XRP: Tracing buying opportunities after this moving average crossover

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

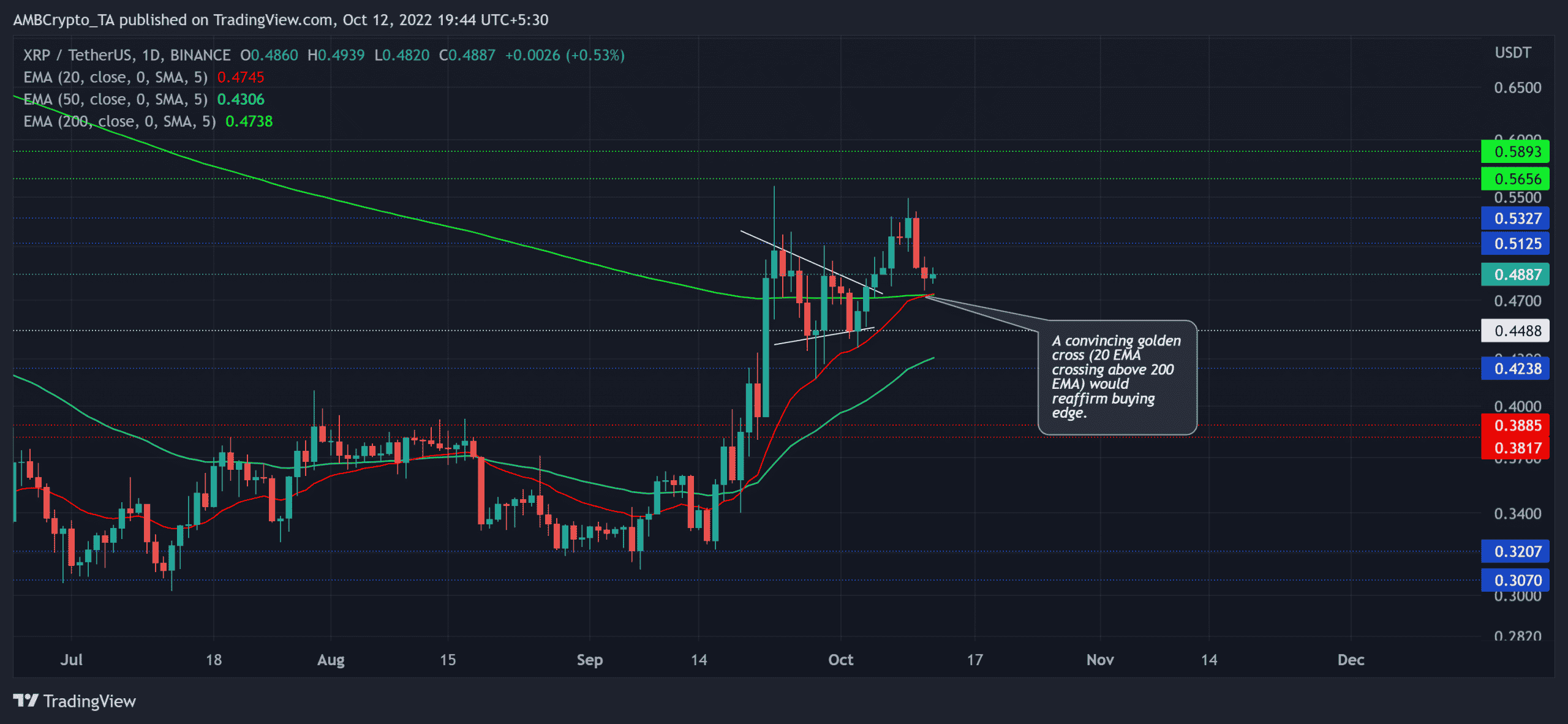

- XRP noted a golden cross on its daily chart.

- The altcoin saw an increase in its MVRV Ratio and social dominance.

After consistent bullish efforts to snap the $0.38-level for over three months, XRP reclaimed critical support levels over the last three weeks.

September-end updates in the SEC v. Ripple lawsuit set the foundation for a solid rally above the constraints of the EMAs.

Here’s AMBCrypto’s Price Prediction for XRP for 2023-24

This bullish rebound chalked out a bullish pattern on its daily chart. A sustained crossover of the 20/200 EMA could now allow the coin to continue its bull run in the coming sessions.

At press time, XRP was trading at $0.4887.

XRP saw a golden cross, can it continue to grow?

While consolidating in the $0.3-$0.38 range for nearly three months, XRP unveiled mixed investor sentiments amidst the uncertainties in its ongoing lawsuit.

The recent buying pressure led XRP to finally sustain a position above the daily 20/50/200 EMA.

In the meantime, the altcoin witnessed a bullish pennant pattern while the buyers inflicted an expected breakout over the last week. After an expected breakout, the 200 EMA exhibited rebounding inclinations.

Another rebound from the 200 EMA could open doorways for a near-term rally. The buyers would look to retest the $0.53-level in the coming sessions. A close above this level would open doorways for testing the $0.56-$0.58 resistance range.

However, a decline below the 200 EMA can reignite some selling pressure. In this case, the first major support would lie in the $0.44-region followed by the 50 EMA.

An increase in MVRV and Social Dominance

Since late August, the MVRV Ratio (30d) has been on a consistent incline. As a result, it turned positive in mid-September. Santiment Data showed an interesting correlation of heightened Social Dominance whenever the ratio turned positive. As a result, the price action has been on a slight uptrend too.

All in all, XRP’s jump above the 20/50/200 EMA has confirmed an increased buying pressure. A close below the 20/200 EMA would hint at a potential bullish invalidation. In either case, the targets and triggers would remain the same as discussed.

Finally, the traders should factor in Bitcoin’s movement and its effects on the wider market to make a profitable move.