Why it’s worth keeping an eye on Bitcoin’s volatility

Bitcoin, at the time of writing, was trading close to its latest ATH of $52,547, with the crypto far from its 2017 ATH under $20,000. In fact, its market capitalization was just shy of $ 1 trillion. What then? Well, if the price continues to hike at the same pace, a 10x increase would lead to the market capitalization of Gold getting toppled.

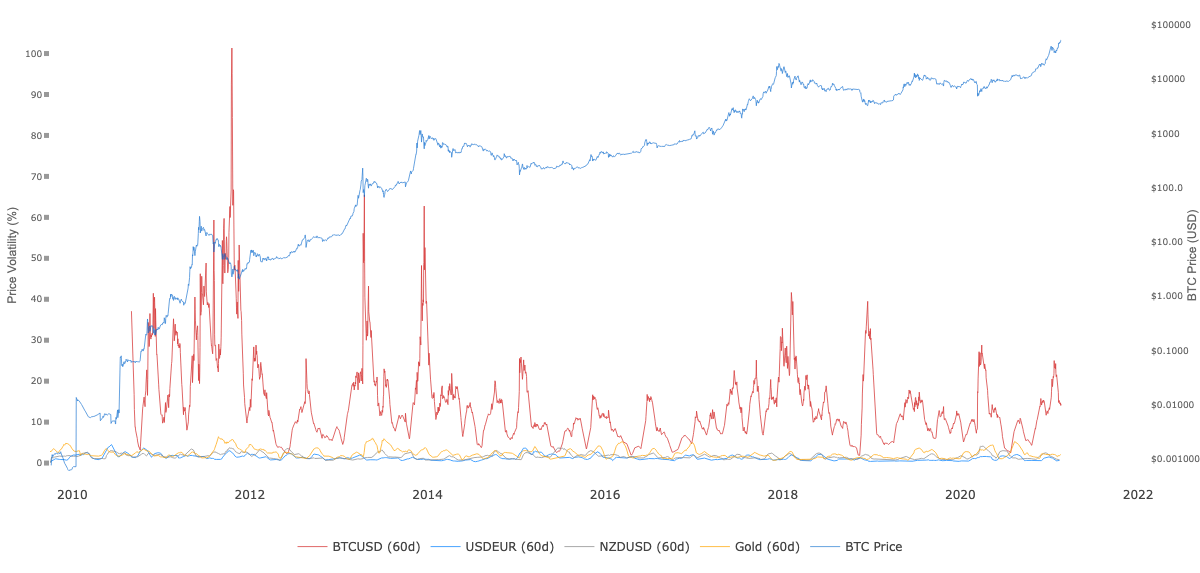

The crypto-asset’s volatility is currently a little over 14%, especially after the price hit its latest ATH on the price charts. Here, it is important to note that BTC’s volatility has dropped by over 10% to hit this level. Interestingly, when compared to the volatility of other assets, emerging currencies have higher volatility, 35%, when compared to Bitcoin.

Even at a price level of $51,000, how can the volatility be 14.45% and what does this mean for the future of the price rally? Well, this is clearly a sign that the volume of Bitcoin being traded on exchanges and its demand is not high enough to sustain the price at the press time level. Here, it’s worth looking at other metrics too.

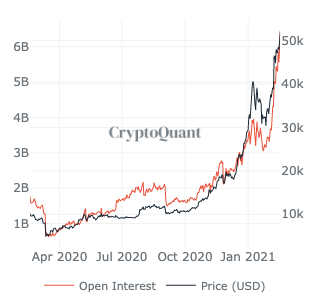

Source: Woobull ChartsThe total number of outstanding Bitcoin contracts on all derivatives exchanges is climbing steadily. This can be understood using the following chart,

Source: CryptoQuant

Bitcoin’s Open Interest on exchanges has been forming a pattern since September 2020, based on which it is set to rise in the following weeks, as can be observed from the chart. Since the pattern emerged in late 2020, it may follow through into 2021 or it may not. The success of the pattern will be reliant on the hands of the trader.

The volatility of the asset and the number of Bitcoin contracts are not the only metrics calling for a trend reversal in Bitcoin’s price. Trade volume and metrics on derivatives exchanges are key to the sentiment of retail traders. Institutional traders are generating demand, buying, and HODLing, however, those have long-term consequences.

An immediate impact comes from retail trader activity on spot and derivatives exchanges. Traders can expect a correction in the short-term as a result of volatility loss, however, there is enough stablecoin flow and interest on derivatives exchanges for a bounceback to its ATH levels later.