AAVE’s new milestone represents a 2920% growth above 7-day average

The social activity of AAVE, the native token of the popular ghost protocol Aave, has rallied in the last week, according to the data from LunarCrush.

As of 12 October, AAVE’s social engagements hit a high of 1.89 million. This milestone represented a 2920% growth above the 7-day average.

A strong correlation exists between a crypto asset’s social activity and its price movement. While AAVE’s social engagements hit a new high during the intraday trading session on 12 October, its price failed to see any such growth.

AAVE, why?

According to data from CoinMarketCap, AAVE exchanged hands at $67.38 at press time. In the past 24 hours, its price saw a negative growth of 7%.

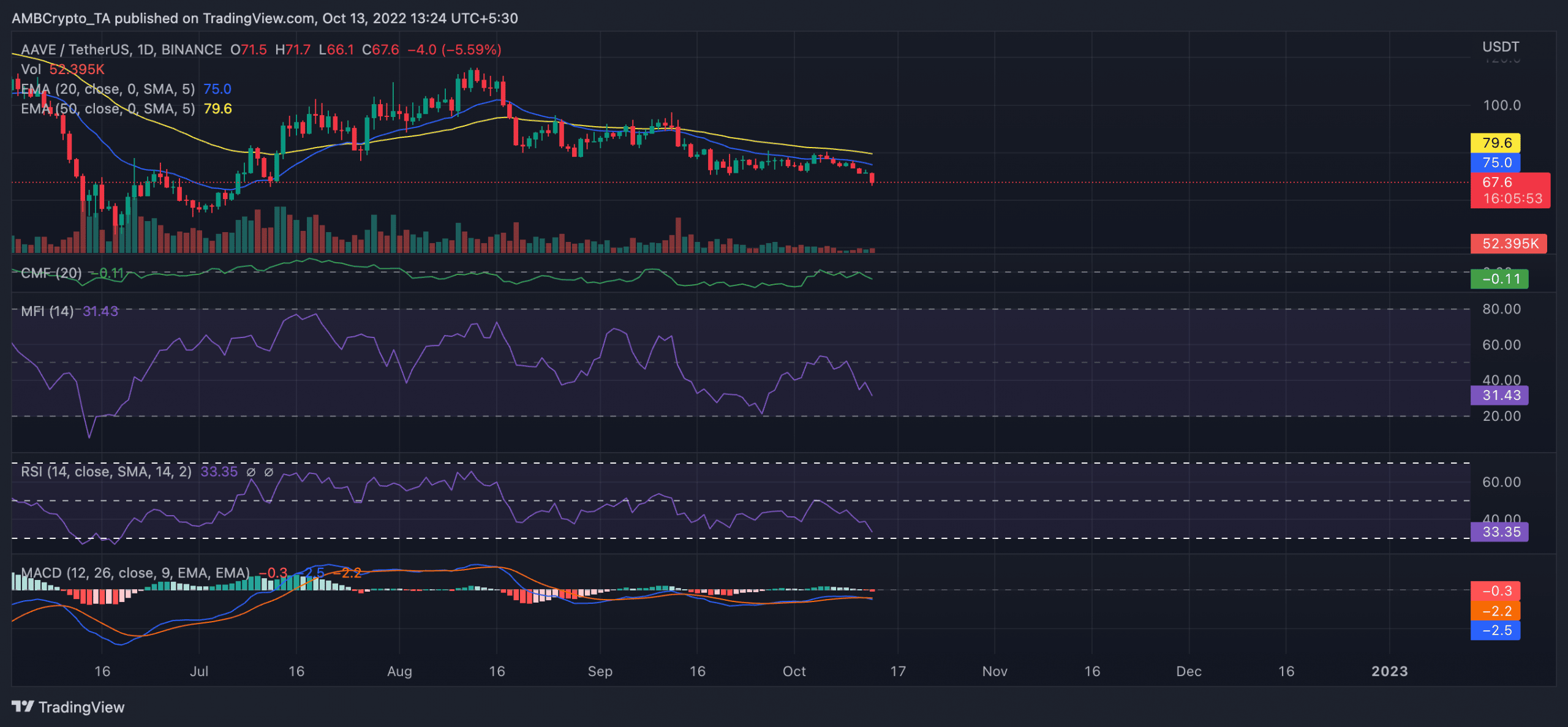

On a daily chart, the bears ravaged the AAVE market. A look at the token’s Moving Average Convergence Divergence (MACD) revealed the commencement of a new bear run on 11 October. AAVE’s price has since decreased by 9.5%, data from CoinMarketCap showed.

With a continued fall in the asset’s price, the AAVE market has struggled with a fall in investors’ liquidity in the past few days. At press time, key performance indicators were spotted in downtrends and have been so positioned since 5 October.

Beneath the 50-neutral spot, AAVE’s Relative Strength Index was 33.35 at press time. En route to the oversold territory, the Money Flow Index was at 31.43, as of this writing.

