Will Aave’s long-term growth plans dampen short-term investor expectations?

- Aave reveals how past grants have contributed to the network

- Why the focus on development is the right way to go for AAVE

Aave announced that snapshot voting for a recent proposal seeking for the renewal of Aave Grants DAO kicked off. If approved, the decentralized network may embark on stimulating more development in pursuit of long-term growth.

Read AAVE’s price prediction 2023-2024

The official announcement revealed that the proposal being voted on was the 4th proposal of its kind aimed at boosting development. The move came at a time when the market has been experiencing a slowdown in the crypto market.

The crypto winter has substantially eroded trust and utility in the segment, thus the snapshot voting is of significant important for AAVE.

Snapshot voting is live for our proposal to renew Aave Grants DAO!

This is Aave Grants' 4th proposal to drive development, attract the best contributors, and ensure Aave's long-term growth by funding talented builders and cultivating Aave's culture ?https://t.co/WLcG2TIgql

— AaveGrants.lens (@AaveGrants) January 7, 2023

If the proposal is passed, it will allow Aave to focus more intently the network’s long-term future. Since this is voting on grants renewal, it might be a good idea to look into how past grants have been handled, and whether they have benefited the network.

Aave Grants revealed that more than 122 grants were awarded since the last proposal. The recipients of those grants focused on the development of applications and integrations, as well as education and marketing for the community. Some of those grants have gone into hackathon awards so one can say they have benefited the network.

Will Aave Grants DAO have an impact on short and long-term price performance?

A short-term price impact is unlikely since there will not be any direct correlation with demand. Nevertheless, it may have an impact especially since it is heavily centered on facilitating development.

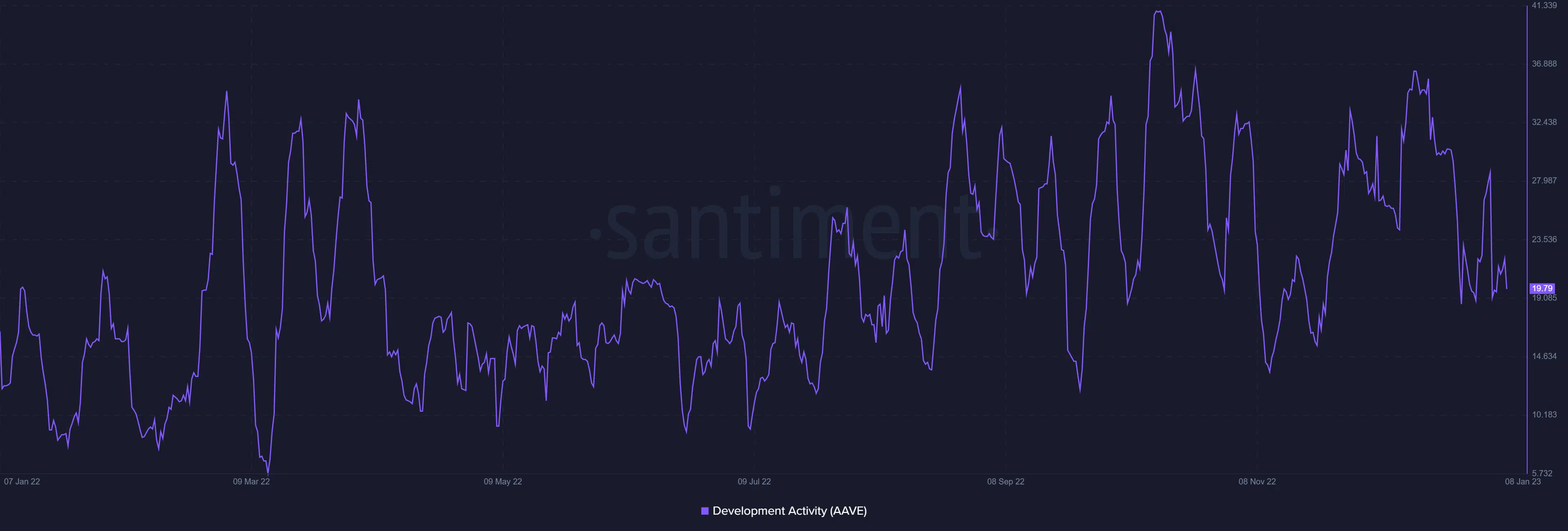

Aave managed to achieve healthy development activity in the last 12 months but the same metric indicated a significant drop in the last four weeks.

Healthy development may encourage more investors to consider the state of the network. This might contribute to higher investor confidence but this is just one aspect.

