SAND could see an extended rally unless these holders change course

- SAND likely to continue its climb courtesy of sustained demand.

- The price levels investors should consider for short-term profit-taking.

The metaverse and NFT projects may experience renewed interest in 2023 and hence the need to look into their potential. One such project is The Sandbox which recently made a major development-related update.

But more importantly, its native token SAND kicked off this month on an optimistic note.

Are your holdings flashing green? Check the SAND profit calculator

A recent WhaleStats alert revealed that SAND concluded the week by joining the list of top 10 most purchased tokens by ETH whales. This was observed in the last 24 hours at press time and it highlighted the existing demand that has propelled SAND in the last few days.

JUST IN: $SAND @TheSandboxGame now on top 10 purchased tokens among 100 biggest #ETH whales in the last 24hrs ?

Check the top 100 whales here: https://t.co/N5qqsCAH8j

(and hodl $BBW to see data for the top 5000!)#SAND #whalestats #babywhale #BBW pic.twitter.com/T5FSAvoF2P

— WhaleStats (tracking crypto whales) (@WhaleStats) January 7, 2023

The surge in ETH whale demand is quite an interesting observation considering SAND’s latest performance. The token pulled off a 24% rally in the first week of January.

The demand from ETH whales increased the chances of SAND extending its bullish momentum into another week. But this prospect might be dampened by potential profit-taking as the price approaches profit-taking zones.

Playing in the SAND

SAND traded at $0.45 at press time and an extended upside may push SAND towards the $0.50 range. The latter could be taken as an important price zone for the token because it will come into contact with the 50-day Moving Average.

The price will also be within the 50% Relative Strength Index (RSI) level if not above. This retest is more likely to boost the likelihood of short-term profit-taking, and thus the possibility of a bearish retracement.

The buying pressure from ETH whales may boost investor sentiment and support an extended rally. In addition, The Sandbox recently announced its upcoming launch of a new metaverse game called Game Maker 0.8. This announcement may have also contributed to a favorable investor sentiment.

A first glimpse into ???? ????? ?.?… ?

? New multiplayer gameplay features

? New lighting & visual effect features

? Video & audio streaming

⚔️ Equipment & wearable support in social hubsComing soon!

Deeper dive ?? pic.twitter.com/zfCvB5EJO0

— The Sandbox (@TheSandboxGame) January 5, 2023

Can SAND sustain its bullish momentum?

