Will Bitcoin see a ‘pity bounce’ before pumping to $64,000 and higher

Post 7 September’s debacle, Bitcoin has keenly been recovering on the price charts. Within a span of two weeks, the king coin’s valuation climbed from its local $42.8k lows to $48k. Interestingly, at the time of writing, Bitcoin was the only coin that managed to project a positive weekly RoI [up 5% at the time of writing] in the top 7 list.

So, is this merely a ‘pity bounce’ that the market was witnessing before the actual pump, or has Bitcoin already begun its rally unobtrusively? Well, looking into the state of a few key metrics would help in answering the question with surety.

Momentum

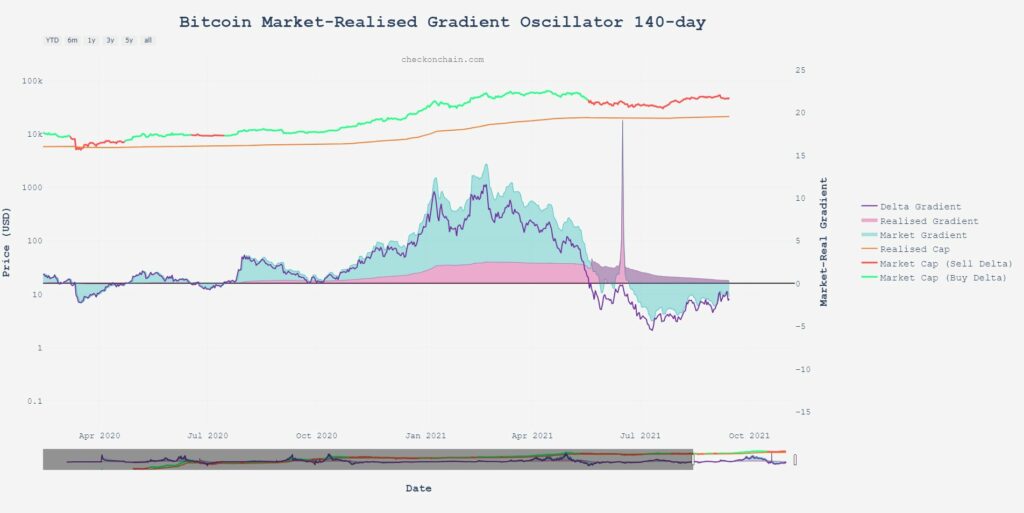

The state of the MRGO [Market-Realized Gradient Oscillator] seemed to be fairly appealing at press time. This model helps in keeping track of the change in momentum based on the projections of the realized and market gradients.

Whenever these gradients get steeper with time, it means the acceleration of an ongoing trend is likely. Historically, an uptrend has, more often than not, translated into a bullish narrative. In essence, every major rally that has happened in the past has been accompanied by some amount of positive momentum.

Quite evidently, the momentum that had been trending in the negative territory since May, has finally started advancing towards the positive territory. The trend looks decisive this time and there are no warning signs, as such, that have been projected by this on-chain metric.

Source: checkonchain.com

Will ST HODLers play spoilsport?

