A look at the state of BTC HODLing and its impact on the current price level

- Bitcoin HODLing reached a 12-month high indicating healthy accumulation.

- Upside potential is still limited amid low whale and institutional demand.

It has been a while since Bitcoin [BTC] delivered a sizable performance. If you are like most crypto enthusiasts, chances are that you are wondering whether BTC will offer some redemption in 2023, or perhaps even this month. Well, if you happen to be in this camp, here are some things to consider.

Read Bitcoin’s [BTC] price prediction 2023-2024

What would it take for Bitcoin bulls to show themselves strong? Well, one of the answers is that long-term HODLing would have to be dominant. The good news in this regard is that Glassnode Alerts have revealed that the Bitcoin supply last active 2-3 years is now at a 12-month high. In other words, the number of addresses hodling their BTC is rising.

? #Bitcoin $BTC Amount of Supply Last Active 2y-3y (1d MA) just reached a 1-year high of 1,668,534.379 BTC

View metric:https://t.co/ov1FrjgNQz pic.twitter.com/JdcwR8UNQi

— glassnode alerts (@glassnodealerts) January 4, 2023

But the amount hodled within this 1-year period represents roughly 0.02% of the Bitcoin in supply. This means the potential impact of this hodl is minimal, although it might offer significant cushioning against the downside.

Can whale and institutional activity foot the bill?

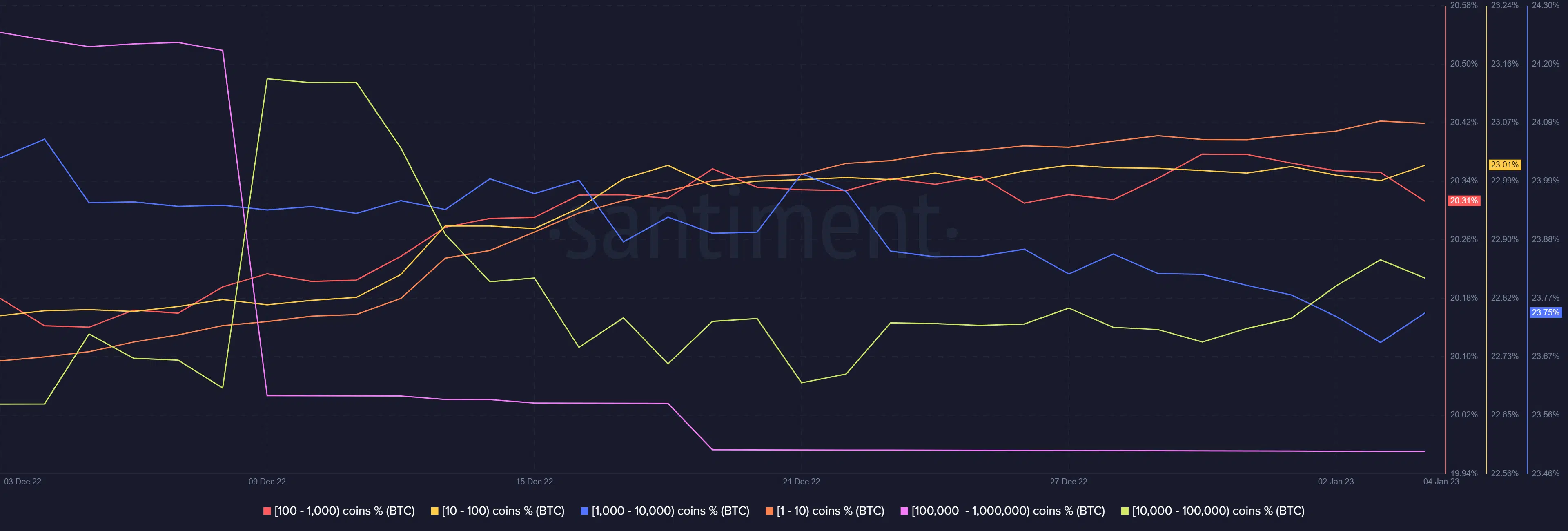

Since the amount of BTC hodling is too low to drive up the price, the next major consideration for the bulls is whale and institutional demand. An assessment of Bitcoin’s supply distribution reveals a mixed bag as far as whale addresses are concerned. Some addresses are contributing to buying pressure while others are contributing to the selling pressure.

Sell pressure in December came from the largest address categories. Addresses holding more than 100,000 BTC have been inactive this week but those holding 100 to 1,000 BTC as well as 10,000 to 100,000 BTC have contributed to selling pressure. Those in the 10 to 100 and 1,000 to 10,000 bought in the last 24 hours, at press time.

