Why MKR’s Q4 rests on its whales

- After a comfortable rally last month, MKR’s bears entered the market.

- Though accumulation was high, the rest of the metrics remained bearish.

Maker DAO [MKR] had a comfortable rally last month as it registered promising gains. However, the winds changed direction as the token’s price dropped considerably over the last seven days.

Read Maker DAO’s [MKR] Price Prediction 2023-24

Whales are now buying Maker

Maker took investors off guard last month when its price started to rally. In fact, MKR’s price went up by more than 23% in the last 30 days. But things changed soon as the MKR bears entered the market.

As per CoinMarketCap, MKR’s price moved southward as its price dropped by over 10% last week. Not only that, but just in the last 24 hours, the token’s value plummeted by over 1.2%.

At the time of writing, MKR was trading at $1,401.03 with a market capitalization of over $1.3 billion. The bad news was that the price plummet was accompanied by a hike in trading volume. While the token’s price sank, whales took the opportunity to increase their accumulation.

As per Lookonchain’s recent tweet, a whale bought a total of 1,750 MKR, worth $2.5 million, at an average price of $1,429 in the past three days.

The whale swapped 80% of its position into $MKR, and 20% is $ETH.

Bought a total of 1,750 $MKR ($2.5M) at an average price of $1,429 in the past 3 days.https://t.co/64KsldjmrQ pic.twitter.com/MuhrYBU9kY

— Lookonchain (@lookonchain) October 7, 2023

A closer look at the market revealed that buying sentiment was overall dominant. The token’s Exchange Outflow spiked substantially while MKR’s price dropped.

Additionally, its Supply on Exchanges fell, while its Supply outside of Exchanges increased. This clearly suggested that investors were stockpiling the token. On top of that, whales were also confident in MKR, as evident from the rise in its supply held by top addresses.

Will whales’ confidence in Maker pay off?

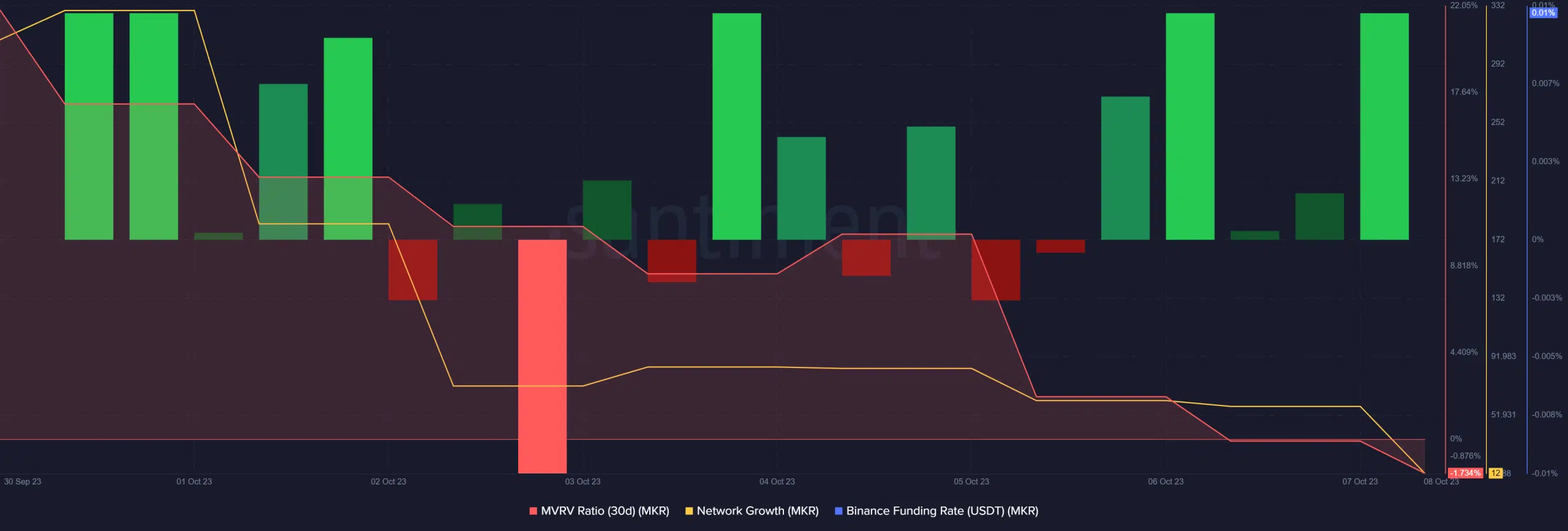

Though the whales had faith in MKR, its metrics continued to support the sellers. For example, MKR’s MVRV Ratio dropped sharply last week. Its Network Growth also followed a similar trend of decline, meaning that fewer new addresses were created to transfer the token.

Additionally, its Binance Funding Rate was green, which meant that derivatives buyers were purchasing the token at a lower price.

Is your portfolio green? Check out the MKR Profit Calculator

Consequently, most market indicators were also in the sellers’ favor. Notably, Maker’s MACD displayed a bearish crossover. Its Relative Strength Index (RSI) also registered a downtrend and was headed towards the neutral mark.

Nonetheless, MKR’s Chaikin Money Flow (CMF) was optimistic as it gained upward momentum in the recent past.