Aave, Maker, Compound: This is the right way to gauge their value

The TVL or the total-value-locked is a technical metric that has been used as a primary yardstick to measure the performance of DeFi lending platforms. Simply put, it measures the cumulative amount of assets that are staked on a particular protocol. The conventional argument advocates that the higher the value locked up in a particular DeFi platform, the better.

By merely flashing the total underlying supply secured by a platform, the TVL, by no means, gauges the entire picture. Different protocols utilize each unit of locked up token in a different way. On some protocols, every token pair requires individual ETH pools, while other networks can inherently provide liquidity to multiple tokens from the same ETH pool.

To put it into simpler terms, on protocols belonging to the latter type, 1 ETH would end up catering to 10 different ERC-20 tokens’ liquidity need, while the former would require 10 ETH to serve those 10 tokens. In effect, the latter network would require way lesser assets locked up, when compared to the former, to provide the same amount of liquidity.

Further, other intrinsic details like the amount of outstanding loans are also eliminated from the TVL equation. Thus, by and large, the TVL is a skewed metric that projects only the 1-dimensional view.

The right way

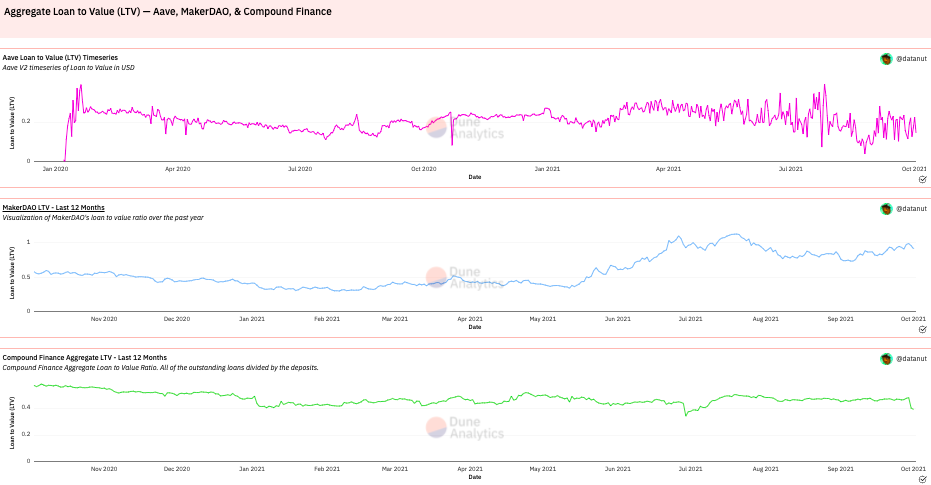

While weighing where each platform stands, it becomes essential to peek into a couple of other factors as well. The loan-to-value is one such key metric. LTV gauges the ratio of the loan to the value of an asset purchased. Ultimately, risk is evaluated based on the likelihood that the liquidity would be adequate to cover the outstanding loan balance. Thus, the higher the LTV, the riskier it would be for users/lenders to provide liquidity to the protocol.

As per the LTV data from Dune Analytics, the aforementioned ratio for Aave, Compound and MakerDAO respectively stood at 15%, 39% and 92% at the time of writing.

Source: Dune Analytics

As such, Aave and Compound, in conjunction, represent 90% of the total DeFi revenue generated, but the same doesn’t highlight how much the protocols actually earn [net value]. Only when the respective outstanding loan amounts are deducted, and the basic accounting standards are followed, users would get a clear-cut picture.

However, it is essential to note here that Maker collects all the fees charged, while Compound and Aave take only 10% of the borrowed rate paid and a bigger part of the pie goes to suppliers. Thus, if Maker started liquidity mining or Aave or Compound dropped it, the basic TVL metric would completely flip and favor Maker.

Additionally, the outstanding debt of Aave and Compound is inflated by a factor or 3x to 4x when compared to the organic outstanding loans, primarily because of stablecoin farming.

All in all, simply ranking DeFi protocols based on the available liquidity is quite biased, to say the least.

Footnote

DeFi tokens, as such, haven’t been in good shape of late. All the three aforementioned tokens have fetched their investors negative returns [AAVE: -22.81%, COMP: – 28.51 and MKR -38.44] over the past month. The risk-adjusted returns of all the tokens have also been negative of late, making them an unfavorable investment option at the moment.