Will this Bitcoin metric repeat its 2013, 2017 bull-phase in 2021

When we talk about market resistance and support for any asset, the thinking is directly associated with psychological ranges such as Bitcoin at $40,000 or Ethereum at $3000, Cardano at $2, and so on. Yet, over time, the entire premise of observing resistance/support only on price charts has changed, as certain values on metrics have been defined as a strong bounce-back for the market.

On-chain data is more defined than ever for Bitcoin, and historical movement based on these metrics may allow us to gauge future directions or trend shifts. At press time, Bitcoin NUPL might be one such metric which requires the market’s attention right now.

Bitcoin NUPL at 0.5; how much to bet on?

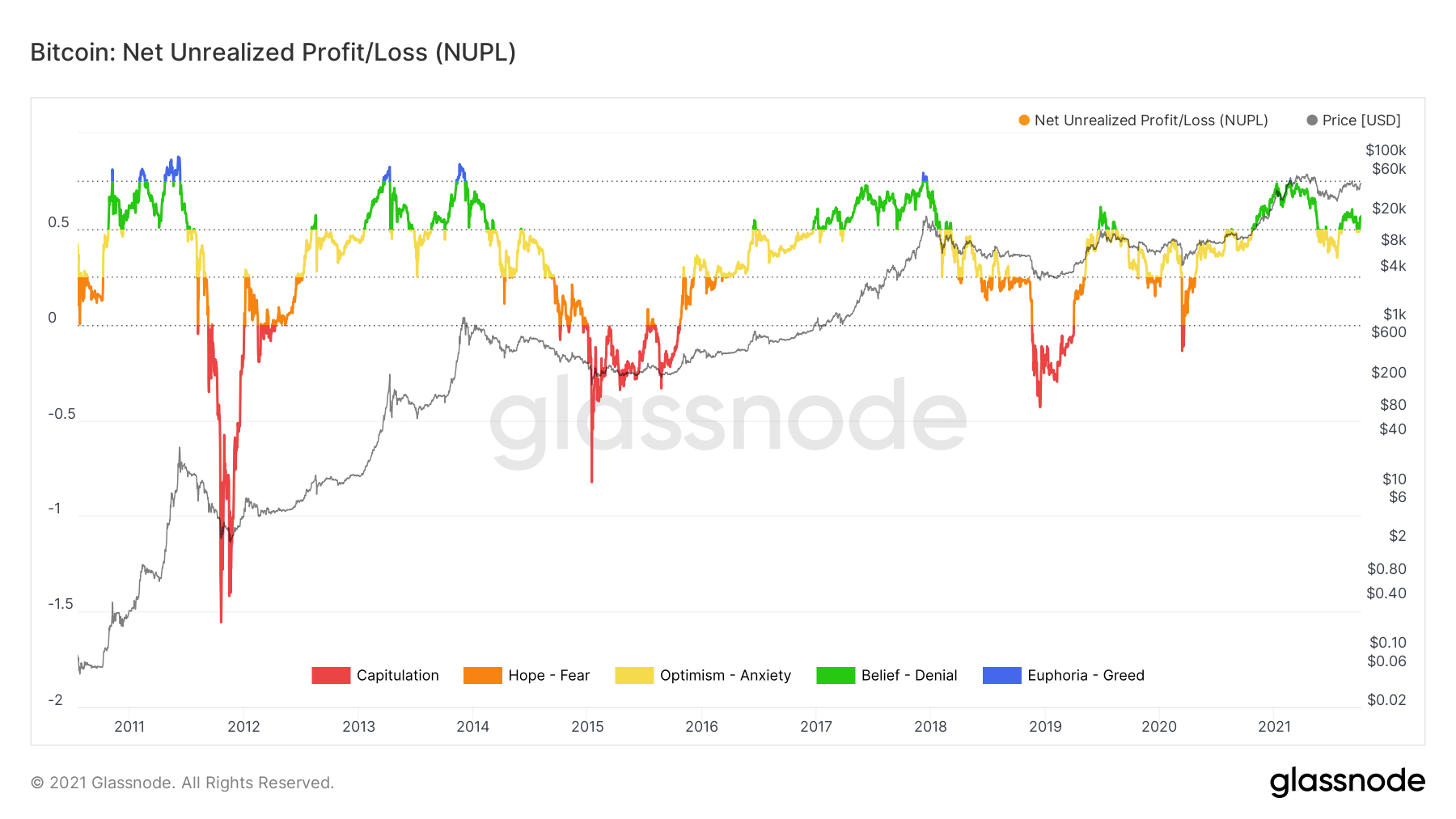

Source: glassnode

Bitcoin Net Unrealized Profit/Loss or NUPL tracks the profitability of investors and it is currently reaching an interesting mark. As per data from glassnode, the NUPL value reached 0.5 despite bullish signs, which indicates that the unrealized profit held in the coin supply is equivalent to 50% of the market cap (approx. $450 billion unrealized profits). However, from here, considering NUPL begins to drop further, the profitability of the coin supply will decrease.

