QNT transaction count hits its highest mark in 2022, but here’s the catch

Too much over-enthusiasm is never good, especially within the crypto market. Different cryptos have witnessed a significant fall in price after ‘euphoric’ traders exited the network post-booking profits. Was this exactly the case with the trending Quant (QNT) crypto?

Here’s AMBCrypto’s Price Prediction for Quant for 2022-2023

Started from the bottom

Quant was one of the big movers in crypto markets to start the week, as the token rose beyond $200, hitting its highest point since last December. Following which, the coin among the top-30 list enjoyed a five-day upswing, gaining over 34% in a week and a +133% pump in the past five weeks.

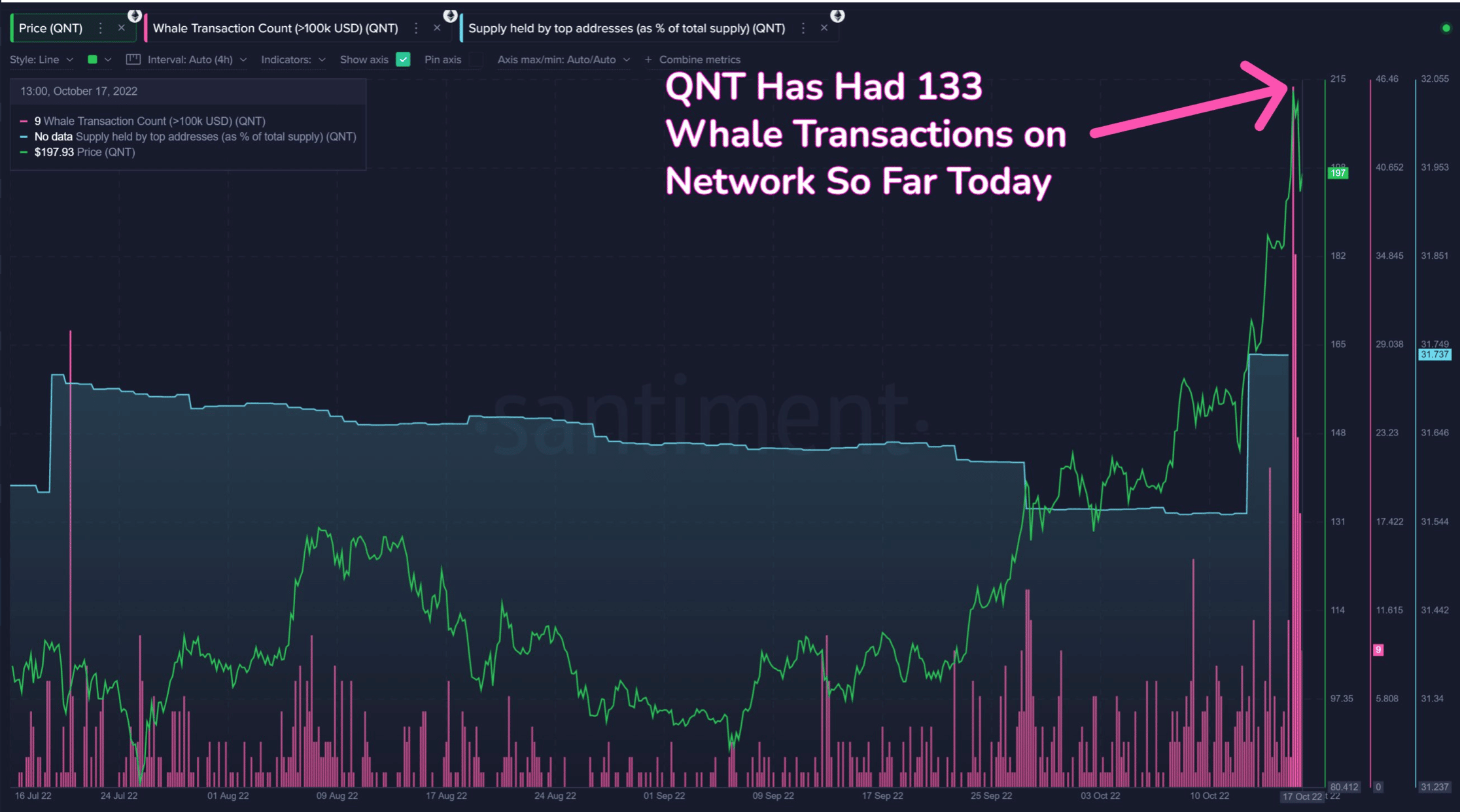

Santiment, the crypto analytical platform shed light on this matter in an 18 October tweet. “Quant has been one of the major outliers in crypto, enjoying a +133% pump the past 5 weeks,” the tweet added. Herein QNT transaction count hit its highest mark of 2022, just prior to price topping.

QNT’s rally was backed by an increased accumulation of coins’ addresses. Especially, the cohort owning 100 QNT and 1,000 QNT, dubbed whales by blockchain analytics firm Santiment.

This didn’t come as a total surprise given the profitability count. Intotheblock data revealed that around 60% of coin holders acquired their coins between one and twelve months ago. Meanwhile, 74% of total holders enjoyed profits compared to just 18% who suffered losses.

In addition to this, according to the social intelligence platform LunarCrush, the past seven days’ social metrics including mentions, engagements, and contributions were entirely remarkable. Apart from the social metrics, other parts of the Quant ecosystem contributed to the uptick.

As per Santiment, QNT’s network growth tremendously increased from 13 October until 15 October.

What’s the catch?

Regardless of the hike, investors/traders need to look out for cautionary signs. For instance, consider the ‘over-enthusiastic’ withdrawals. The price has dropped -7% after a spike in whale $100k+ transactions.

As per Santiment, “QNT was already showing signs of returning to exchanges since Thursday.”

What does this imply?

Well, a likely case or rather an unfortunate case of traders/investors booking profits. Also, the altcoin recorded a sharp decline in its supply held by top exchange addresses in the past two days.

Between 20 July and 13 October, the QNT’s supply held by top exchange addresses had been 1.2 million.

![Bitcoin's [BTC]](https://ambcrypto.com/wp-content/uploads/2025/05/Kelvin-_20_-400x240.webp)