Ethereum staking surges, withdrawals take a breather

- Total ETH staked has hit 24.4 million ETH, while withdrawals hit 3.01 million ETH.

- Deposits and the total number of ETH deposits have been on the rise.

The Shapella upgrade brought about a remarkable development by allowing Ethereum [ETH] holders to withdraw their staked funds. This created a wave of analysis and speculation on how it might influence the pricing of ETH.

Even with this upgrade, staking ETH continued to gain momentum and expand. Furthermore, compared to the total amount staked, the volume of withdrawals appeared relatively insignificant.

Staked Ethereum sees more volume than withdrawal

Following the successful transition of Ethereum to a proof-of-stake (POS) consensus mechanism with the Shanghai upgrade, the Shapella upgrade emerged as the next significant milestone. This upgrade witnessed the withdrawal of millions of staked ETH from the network.

However, recent data provided by WuBlockchain and OkLink suggested that the volume of staked ETH still outweighed the volume of withdrawals.

According to OKLink, more than 3 million ETH have been unstaked since the Shanghai upgrade, and the current number of validators is 602,860. The current staking amount of ETH is 19.29 million, and the staking rate is 16.04%. https://t.co/z58qNyBqeu

— Wu Blockchain (@WuBlockchain) June 5, 2023

As of this writing, OkLink’s data indicated that there were 24.24 million ETH staked at press time. This represented a staking ratio of 16%, considering the total ETH supply of 120.24 million. Moreover, the total ETH withdrawn stood at 3.01 million, highlighting a substantial gap between the staked and withdrawn amounts.

Among the major stakeholders in the market, Lido [LDO] held the largest share, with 29.1% as of the time of writing. Coinbase followed closely behind, capturing nearly 8% of the market share.

New Ethereum deposits rose

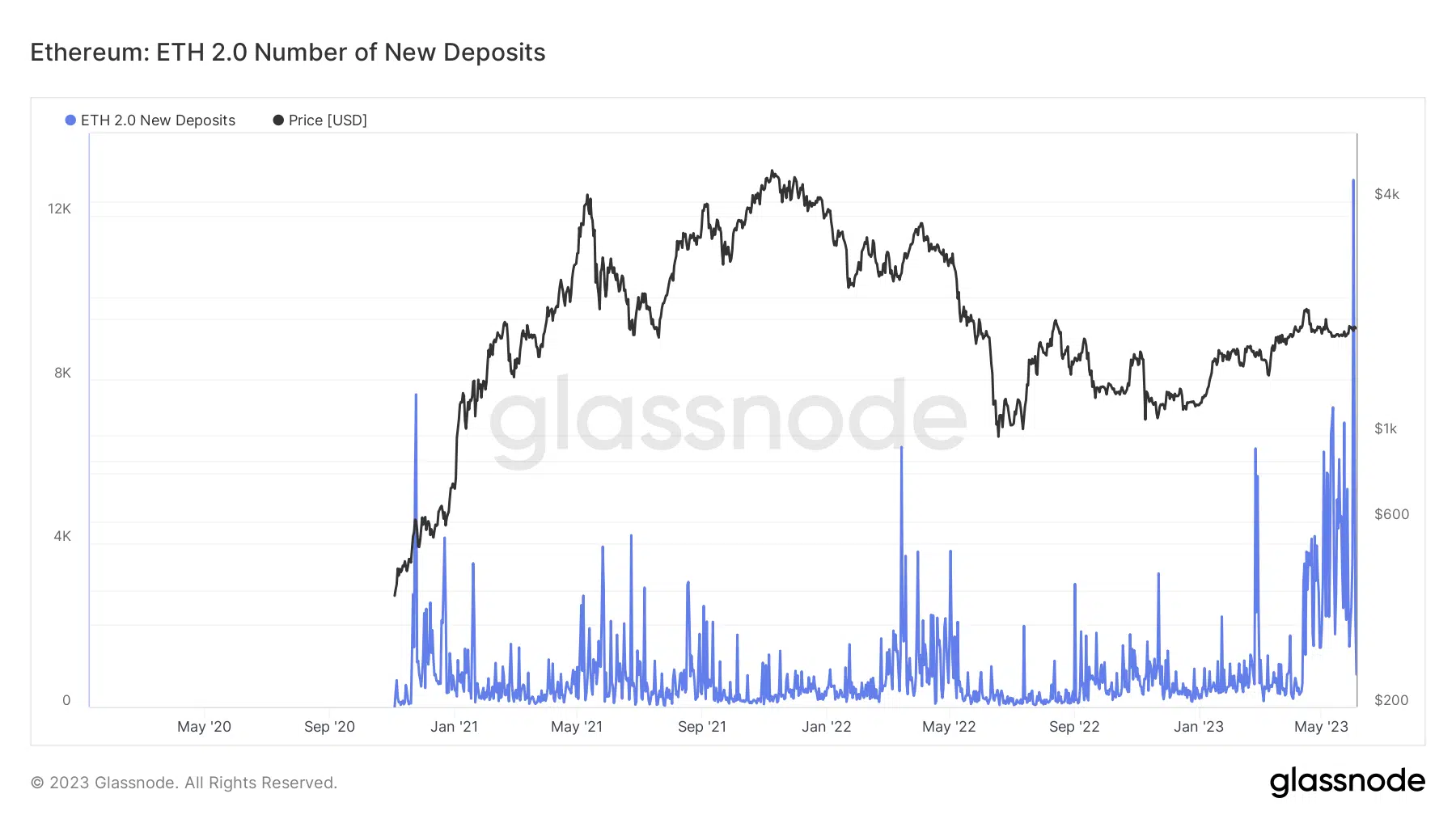

The Glassnode chart monitoring new Ethereum staking deposits showed noteworthy activity levels, highlighting the ongoing stake accumulation within the network. Upon examining the chart, it became apparent that there had been multiple instances where the deposit count reached all-time highs.