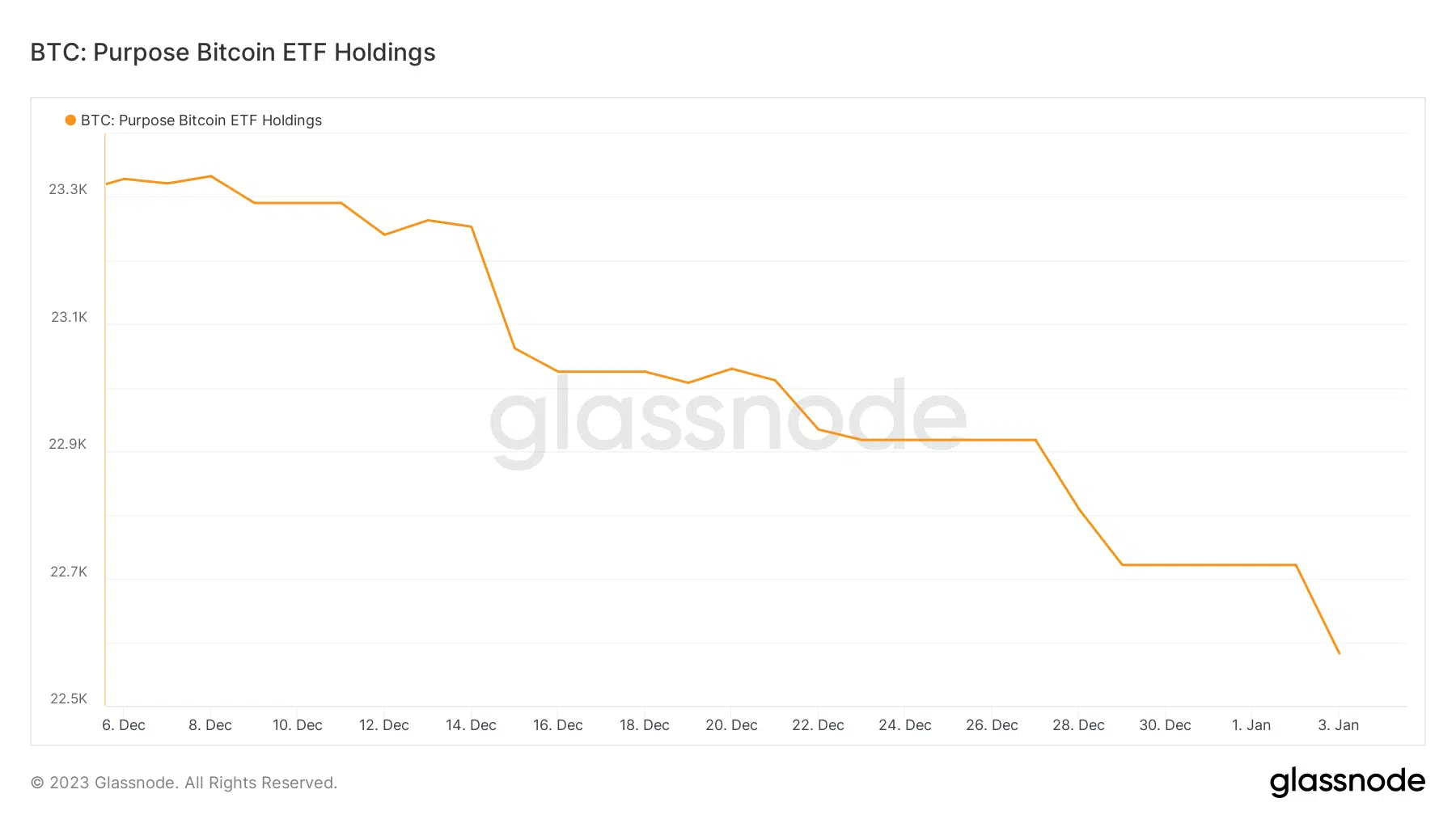

Also worth noting is that smaller addresses (the retail segment) have been buying. Another interesting observation is that institutional demand is still lacking. The Purpose Bitcoin ETF Holdings has been offloading its BTC in the last four weeks, thus contributing to selling pressure.

How many BTCs can you get for $1?

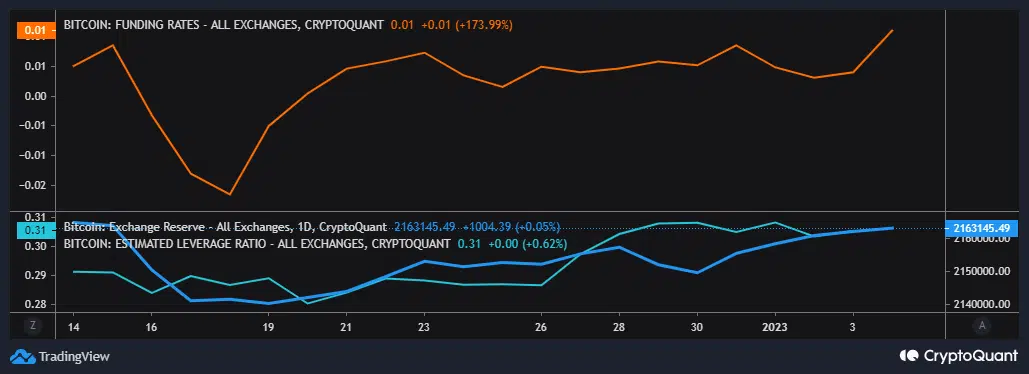

The above observations suggest that retail accumulation is supporting the current price level. In addition, Bitcoin exchange reserves grew in the last four weeks, which is consistent with the selling pressure observed from whales. Derivatives demand for BTC also scaled up slightly, and so did leverage.

The higher estimated leverage ratio suggests that we might see a return of volatility in the next few days. But, it is still too early to call whether it will be bullish or bearish volatility.

![Magic Eden crypto [ME] surges post-listing, but concerns rise](https://ambcrypto.com/wp-content/uploads/2024/12/Magic_Eden-1-400x240.webp)