XRP traders, here’s why the crypto market may take a while to act in your favor

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- XRP was in a bearish market structure and could drop to a 23.6% Fib level ($0.3839)

- XRP saw a decline in trading volume and active addresses in the past 24 hours

Ripple [XRP] was trading at $0.3918 and was set for a further price correction in the near term. Interestingly, the two-hour timeframe recorded a bullish Moving Average Convergence Divergence (MACD) crossover which signaled a buying opportunity.

However, the four-hour chart showed a possible bullish crossover that may not happen, given the bearish structure. If bears gain more control and Bitcoin [BTC] drops below $17K, XRP could reach the 23.6% Fib level ($0.3839).

Read XRP’s price prediction 2023-2024

Possible breach of the support at 38.2% Fib level ($0.3907): Will bears sustain the momentum?

XRP could breach the current support level at 38.2% Fibonacci retracement level ($0.3907). In addition, XRP could experience a further drop to retest the support at 23.6% Fib level ($0.3839).

Two key technical analysis indicators point towards the above bearish outlook. In particular, the Relative Strength Index (RSI) indicator dropped below the 50-neutral mark and crept sideways. This showed that buying pressure waned off, and selling pressure was steadily rising.

Furthermore, the On-balance Volume (OBV) showed a downtick indicating a drop in trading volumes. Thus, it could undermine enough buying pressure to boost bulls. Put differently, sellers could gain more leverage with the reduced trading volume and push XRP prices lower.

But a candlestick close above the 50% Fib level ($0.3962) could negate this bearish inclination. In such a case, XRP could target a new resistance level at 61.8% Fib level ($0.4017).

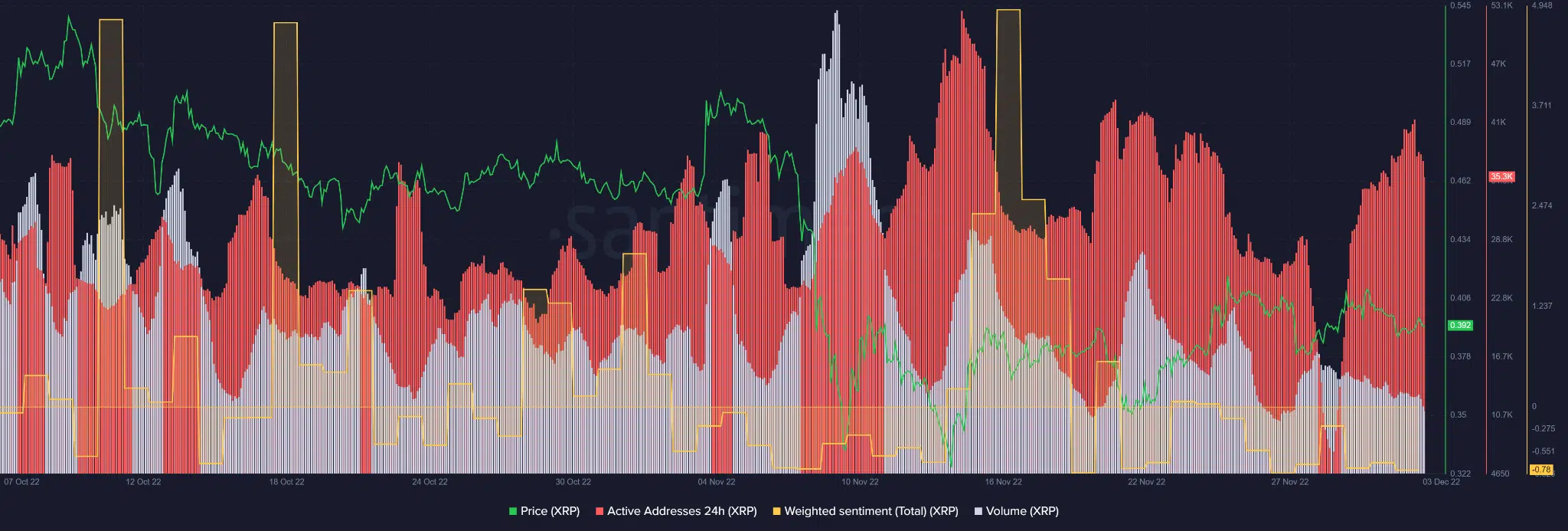

XRP recorded a decline in active addresses, volume, and sentiment

According to Santiment, XRP’s recorded a drop in active addresses (red) in the past 24 hours. Correspondingly, the reduction in active addresses engaged in trading led to a decline in trading volume (white). Thus, this indicated a drop in buying pressure.

Moreover, XRP’s weighted sentiment was deep in the negative territory. It showed that most analysts had a bearish outlook for the crypto asset and could send the price downwards.

However, any bullish sentiment on BTC, especially if it regains $17K and moves upwards, could lead to XRP’s price inflection to the upside. Thus, monitoring BTC’s performance and XRP’s on-chain metrics will come in handy.