Why this exec expects Bitcoin mining to be ‘less profitable’ in 2022 than in 2021

Often considered the king coin of the crypto market, Bitcoin was trading at $48,611 at the time of writing. With that, BTC is down almost 1% in the last one day and slipped by 3.7% over the last two weeks on CoinGecko.

Ahead of 2022

That being said, Argo CEO Peter Wall recently told CNBC that what drove the price of Bitcoin in 2021, will also be its drivers in 2022. Adding to that, Wall also analyzed that the market has matured overtime when it comes to both the capital markets and the regulatory outlook. From a mining perspective, he said,

“We’ve seen this year, the industry go from being essentially teenagers at the start of the year–kind of uncertain in themselves to a very confident young professionals in their 20s.”

He further explained in the age analogy that the mining ecosystem is even more mature in its 30s. He also commented,

“…regulators are now taking the space more seriously.”

Having said that, Wall predicts that 2022 will see more hashrate come online as more miners get added to the system. This is when miners are “extremely on the profitable end of things right now.” He also explained,

“The margins are still very, very strong…but it’ll be a little probably less profitable in 2022 than it’s been in 2021.”

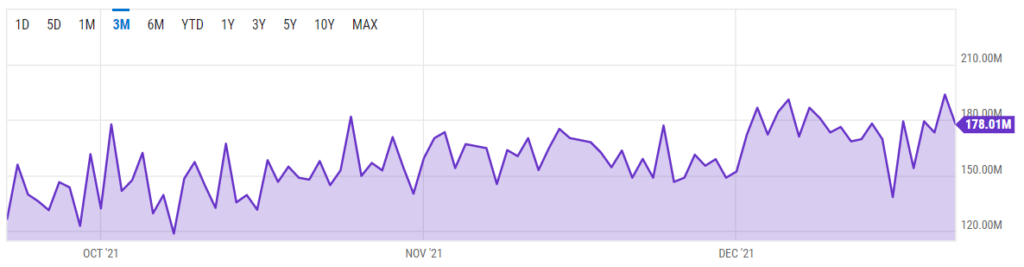

Meanwhile, it is worth noting that the Bitcoin network hashrate at the time of writing is 178.01M. A significant increase from the levels seen in October.

Mining profitability

With that, let’s also look at an analysis by Arcane Research around BTC mining and mining stocks as per its recent monthly report. Until November, the report pointed at a growth in mining returns. However, since then, there has been a fall in profitability.

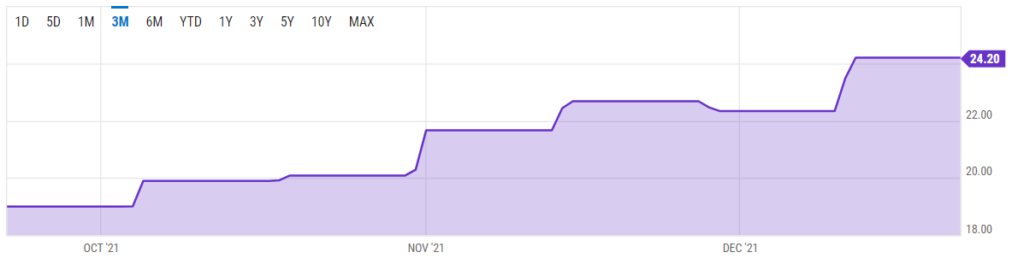

Not to mention that the relative measure of BTC difficulty has been on a rise in the last 3 months, with a value of 24.20T at press time.

Despite the fall, the report called mining highly profitable, stating,

“Even though cash flows have fallen, mining is still highly profitable…Even after the recent decline, cash flow margins have improved in 2021 since the bitcoin price has increased faster than the hashrate.”

If we look at the past year, another research report has found that Bitcoin miners made over “$15.3 billion in revenue, representing a year-on-year increase of 206%, a record year.”

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-5-1-400x240.webp)