XRP bulls demonstrate strength at key level, but should you buy now

If you have been keenly following up on XRP and the Ripple-SEC legal battle, then you will be pleased with the latest developments. More importantly, XRP investors might receive another confidence following the latest judicial ruling.

According to recent reports, the judge presiding over the case has allowed multiple third parties to join the lawsuit. SEC had reportedly objected to this outcome because the approved parties are inclined towards Ripple.

#XRPCommunity #SECGov v. #Ripple #XRP Judge Torres, over the SEC’s objection, grants I-Remit’s and TapJets’ requests to file amicus briefs in support of Ripple. pic.twitter.com/07kyBi7NYj

— James K. Filan ???? (@FilanLaw) October 11, 2022

The XRP community of supporters saw this development as favorable for Ripple’s defense against the SEC. Investors should note that this does not necessarily guarantee that the final judgment will favor Ripple.

Nevertheless, it underscores the strong defense narrative that Ripple has held up so far.

Previous rulings favoring Ripple have triggered favorable investors’ sentiment but will history repeat this time?

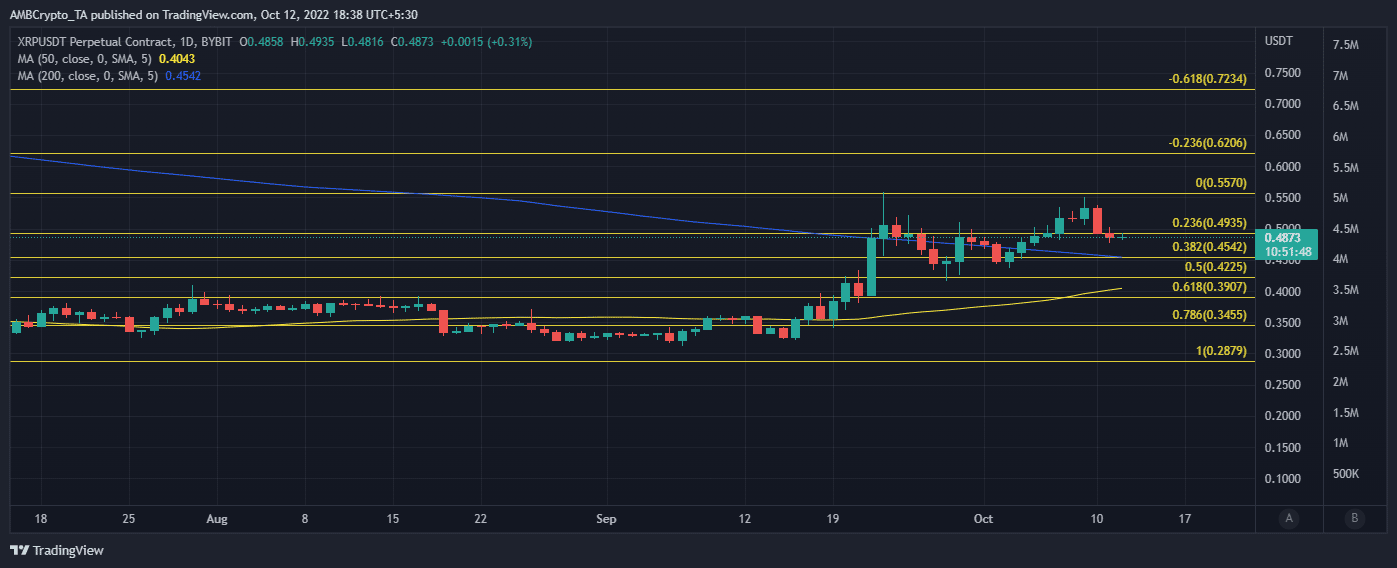

XRP’s press time price position highlighted increased chances of a pivot in favor of the bulls. Notably, the alt has been bullish since mid-September and recently peaked at $0.55 before experiencing a bearish retracement.

It’s here to be noted that XRP retraced by roughly 11% from its current weekly top in the last two days. It traded at $0.488 at press time, which was just below its 0.236 Fibonacci retracement line.

It had already demonstrated a slight upside in the last 24 hours with significant chances of more upside. This outlook might be enforced by the current price level near the Fibonacci line.

Here’s AMBCrypto’s price prediction for Ripple (XRP)

Boosted investors’ confidence might also strengthen XRP bulls in the next few days courtesy of the favorable judicial ruling.