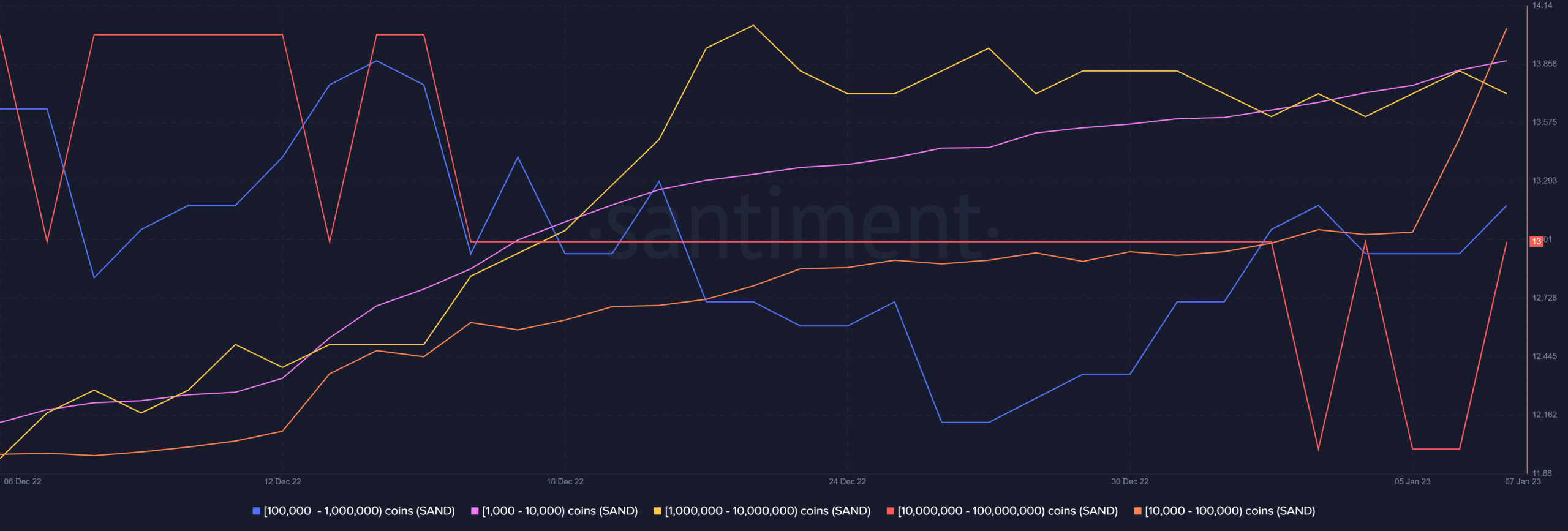

SAND’s ability to continue rallying ultimately depends on whether it can garner enough demand. Its supply distribution metric reveals that most of the top address categories are still contributing to bullish pressure.

This observation supported the expectation of a continued bullish momentum.

A 209.93x hike on the cards if SAND hits ETH’s market cap

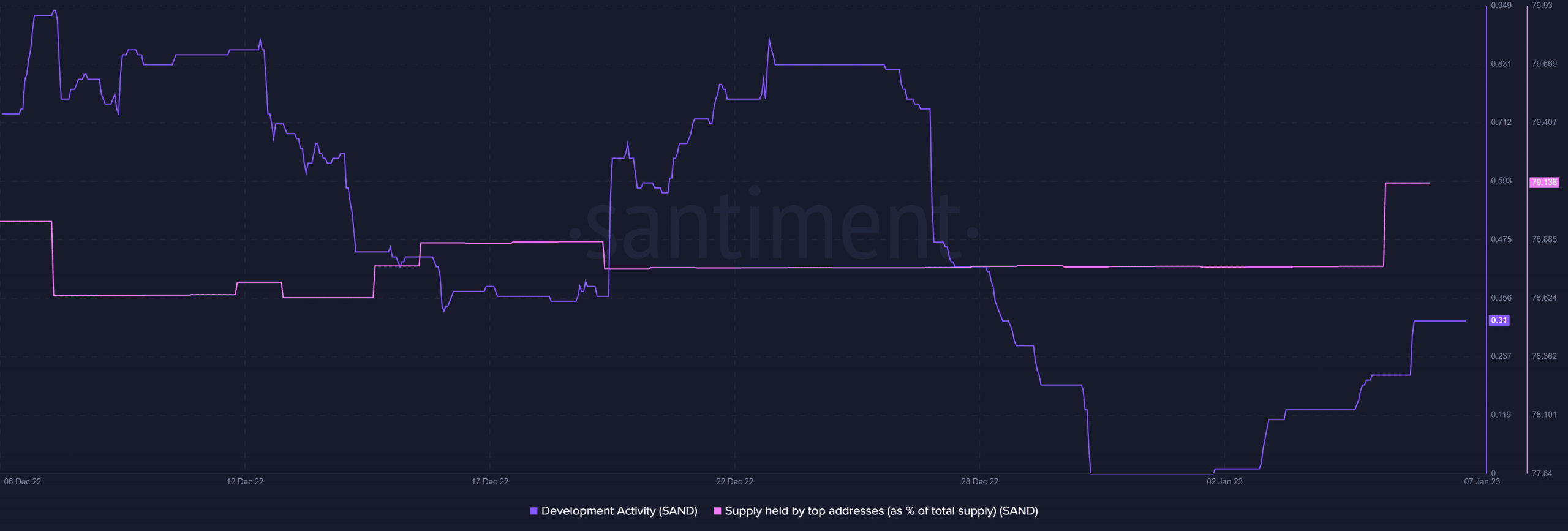

There are other signs supporting the same outcome. For example, the supply held by top addresses recently registered a sizable uptick, confirming that whales have been buying. Also, The Sandbox kicked off January with a surge in development activity.

These observations may further strengthen investor sentiment in favor of the bulls. Nevertheless, investors should keep an eye out on the aforementioned take-profit zones.