Yearn Finance whales move close to $60m in double transactions, decoding ‘why’

- 3,869 YFI were moved twice in separate transactions on 8 February.

- There has been more YFI outflow on exchanges in recent days.

Yearn Finance (YFI) recently experienced its biggest volume of “whale transactions” in the past three months. So where do the protocol and YFI stand right now, and what could be in store with these whales’ latest move?

Read Yearn Finance (YFI) Price Prediction 2023-24

Whale Yearn

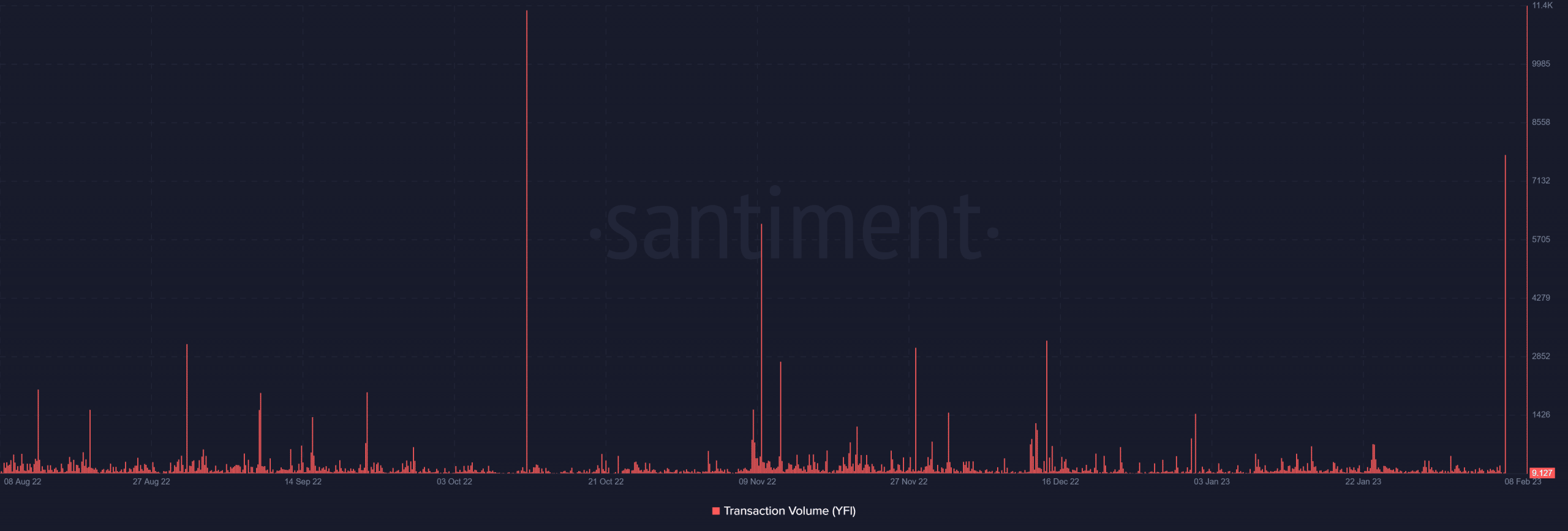

According to a recent report by Santiment, on 8 February, there were two similar whale transactions involving Yearn Finance (YFI). A total of 3,869 YFI, worth about $29.8 million, were transferred between a known proxy and an address in two different transactions.

As a result, there was a noticeable uptick in the transaction volume indicator. Additionally, the volume levels seen were the highest since November.

Some possible reasons for a whale move

While the immediate cause of this whale move is unknown, numerous hypotheses could help explain the massive move. First, whales may be rebalancing their cryptocurrency holdings by trading different coins and maximizing profits.

Second, when they believe the price has peaked, they may sell off huge quantities of their stock to cash in on their gains. Third, we could see Yearn Finance (YFI) being hoarded ahead of a price increase.

Finally, it may serve as a way to control the token’s liquidity by adding or subtracting from an exchange’s holdings.