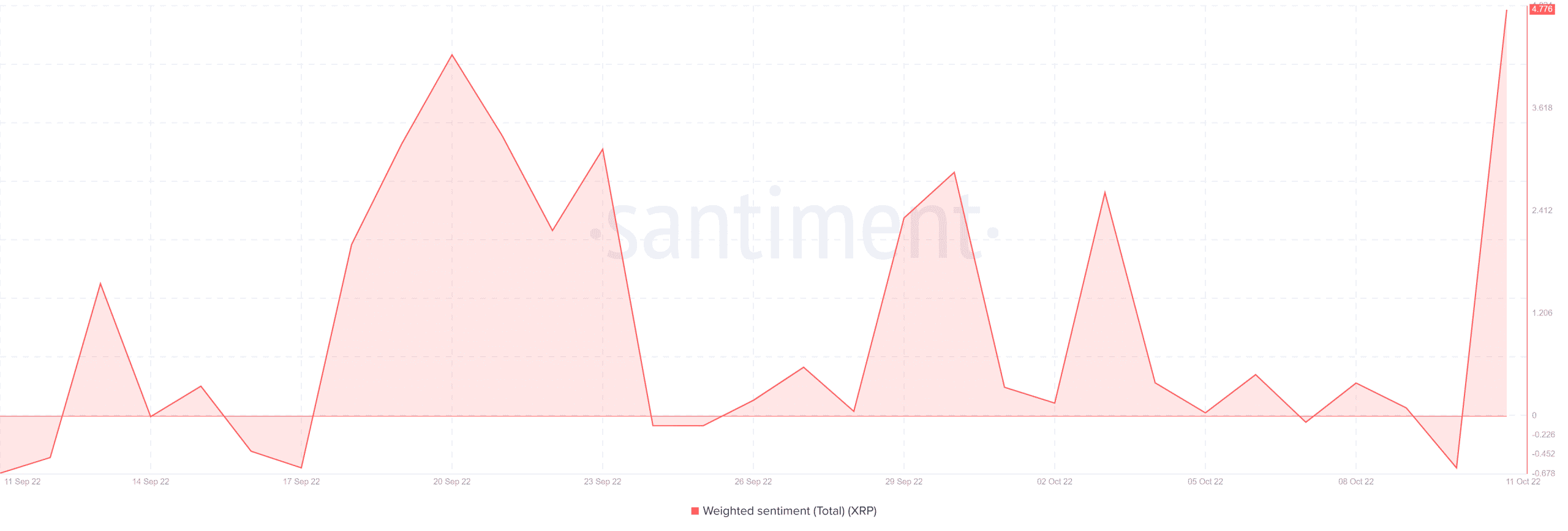

The metrics side of things already demonstrated some changes. For example, XRP’s weighted sentiment shot up in the last three days. And, at press time, it was at the highest level in the last four weeks.

