Amid vanishing Bitcoin whales, these BTC investors seem ready to hold the fort

- Retail investors show interest in Bitcoin, whereas whales seemed disinterested

- Activity on Bitcoin declines, however, BTC’s market cap dominance grows

According to data provided by Glassnode, it was observed that the number of addresses holding more than 0.01 Bitcoin [BTC] had reached an all-time high. This was indicative of massive interest in Bitcoin coming from retail investors.

Are your BTC holdings flashing green? Check the profit calculator

David vs Goliath

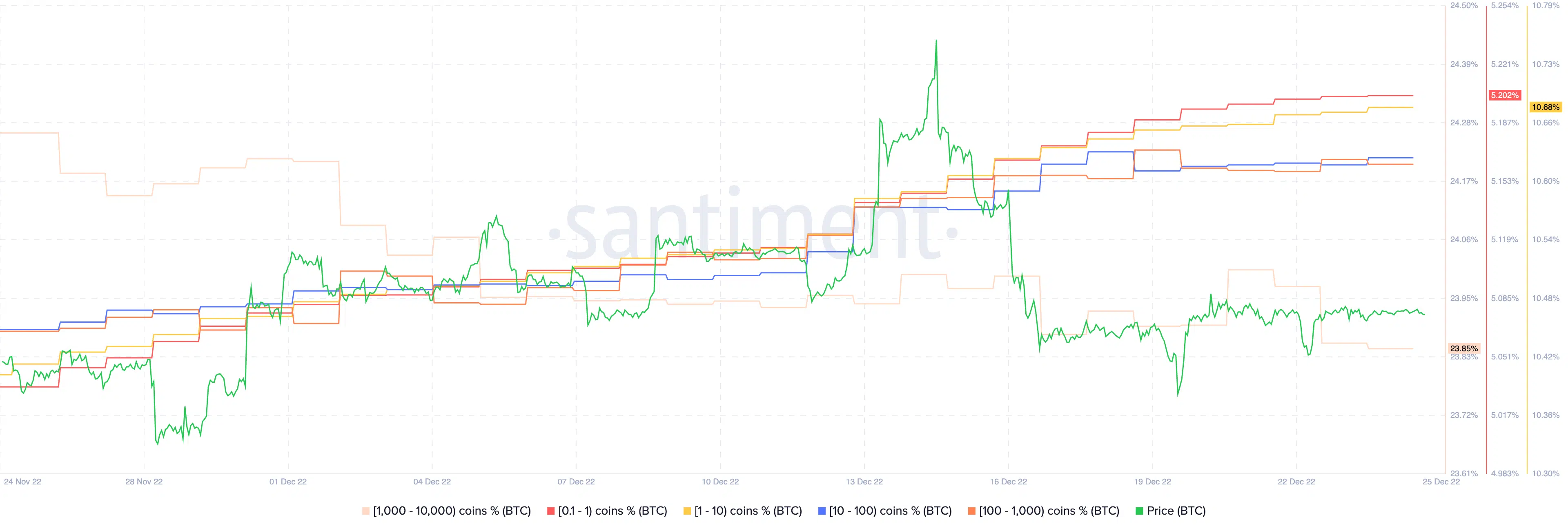

The interest from retail investors can also be observed through Santiment’s data. According to Santiment, Bitcoin addresses that were holding anywhere from 0.01 BTC to 1000 BTC, started buying more Bitcoin.

This buying spree occurred right after Bitcoin’s prices dropped on the 15 December. It appeared that after the said date, multiple retail investors decided to buy BTC at a discount.

However, during the same period, addresses that holding 1,000 to 10,000 Bitcoins, started reducing. This meant that BTC whales had started to exit their positions and were selling their BTC.