Outflow increases as price drops

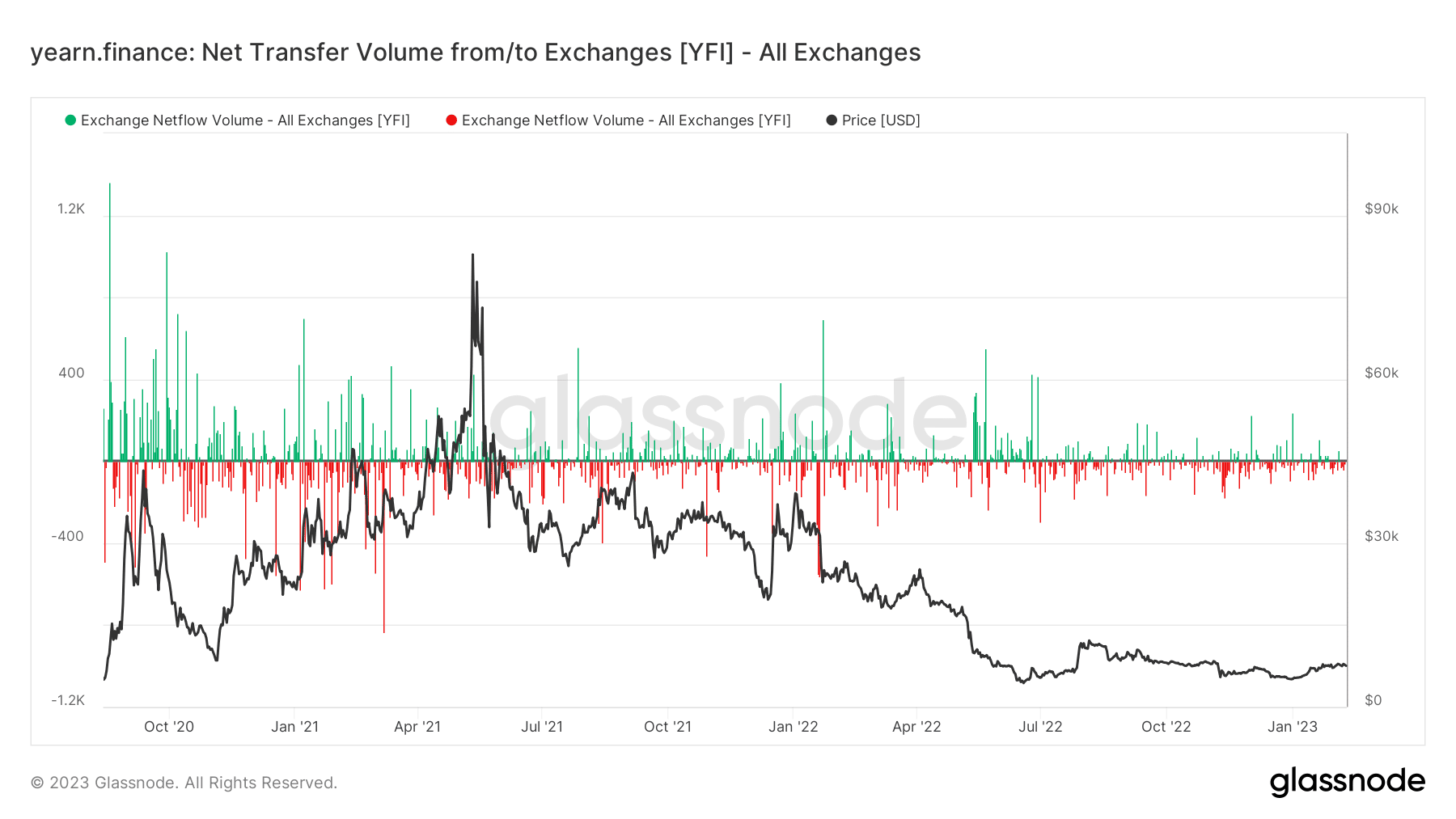

According to the Netflow metric on Glassnode, the asset has also seen a respectable amount of outflow. More than nine YFI left the exchange on 8 February, as measured by Netflow.

This may not be an accurate representation of the total volume of transactions logged by Santiment, but it did indicate the existence of a token outflow.

The daily period chart demonstrated that YFI had begun to trade sideways since its January rise. But it has managed to keep its support between $7,100 and $6,900.

It was trading at about $7,500 at the time of writing and had lost more than 2% of its value. In addition, the Relative Strength Index (RSI) indicated that although the trend was still bullish, it was waning.

Is your portfolio green? Check out the Yearn Finance Profit Calculator

TVL remains flat

On the other hand, the Total Value Locked (TVL) at Yearn Finance has been declining per data from DefiLlama. The TVL was $449.62 million as of the time of writing and has not had an uptrend since its drop began with the debut of Arbitrum.

The impact of the recent whale migration is still to be determined, but based on the measures thus far, neither a positive nor negative influence has been noted.