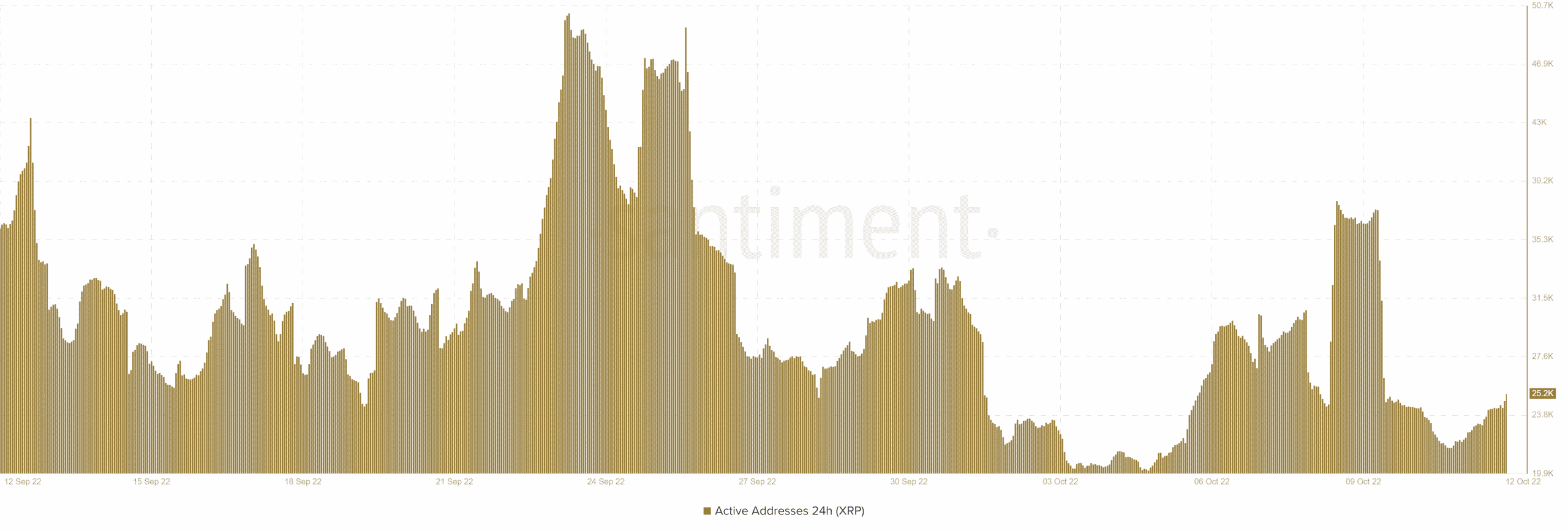

A sentiment change is only as good as the strength of the accompanying volumes that it can command. We observed a drop in active addresses in the last three days but the last 24 hours delivered a slight uptick in the same metric.

Active addresses increased by roughly 5,000 address in the last 24 hours. This was enough to cancel out most of the existing sell pressure but not enough for a major bullish uptick.

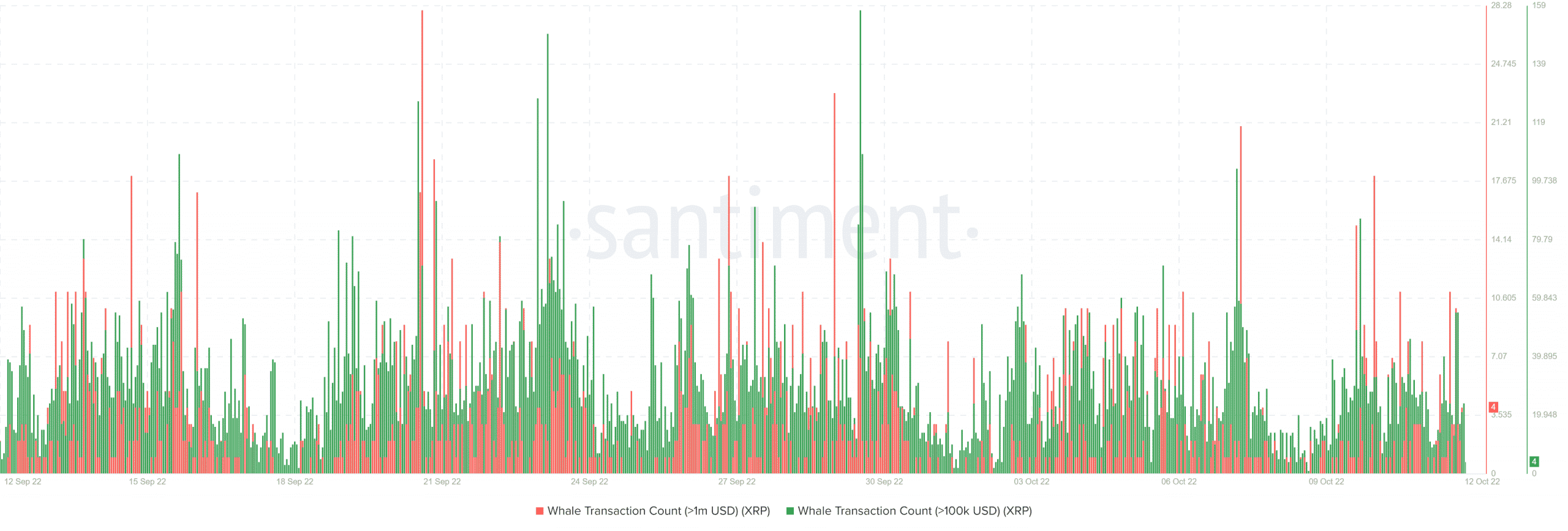

Well, whales often have the biggest impact on price action. Whale transaction count for transactions worth over $1 million was not out of the ordinary in the last 24 hours.

Conclusion

The sentiment shift courtesy of Ripple’s recent judicial ruling can potentially trigger another accumulation wave.

This will depend on whether it can secure enough bullish demand.

On the flip side, XRP might extend its downside if market factors continue to hammer down on the crypto market.