However, 1 June marked a new milestone, recording the highest number of new ETH deposits with 12,863. As of this writing, the number of new deposits had declined slightly to nearly 800. While this decrease suggested a slight dip, it demonstrated the daily influx of deposits into ETH staking.

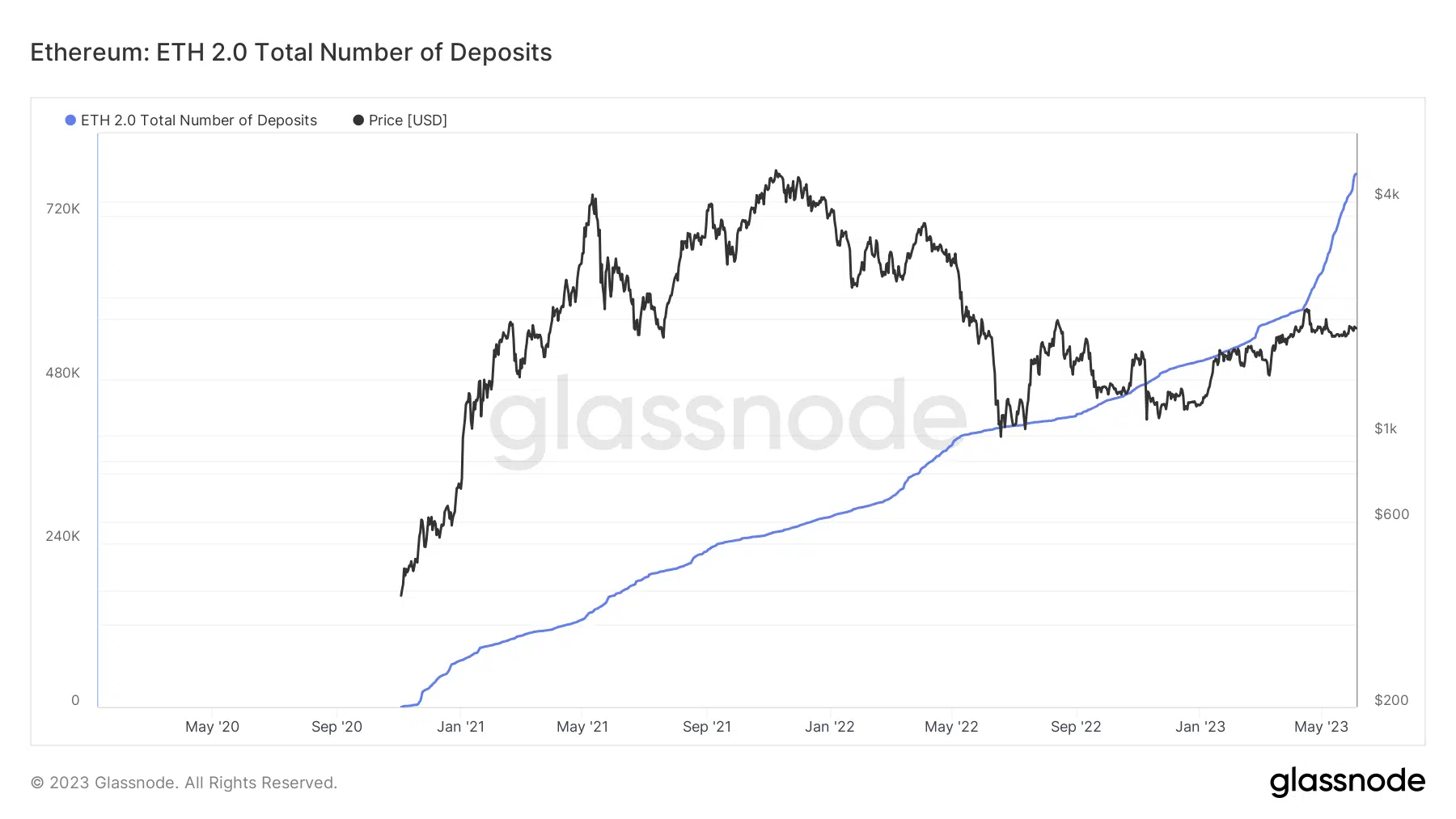

Total number of deposits on continuous ATH

The continuous inflow of new Ethereum deposits has resulted in a consistent upward trend in the total number of deposits. As indicated by the “Total Number of Deposits” metric on Glassnode, this figure has remained close to an all-time high.

Realistic or not, here’s ETH market cap in BTC’s terms

As of this writing, the total number of deposits was approximately 790,000, representing the highest recorded number.

On 2 June, the metric stood at 778,020, indicating a constant rise in deposits as new ones were added. This suggested a sustained and growing interest in depositing Ethereum into staking.