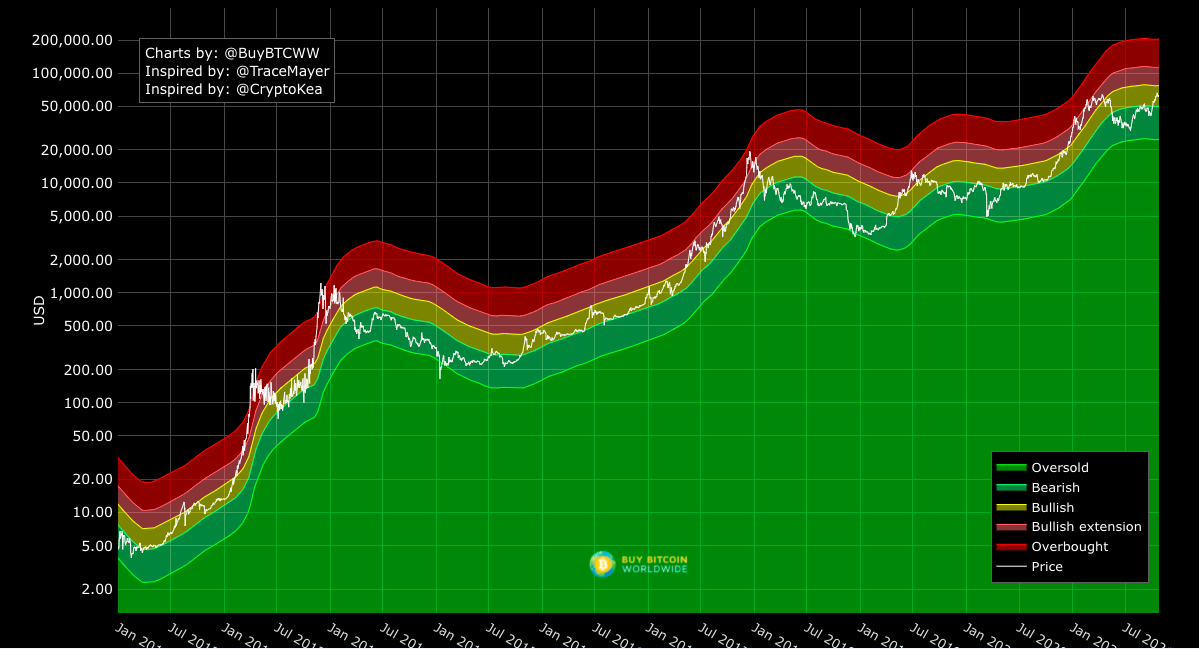

Now, as far as the intensity of the trend is concerned, having a look at the Mayer Multiple bands would give a better understanding.

From the snapshot attached below, it can be observed that BTC’s price recently entered the ‘bullish’ band [yellow].

Whenever BTC’s price has stepped into the aforementioned band from below, it has more often than not pushed itself to the extension region and then, to the overbought zone.

Notably, at press time, the extension zone was encapsulated within the $76.9k – $113.09k region. Thus, if the elevation tradition is adhered to this time too, BTC would hit new highs very soon.

Source: buybitcoinworldwide.com

Simply put, this bullish phase is just like any other. The market might hiccup a little here and there, but it would likely be able to bounce back stronger and achieve its 6-digit valuation next month.

Thus, there’s not much for HODLers to worry about at this stage.