XTZ [Tezos] defies sell pressure to deliver more upside but here’s the caveat

The cryptocurrency market is once again looking like a sea of red courtesy of the price swings within its narrow range. However, there are those that manage to stand out by moving contrary to the rest of the market and XTZ is one of them.

XTZ seemed like it was poised for a fourth day in the green after delivering a bullish momentum since 4 June. It traded as low as $1.83 during the weekend and has maintained the same trajectory. XTZ rallied as high as $2.20 at press time but has since then struggled to maintain more upside.

Exploring the potential reasons for a short-lived rally

XTZ has been trading within a narrow range since mid-May just like most of the top cryptocurrencies. It is currently within the upper range which has been acting as the resistance line. This explains why its price action seems to be facing a lot of resistance near the $2.15 price level.

XTZ already showing signs of bullish weakness and a bit of a retracement after its rally a few hours ago. Its RSI is hovering near the 50% level where it is bound to attract some friction for the bulls. This is because some traders will likely take profit near this level, thus increasing the probability of a bearish correction.

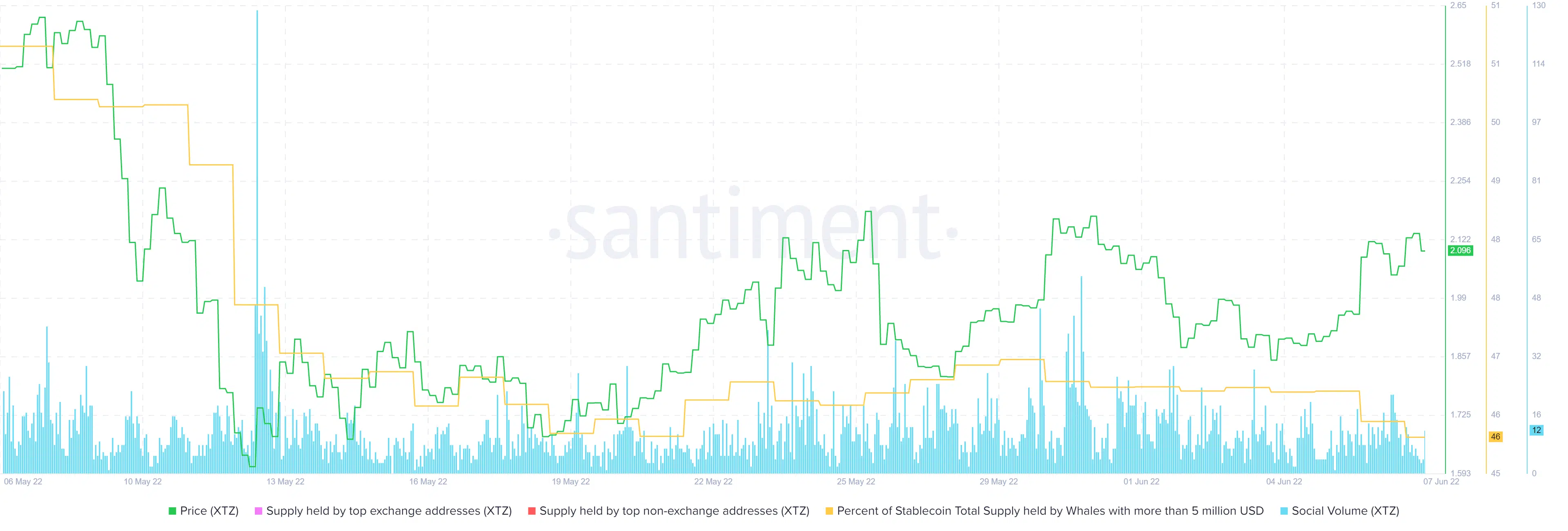

The likelihood of a reversal is further exasperated by the lack of enough accumulation to support more upside. On-chain metrics also seem to align with this expectation. For example, the supply held by whales metric indicates significant outflows between 6 and 7 June.

XTZ’s market cap also reduced slightly in the last two days and this confirms that the bullish pressure is running out of steam. Despite the current price outlook, Tezos continues to maintain strong growth and increased popularity in the art world.

One could argue that Tezos is rapidly turning into the next Ethereum. It has shown a heavy hand in support of digital art as the natural direction for NFT technology. The network maintained healthy social volumes in the last 30 days amid market headwinds.

Although XTZ’s current short-term outlook seems bearish, its price has been achieving higher lows. This might be a sign that there is healthy accumulation near the bottom and this might contribute to more long-term bullish pressure.