Are Ethereum investors’ HODLing decisions bearing any fruit yet

Ethereum just underwent the London hard fork and its effects on the crypto’s price action will be something to look out for. However, until then, something interesting can be seen as far as investor behavior is concerned.

Are Ethereum investors looking good?

As a matter of fact, they are. Bitcoin HODLers are very common and they are known for being super bullish and they will HODL BTC until kingdom come. However, ETH holders seem to be in the same space right now.

Despite all the volatility the second-generation cryptocurrency has seen, ETH HODLers appear to be unfazed at the moment. In fact, since August 2020, HODLer (those who have held ETH for more than 1 year) stats have been climbing at a steady pace.

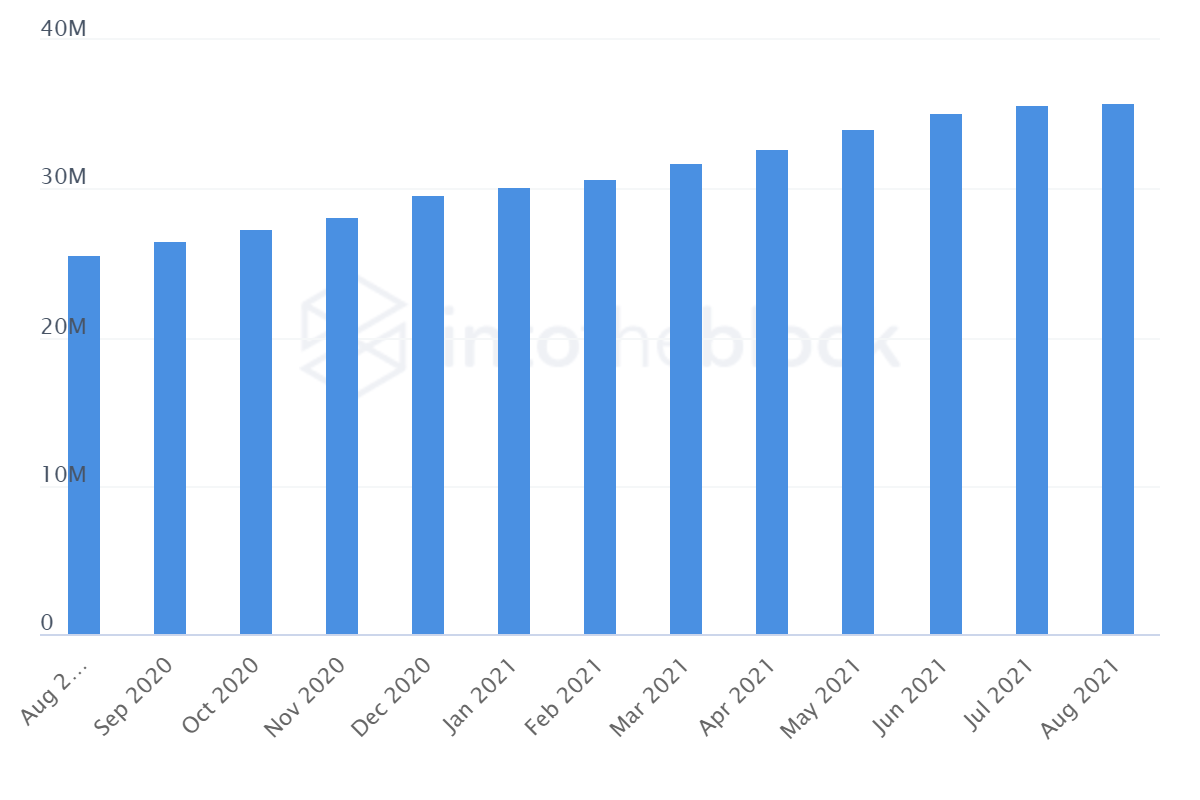

Ethereum HODLers now reach 36 million addresses | Source – Intotheblock – AMBCrypto

Back then, about 25.5 million addresses held Ethereum for an average time of 2.6 years. Right now, the average is up to 3.2 years and the total number of HODLer addresses has climbed to almost 36 million.

Additionally, this phenomenon has started having an impact on daily trades as well. For instance, exchange flow data seemed to suggest that outflows have been consistent in the market for over 10 months now. ETH can be HODLed in a wallet or a DeFi yield app, but this exit from exchanges is a bullish sign which signals profits.

Ethereum exchange flows | Source: Glassnode – AMBCrypto

How huge are the profits?

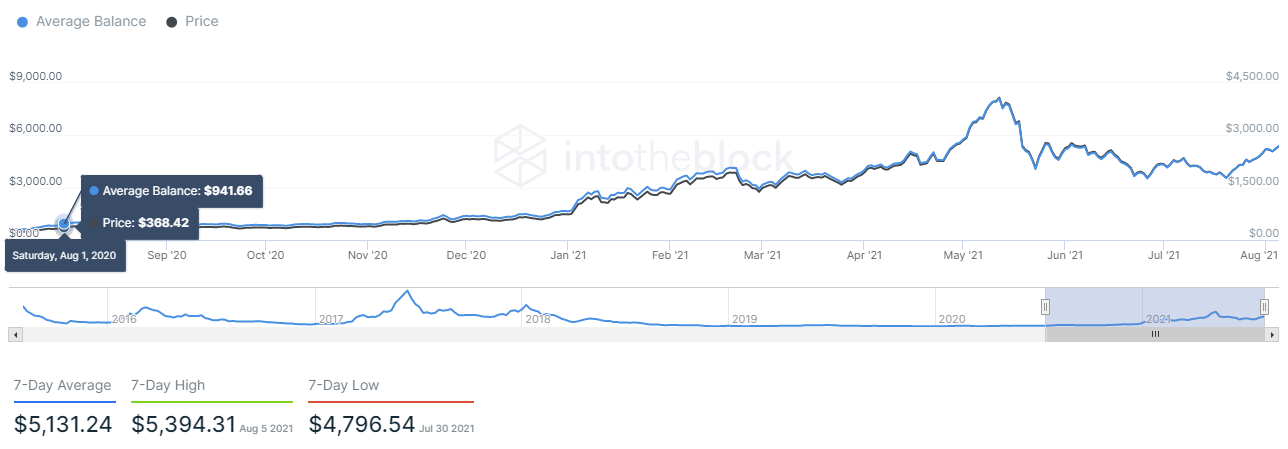

Pretty huge. This extrapolation is drawn from the fact that the average balance on every address is remarkably higher now, when compared to last year.

Currently, every address has an average balance of $5,131.This amount is a 418% hike from the previous balance of $989. A hike in participation and a steady price rise have both placed Ethereum investors in a good spot.

Ethereum Average balance up by 418% | Source: Intotheblock – AMBCrypto

Additionally, unrealized profits are also significantly higher than last year’s standing. A yearly comparison shows an increase in profitability, something that is the main focus of any investor.

The total supply in profit is also a factor that is important for a healthy market. At the moment, the same is at a 72-day high of 93.6%. This, combined with increasingly optimistic investor sentiment, puts ETH HODLers in a strong position.

Ethereum relative unrealized profits | Source: Glassnode – AMBCrypto

It will be interesting to see if any changes take place in these stats on the back of London. Investors, invest only after you research well.