Algorand gets layer-2 protocol Mikomeda; but how did ALGO react to it

Algorand is one of the cryptocurrencies, which has seen its network grow despite the ongoing crypto winter. It has even collaborated within new avenues.

Recently, a layer-2 protocol Mikomeda was launched on the platform. Despite the success of the launch, there was no positive impact on ALGO’s price. However, there was one aspect where Algorand showed massive growth and that was its TVL.

Here’s AMBCrypto’s Price Prediction for Algorand for 2022-2023

The Milkomeda protocol was launched on 19 October as the first rollup and EVM support for Algorand.

Even though ALGO’s price continued to decline, the network showed great promise in terms of its DeFi success.

Since 9 October, Algorand’s TVL has grown tremendously. At the time of writing, the total value locked by Algorand was at $286.9 million.

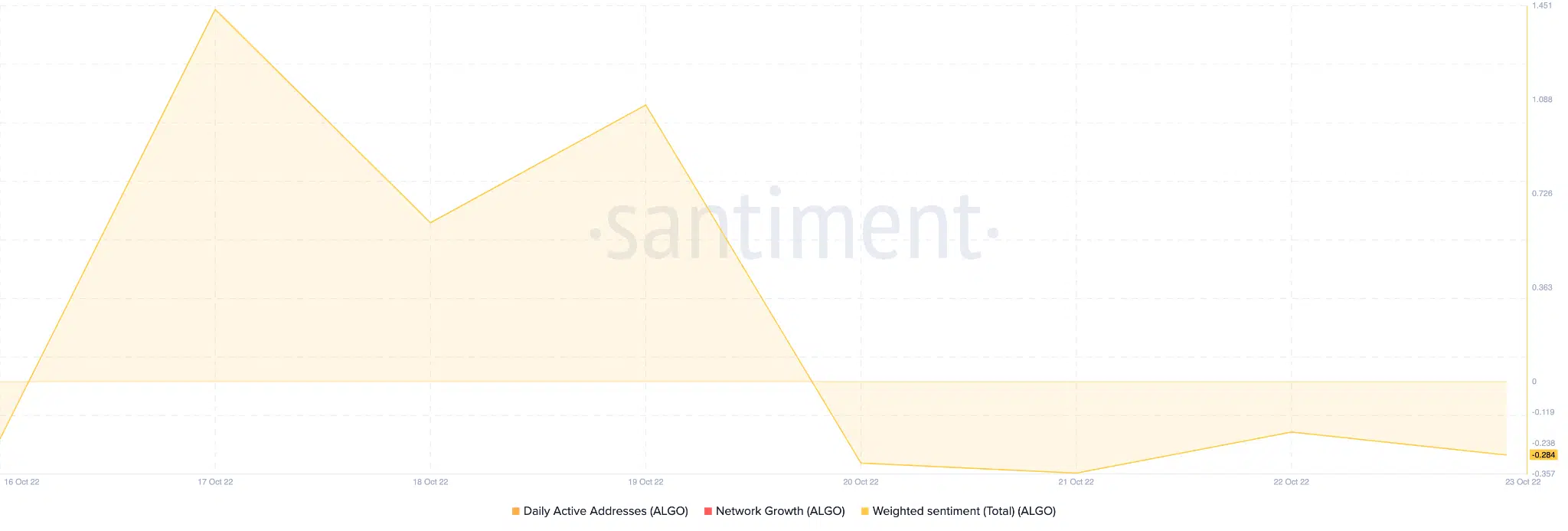

However, the growth in the DeFi space and the launch of the new layer 2 protocol weren’t enough for Algorand to sway public opinion on its side.

By taking a look at the image below, it can be observed that over the last few days, the weighted sentiment turned negative. Thus, implying that the crypto community had more negative things to say about Algorand.

Coupled with the negative sentiment, Algorand witnessed a decline in its social engagements and mentions. According to LunarCrush, an analytics firm, Algorand’s social mentions declined by 1.59% and its social engagements fell by 16.39% over the past week.

The decline in investors’ sentiment and social engagements could be one of the reasons why Algorand’s NFT market also had difficulty showing growth.

Taking the ‘fun’ out of nonfungible

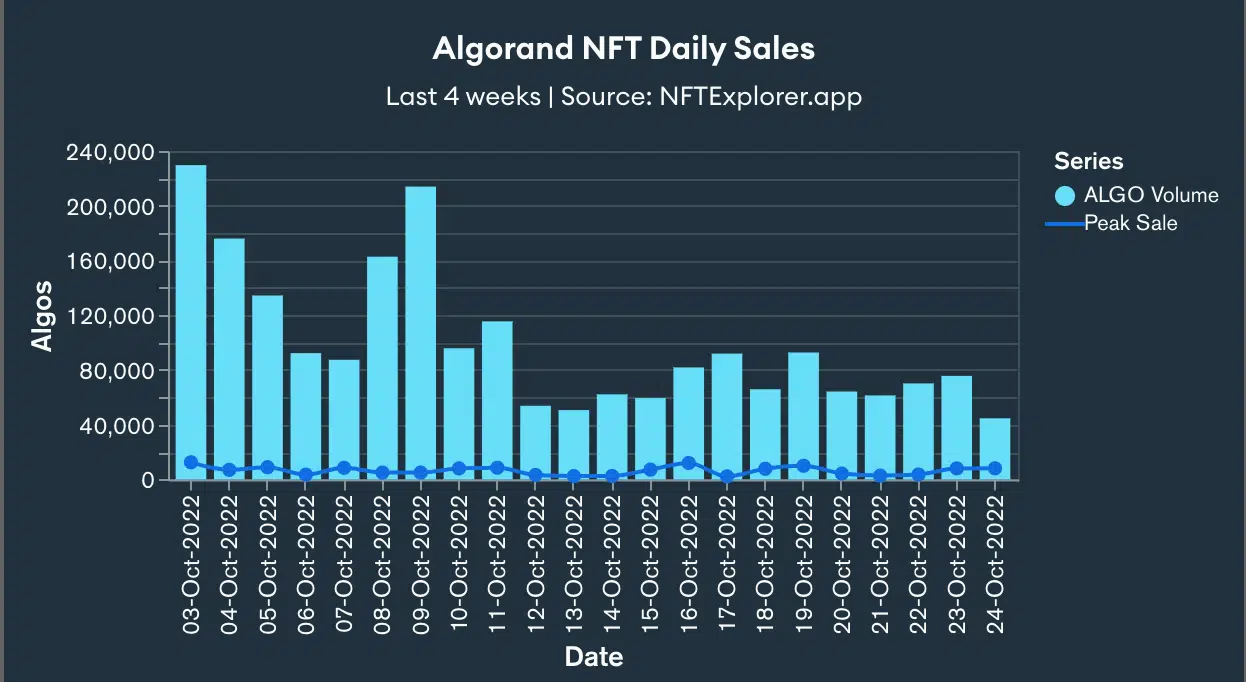

As evidenced by the image below, it can be seen that there was a decline in the number of daily NFT sales on the Algorand platform.

Since the past four weeks, the number of users buying NFTs on the Algorand network has reduced. In fact, the number of unique buyers buying NFTs has also decreased since September.

Source: nftexplorer

At the time of writing, Algorand was trading at $0.31 and had depreciated by 5.64% in the last seven days. However, the fees being generated on the network witnessed a massive surge and increased by 11.87% over the week. In fact, its volume also went up by 30.86% over the last 24 hours.

![Kusama [KSM] explodes 119% in one day - How DOT helped](https://ambcrypto.com/wp-content/uploads/2024/11/Michael-KSM-400x240.webp)