Also indicating increased AAVE selloffs in the past few days, its Chaikin Money Flow Index (CMF) rested below the center line (red) at -0.12.

With increased AAVE distribution in the last few days, the sellers had control of the market, at press time. This was confirmed by the Exponential Moving Average (EMA) position.

At the time of writing, the 20 EMA (blue) was below the 50 EMA (yellow) line, depicting the severity of the ongoing bear action.

Aave in Q3

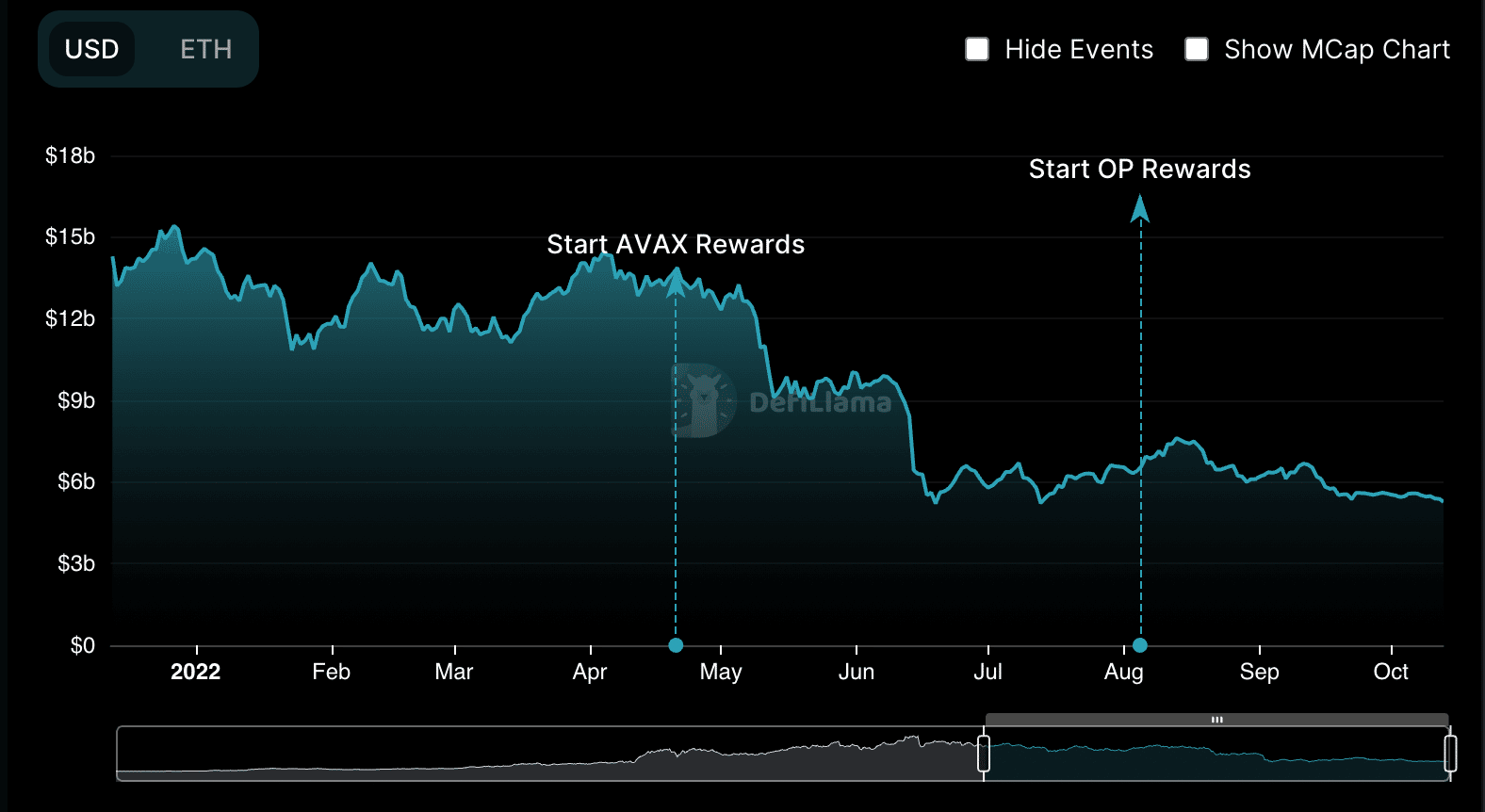

Deployed on seven networks and with a current total value locked (TVL) of $5.27 billion, Aave ranked fourth on the list of decentralized finance (DeFi) protocols with the highest TVL, as per data from DefiLlama.

In Q3, after its TVL rallied to a high of $7.4 billion on 12 August (a few days after it launched its $OP rewards), it soon embarked on a decline when the hype died down. Aave closed Q3 with a TVL of $5.58 billion, a 25% decline from the 12 August high.

So far this month, the protocol’s TVL has dropped by 5%.