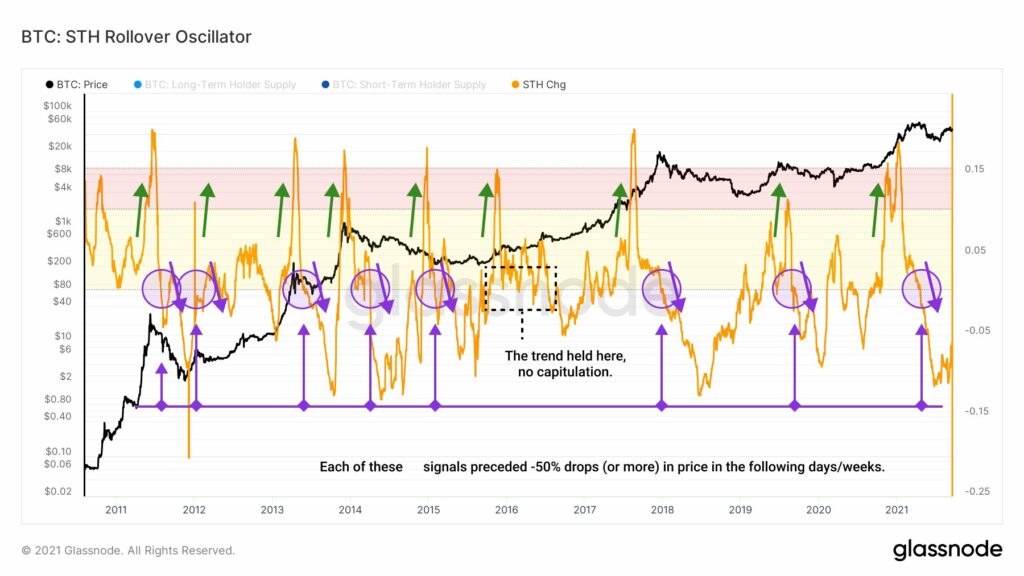

Whenever weak hands tend to exit the market, they leave a negative imprint on the price. When old hands sell into strength, a fair share of coins flow into the ST hands. Eventually, the sell supply floods demand, the price peaks and the market eventually turns over. By this point, the long-term HODLers get into their accumulation mode and STH supply begins to trend downwards.

The STH Rollover Oscillator helps in gauging such trends and, has been able to identify market tops. As can be seen from the chart attached, whenever this indicator peaked, in the past [represented by green arrows], Bitcoin’s price also customarily peaked. Similarly, a fall in the reading of this metric ended up pulling BTC’s price down along with it.

After every purple trigger, the market has bottomed and then bounced back. This time around too, it was seen that that the oscillator had already started its upward trend, implying that the market would most likely reach its peak within the next couple of months.

Source: Glassnode

How strong is the bullish impulse?

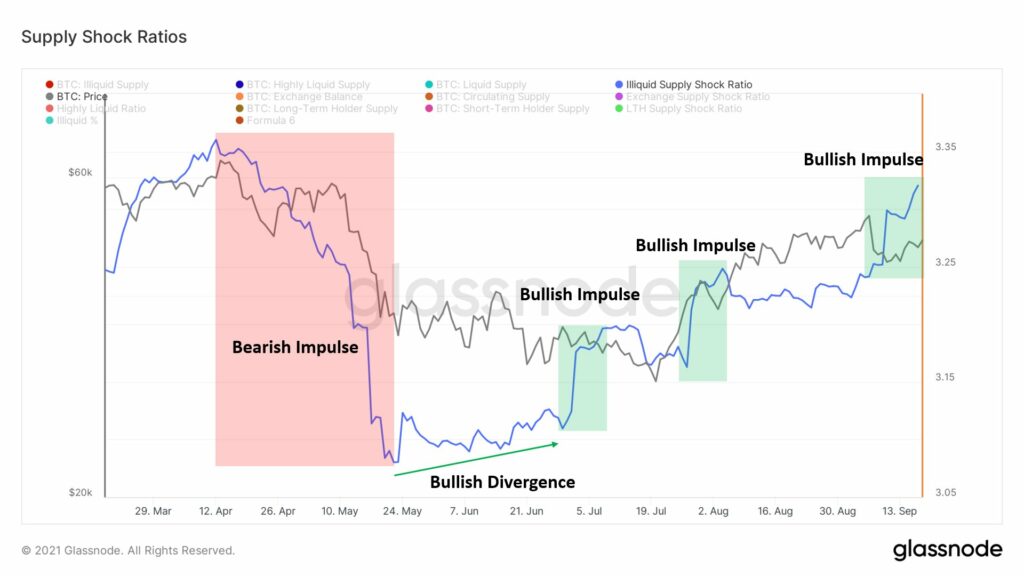

Further, the supply shock ratios have also become even more concrete in their depiction. Bitcoin’s illiquid supply shock ratio had evidently been trending downwards until recently. However, the northbound movement started a few days back and there has been no looking-back since then.

A supply shock is an event that triggers a sudden increase or decrease in the supply of an asset. The change usually ends up affecting the equilibrium price and triggers an change in valuation. This time aound, the market is currently in another bullish impulse of Bitcoin getting locked up by strong hands.

If the trend proceeds in the same direction, there wouldn’t be much for market participants to worry about Bitcoin’s price. Sharing his opinion on similar lines, popular on-chain analyst Will Clemente recently asserted,

“Expecting continued upside through October”

Source: Glassnode

Keeping the state of the aforementioned metrics in mind, it can be concluded that the odds of a “pity bounce” scenario unfolding itself seemed pretty unlikely. Having said that, an eye needs to be kept on the derivatives market for short-term fluctuations. If not-much drama happens over there in the coming days, then Bitcoin’s rally to its pre-set highs, including $64k, should be quite mellow.