Now, based on historical data, the 0.5 NUPL level has acted as strong support, from which Bitcoin has gone on to attain new ATH levels. The prime examples being 2013, and 2017; the two largest rallies before 2021. Yet, there have also been times when the indicator continued to drop below the 0.5 mark, particularly in 2019, when prices dropped 30% towards the end of the year.

2019 was a long time back though

Now, giving the other improving on-chain data its due credit, it is important to note that the dynamics of the market have changed multi-fold since July 2019. Now, another key development over the past few weeks is that the spend volume age bands have decreased severely since January 2021.

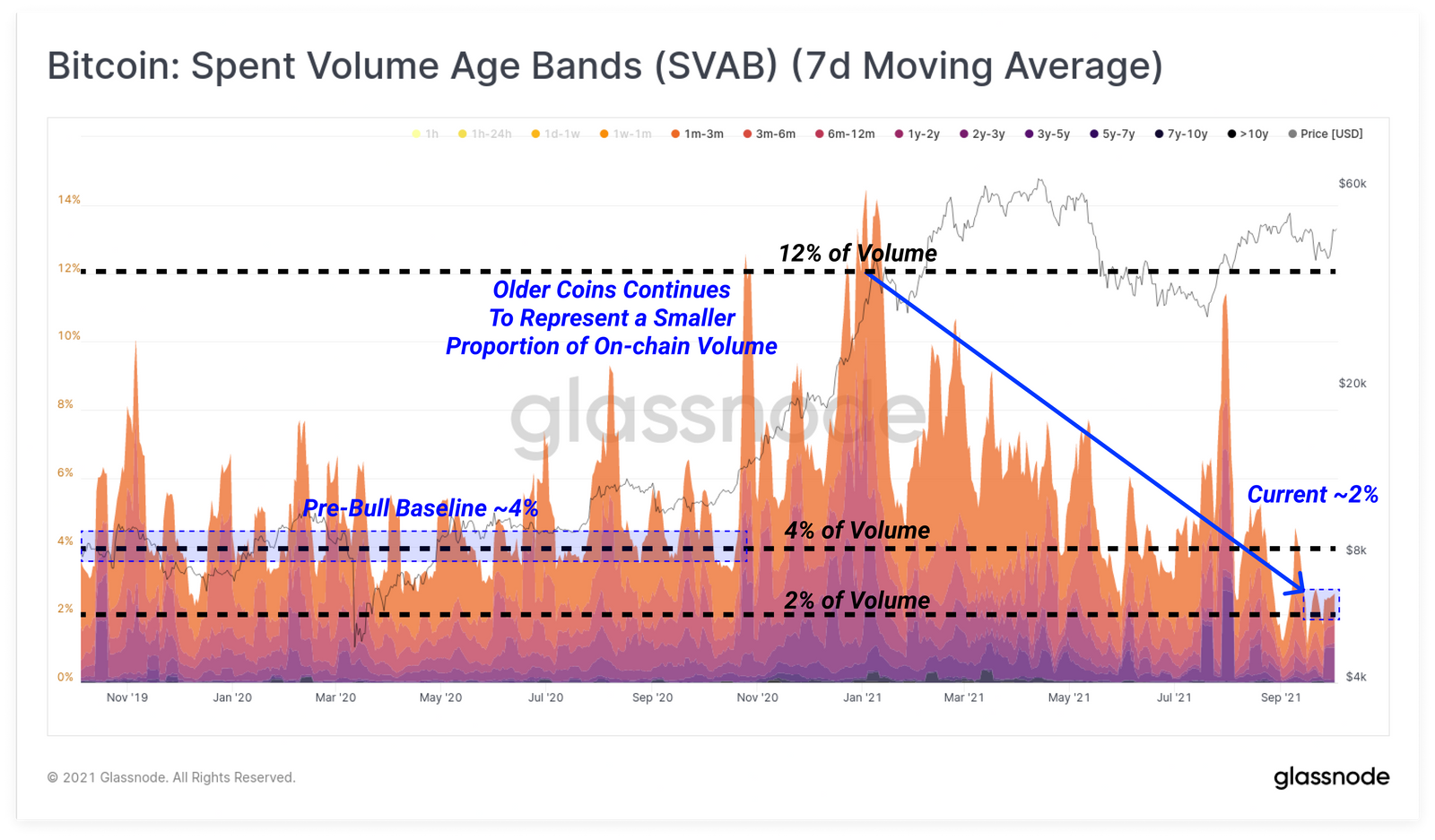

Source: glassnode

At press time, the old-coin volume dominance has dropped down to a multi-year low of 2%, and for comparison, it was 4% before the bull-phase in 2020. With old hands exhibiting more conviction at press time, the shuffling trading volume could basically be short-term trades taking profit while new buyers are absorbing.

Yet, it is also important to remember that institutions haven’t dipped their toes in yet, since Q4 2020-Q1 2021. So the trigger points for a solid bull-confirmation are still up in the air.