Glass half empty

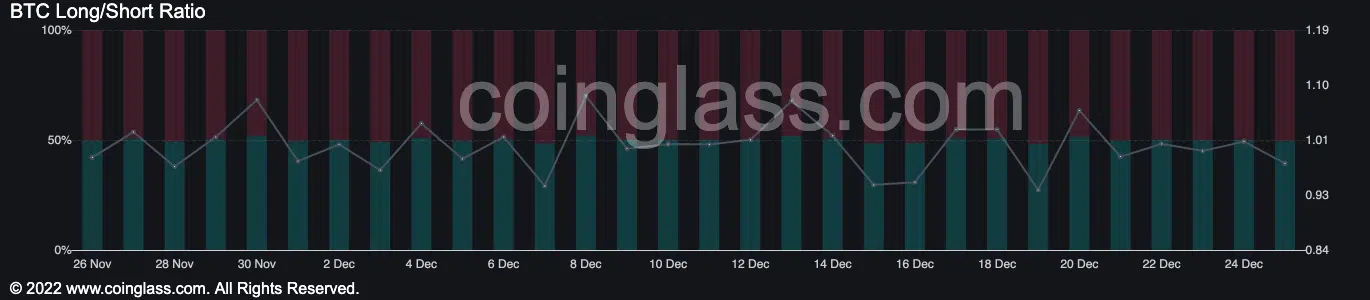

It appeared that large addresses were losing faith in BTC. This sentiment was also shared by traders. According to data from Coinglass, the number of short positions taken against Bitcoin had increased over the past few days. At press time, 51% of traders had taken short positions against Bitcoin.

One of the reasons for the growing number of short positions being taken against BTC could be the growing exchange reserve. According to CryptoQuant, the exchange reserve had continued to rise, which indicated that the selling pressure on BTC could increase.

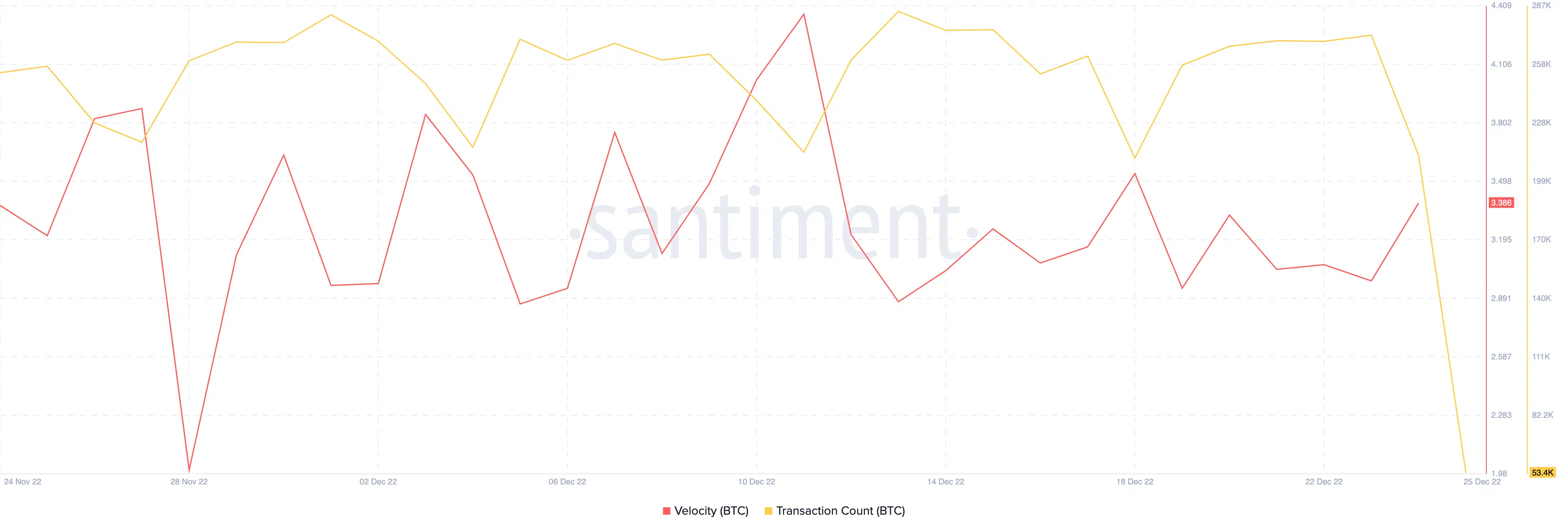

Another cause for the pessimistic view that traders were keeping could be due to the declining activity on Bitcoin’s network. According to data provided by Santiment, Bitcoin’s velocity fell significantly over the past few days.

This indicated that the number of times $BTC had been transferred amongst addresses had decreased. Coupled with a declining velocity, the number of BTC transfers witnessed a drop as well.