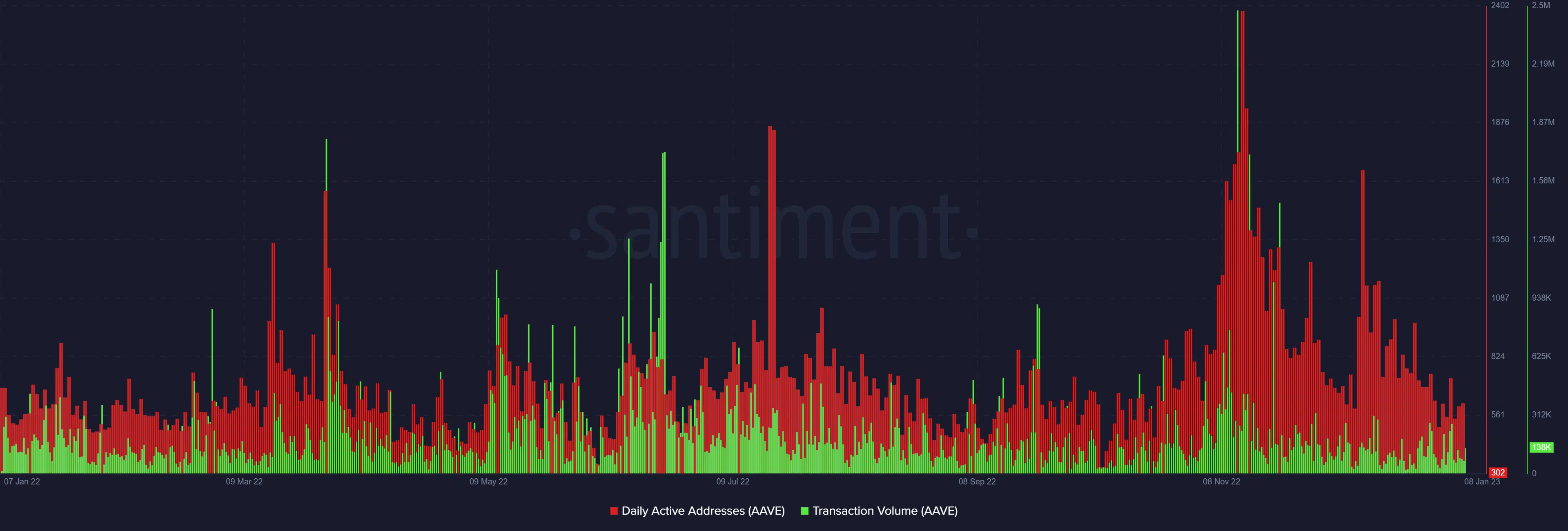

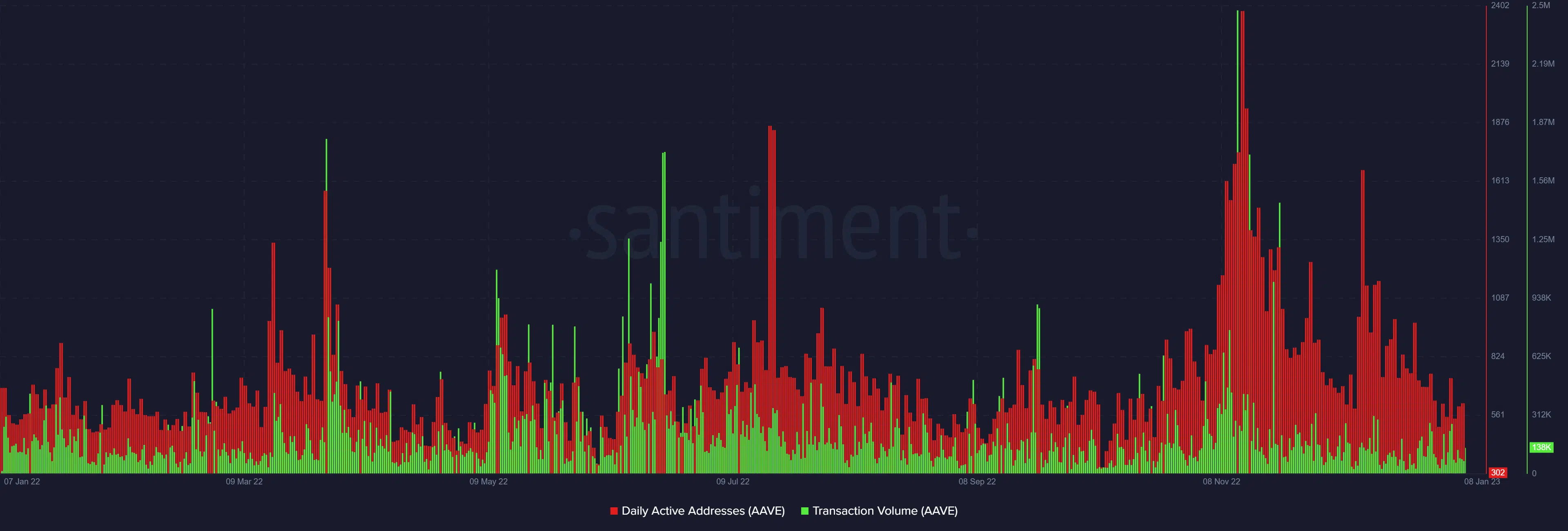

Investors should also consider other areas of growth that may contribute to long-term growth. For example, network growth is another area that has taken a huge hit from November to the present.

How many AAVEs can you get for $1?

AAVE’s tanking network growth might be due to lower Web3 activity thanks to the bear market. A resurgence or pivot in network activity will likely manifest when demand for crypto recovers.

The above observation was also backed by the fact that transaction volume and daily active addresses have also declined in the last few weeks.

Regardless of the market outcome in 2023, Aave’s decision to aim the grants at network development can act in favor of investors for the long-term. It will strengthen AAVE’s position when the market eventually recovers.