XRP bulls could regain control and this cohort could be the driving force

- XRP enters a possible accumulation zone after previously lending favor to the bears.

- Assessing whale activity in determining the price outcome this week.

It’s been almost four weeks since Ripple’s win against the SEC, which sent XRP soaring. That rally was short-lived and the cryptocurrency has gradually given up roughly half of the gains achieved on the day the announcement was made.

Read XRP’s price prediction 2023-24

Could XRP be ready to regain its upside or will it extend its downside to post-judicial ruling levels? Let’s first assess the downside that has prevailed in the last three weeks.

XRP peaked at $0.94 on 13 June, but it has since dropped and recently bottomed out at $0.59. This represented a 36% dip from its current 30-day high to its recent low. XRP exchanged hands at $0.63 at the time of writing, which represented a 2.61% upside in the last 24 hours.

This performance could be considered noteworthy because the bears appeared to be losing their momentum. Furthermore, the price bounced back at the 50-day moving average and near the 0.623 Fibonacci retracement line.

XRP managed to steer clear of being oversold by a considerable margin according to the Relative Strength Index (RSI). While this could signify that it has room for more downside, it was worth noting that the Money Flow Index (MFI) was briefly oversold. However, it has since registered some liquidity inflows, thus confirming that there has been some accumulation recently.

Based on the above findings, we can conclude that the bulls are making an attempt at regaining control over XRP’s price action. However, a successful outcome will likely be determined by the level of accumulation currently taking place.

Low whale participation but that might be about to change

On-chain metrics may not inspire much confidence as far as bullish expectations are concerned. Network activity dipped in the last five days and was now closer to its lowest levels in the last four weeks. The on-chain volume also indicated a lack of excitement in the market. Typically not indicative of a scenario underpinning bullish momentum.

Nevertheless, there are some observations that may support the probability of a healthy bullish relief. For example, there was a surge in daily active addresses in the last two days. Whale activity was within the normal levels, hence nothing too exciting.

Is your portfolio green? Check out the XRP Profit Calculator

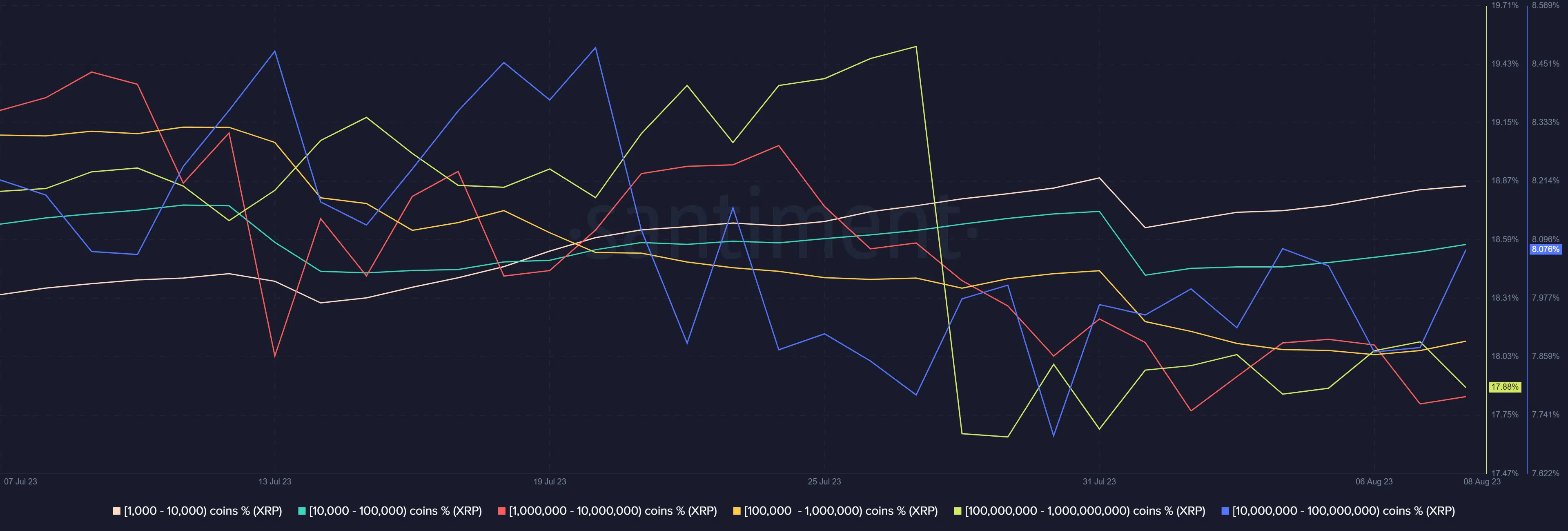

While whale activity might be low right now, the supply distribution suggested that it might change soon. This was because some whales were starting to accumulate XRP.

For example, addresses holding between 10 million and 100 million (denoted in blue have been the biggest contributors to the bullish momentum in the last two days.

Addresses holding over 100 million XRP contributed to sell pressure in the last two days. A pivot from this whale category would likely support more upside.