Another reason why Bitcoin ‘should be on everyone’s portfolio’

Trust in fiat currency seems to be waning by the day, as billionaire investors keep turning to crypto as a hedge against current and future inflation. Over the past year, the likes of Michael Saylor, Bill Miller, Elon Musk, and Stanley Druckenmiller are just some in a long list of high-profile investors who have given bitcoin a considerable space in their investment portfolios.

In a recent interview, Ricardo Salinas Pliego, who is Mexico’s third wealthiest person, went as far as calling fiat currency fraudulent as holders tend to lose purchasing power due to devaluation caused by excessive money printing and inflation. Calling the Dollar a joke, Salians stated:

“Fiat is a fraud. I started my professional career in ‘81. The Peso was at 20 to $1. Today, we are at 20,000 to $1. That’s all there’s to know. And that’s here in Mexico because if we look at Venezuela, Argentina, or Zimbawe, the numbers lose all proportion. The fraud of fiat is something inherent to the fiat system, and we’re watching it happen in the USA. The monetary emission went to the moon, you understand. The Dollar as hard money is a joke.”

Contrastingly, his take on Bitcoin underscored his belief in fiat. The investor stated that the key to its success was its finite supply capped at 21 million coins. He further included Ethereum in his list of assets he ‘did not trust’, citing the same reason, as its unlimited supply could cause asset depreciation in the future. He added:

“I’ve invested a lot of time studying bitcoin and I think it’s an asset that should be part of every investor’s portfolio. It’s an asset that has value, international value, that is traded with enormous liquidity at a global level and that is enough reason for it to be part of every portfolio, period.”

The billionaire had announced in November last year that he had invested 10% of his liquid portfolio into bitcoin. He is estimated to be worth over $13 billion.

Latin American attraction to Bitcoin

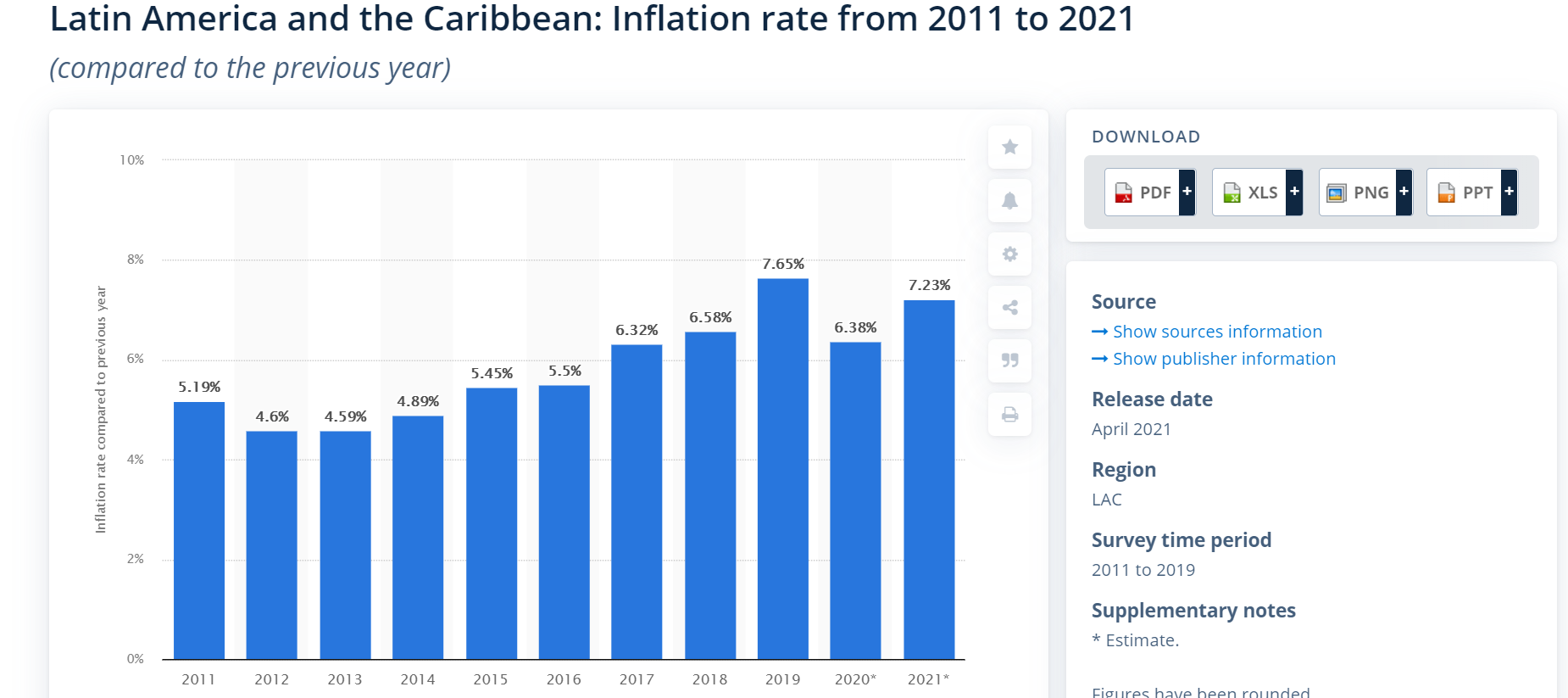

Latin American currencies have been plagued by hyperinflation over the decades, as governments have increasingly minted money artificially, negatively affecting the purchasing power of their citizens.

Source: Statista

It is no wonder then that these economies had started to embrace bitcoin very early on, with top crypto countries in 2019 being Brazil, Colombia, Argentina, and Mexico. While the American Fed has excessively expanded the amount of circulating U.S. dollars, El Salvador recently announced Bitcoin as legal tender, and neighbors such as Argentina, Panama, Paraguay, and Nicaragua had expressed similar interest.