With higher year-to-date returns in 2021, these stocks beat Bitcoin to it

By and large, Bitcoin has been highly popular asset this year, with around 8 out of 10 investors bullish for the coin in the upcoming quarter. However, is it noteworthy that some traditional stocks have outperformed Bitcoin this year.

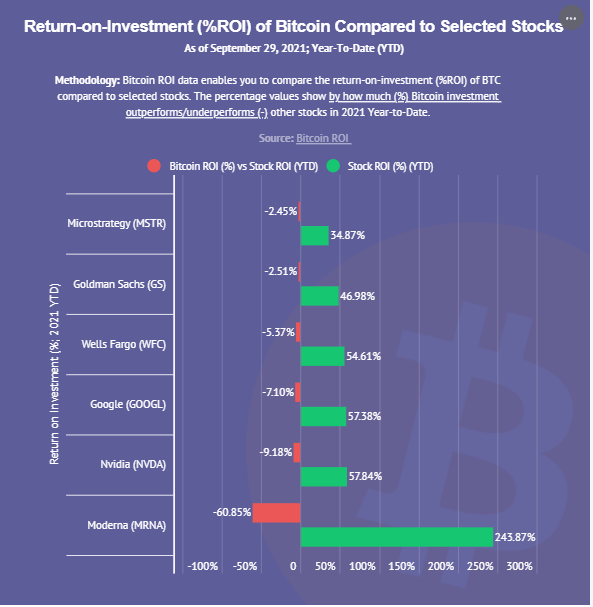

As per data compiled by CryptoParrot, stocks like Moderna and Goldman Sachs have recorded higher returns on a year-to-date basis, when compared to Bitcoin. In 2021, Moderna (MRNA) outperformed by 243.87% while Bitcoin underperformed the stock by -60.85%; Nvidia (NVDA) also outperformed Bitcoin by an estimated 57.84% with the cryptocurrency behind by -9.18; Wells Fargo (WFC) and Goldman Sachs (GS) also recorded superior returns of around 54.61% and 46.98% respectively.

MicroStrategy, which owns over 0.5% supply of Bitcoin, is the largest public holder. Surprisingly, even MicroStrategy stocks overperformed Bitcoin by 4.25% YTD. Other public companies such as Tesla and Square, that own over 0.2% and 0.03% of BTC supply respectively, couldn’t outperform the cryptocurrency.

Bitcoin is also often compared to other asset classes including gold. Recently, Marion Laboure, Analyst at Deutsche Bank Research said that despite the risk associated with BTC, she could potentially see Bitcoin becoming the “21st-century gold.”

Having said that, the lack of a regulatory framework in the cryptocurrency industry remains a hindrance for attracting more investment in this asset class. In September, Bitcoin and other cryptocurrencies underwent chaos, as fears around China’s Evergrande collapse mounted. Another FUD sell-off followed after China’s announcement that rendered private cryptocurrencies “illegal.”

On the other hand, Bitcoin managed to give stellar returns when the stock market was plunging during the Covid-19 phase. After a bloodbath in March and April, the stock market was on a recovery journey in H2 2020. And, some of the pharma and tech companies have led the rally. Ergo, vaccine manufacturer Moderna managed to outperform some of the frontrunners, including Bitcoin.

But, Bitcoin continues to offer diversification opportunities to investors. Additionally, at this point, Bitcoin and other cryptos also offer some tax benefits. The IRS, for instance, reportedly classifies crypto as property, and their treatment is different when compared to stocks and mutual funds. Having said that, the regulatory framework around cryptocurrencies is sill unclear and countries around the world are still working on it.

In this regard, the U.S. SEC has been in the news quite often, what with the mounting lawsuits against crypto-organisations. It remains to be seen what benefit cryptocurrencies can continue to offer, once the regulations fall in place.