Why a ‘bullish’ RUNE doesn’t tell us the whole story

RUNE is currently attempting a recovery after extending its downside over the last few days. It recently retested its structural support near the $3-price level too.

The last time RUNE traded around the same price point was on 23 February and 21 July, both after major bear runs. It looks like things aren’t very different this time, especially since the retest comes after a major downturn.

RUNE’s price dropped by roughly 80% from its end-of-March high to its current support level.

RUNE was trading at $3.36m at the time of writing, after a notable recovery from its $2.46 low on 12 May. The price registered a pullback after the recent local low, before closing the day on the 0% Fibonacci support line.

RUNE’s price looks like it is on a bullish recovery path. A short-term rally will likely retest support near the two closest Fibonacci retracement levels at the 23.60% and 38.2% lines. This means that it will likely encounter support near the $5.42 and $6.90 price levels, respectively.

Will RUNE maintain the bullish trajectory?

RUNE’s price action has been heavily oversold over the last few weeks and is due for a significant retracement. This expectation is further supported by the fact RUNE’s RSI entered the oversold zone at its recent low. It also registered healthy accumulation which aided its ongoing recovery.

The bullish performance over the last three days is also a sign of downward trend exhaustion, paving the way for the bears to take over. RUNE’s on-chain metrics further align with the aforementioned observations.

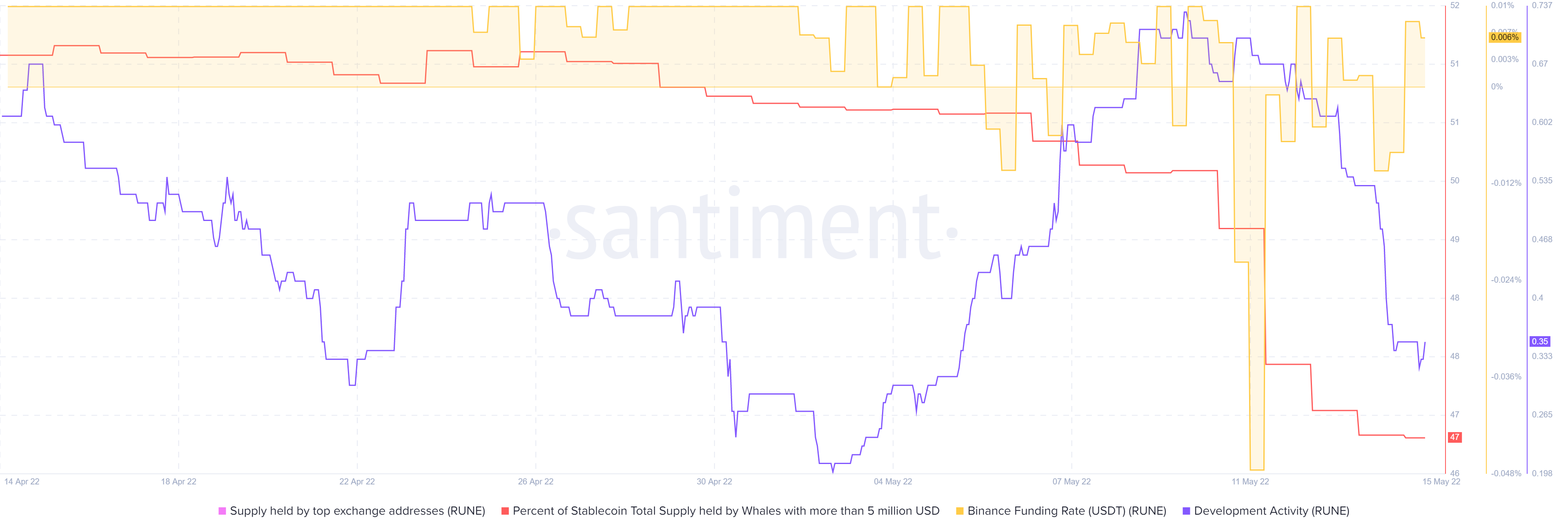

For example, the ‘supply held by whales’ metric indicates that the sell-off is tapering out.

The ‘Binance derivatives funding rate’ metric confirms a recovery to normal levels, thus showing a sign of restored interest from the derivatives market.

Additionally, developer activity has seen a sharp drop in the last five days. This is likely due to the impact of UST de-pegging, especially as developers await a return to normalcy.

THORChain’s latest upgrade also revealed that developers are waiting for the Terra team to provide a recovery plan.

Conclusion

RUNE’s overdue recovery might finally be here. However, it does not necessarily mean the rally is guaranteed. The markets have proved to be extremely volatile and that volatility might strike yet again in favor of more downside.