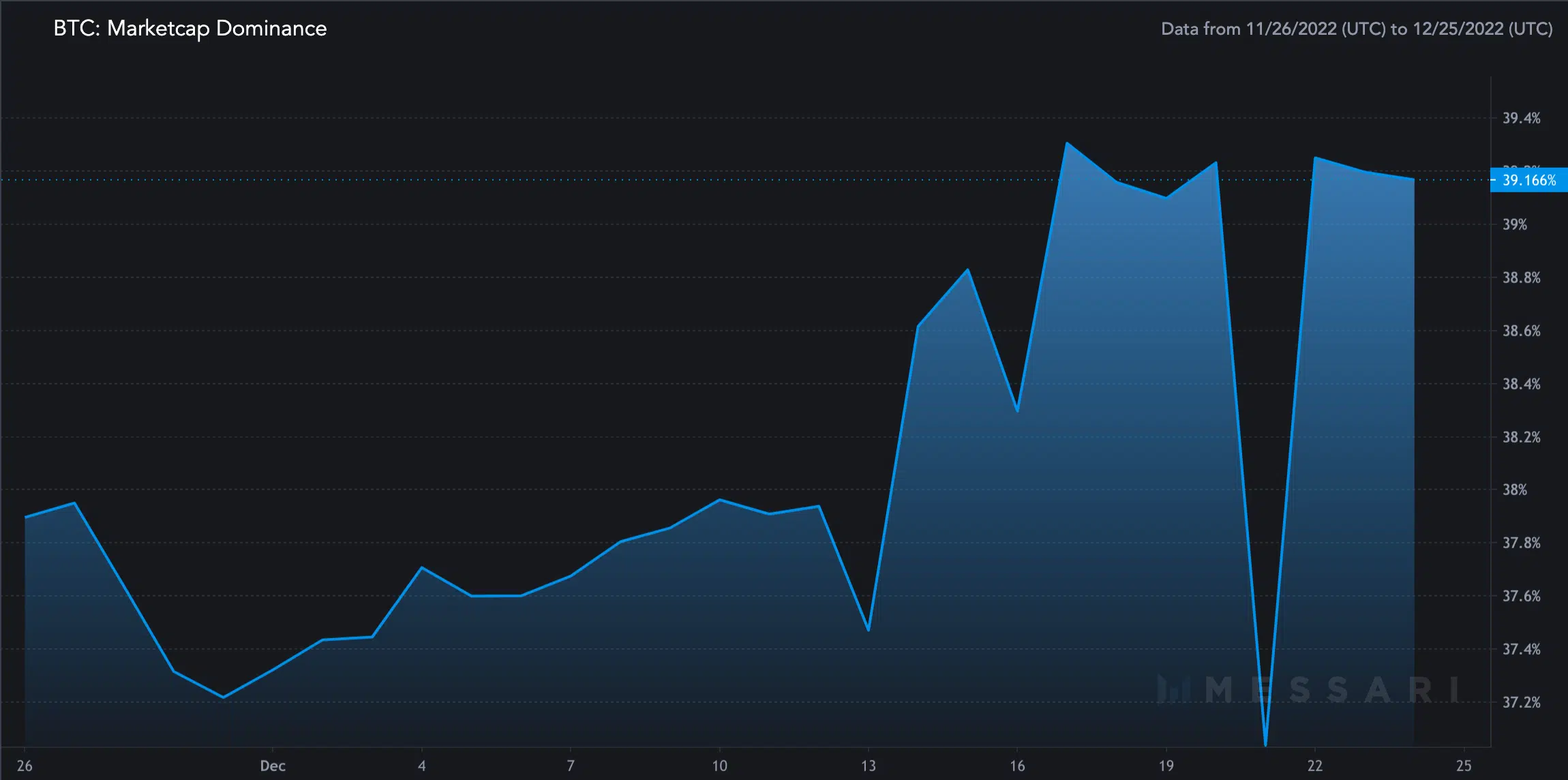

Bitcoin’s market cap dominance, however, was not affected by the lack of activity or trader sentiment. Over the last month, Bitcoin’s market cap dominance grew immensely. According to Messari’s data, Bitcoin had captured 39.16% of the overall crypto market.

How much Bitcoin can you get for $1?

Coupled with a growing market cap dominance, the volatility surrounding BTC fell by 59.51% according to Messari. This made buying BTC less risky for interested investors.

It is yet to be determined whether retail investors’ faith trumps the pessimistic view whales and traders are sharing.

At the time of writing, BTC was trading at $16,840.85 and its price had fallen by 0.03%.