Assessing DOT’s recovery path after significant growth on this front

- Polkadot social metrics underscored a growing interest in the network.

- However, DOT’s development activity stuck to its lows throughout April.

If you have been following up on blockchain networks leading in terms of development, you may have noticed that Polkadot is among them. This strong presence in the list of top networks in terms of development has not gone unnoticed.

Is your portfolio green? Check out the Polkadot Profit Calculator

One of the latest updates pertaining to the Polkadot network offered an overview of its social metrics in April. The findings revealed that the network achieved net positive growth in the last four weeks in key social metrics.

They include social mentions, dominance, engagement, and contributors. For example, social dominance was up by 97.8%, while Twitter volume grew by 100.5%.

?? Check out the latest Polkadot Monthly Social Metrics Overview!

There is a tremendous increase in:

✅ Social mentions

✅ Social Engagement

✅ Social Dominance

✅ Social ContributorsCheck the detail below #Polkadot #DOT pic.twitter.com/1O8TxDYFlS

— Polkadot Insider (@PolkadotInsider) May 2, 2023

Favorable social metrics are important because they underscore growing visibility to potential investors. But will the favorable social metrics have an impact on the demand for Polkadot and its native crypto DOT in the next few weeks? Well, multiple other factors come into play.

These Polkadot metrics paint a less inspiring picture

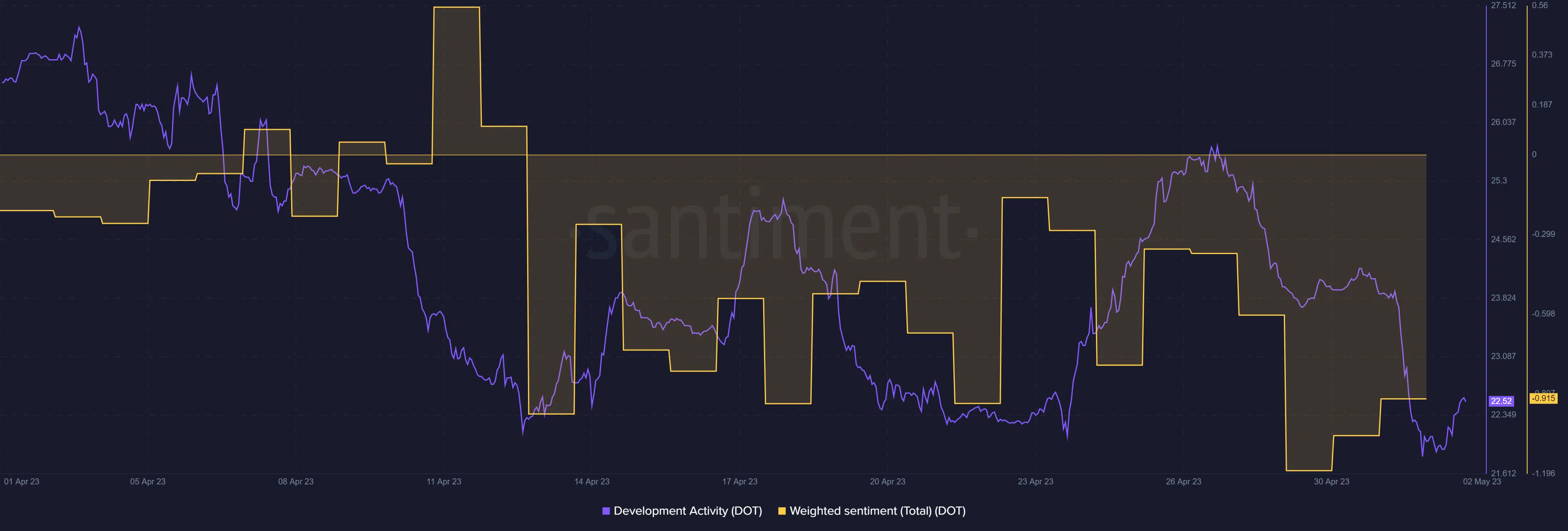

Polkadot’s development activity saw a bit of a slowdown in April and it kicked off May by falling to a new four-week low. Similarly, DOT’s weighted sentiment concluded April at its lowest monthly level.

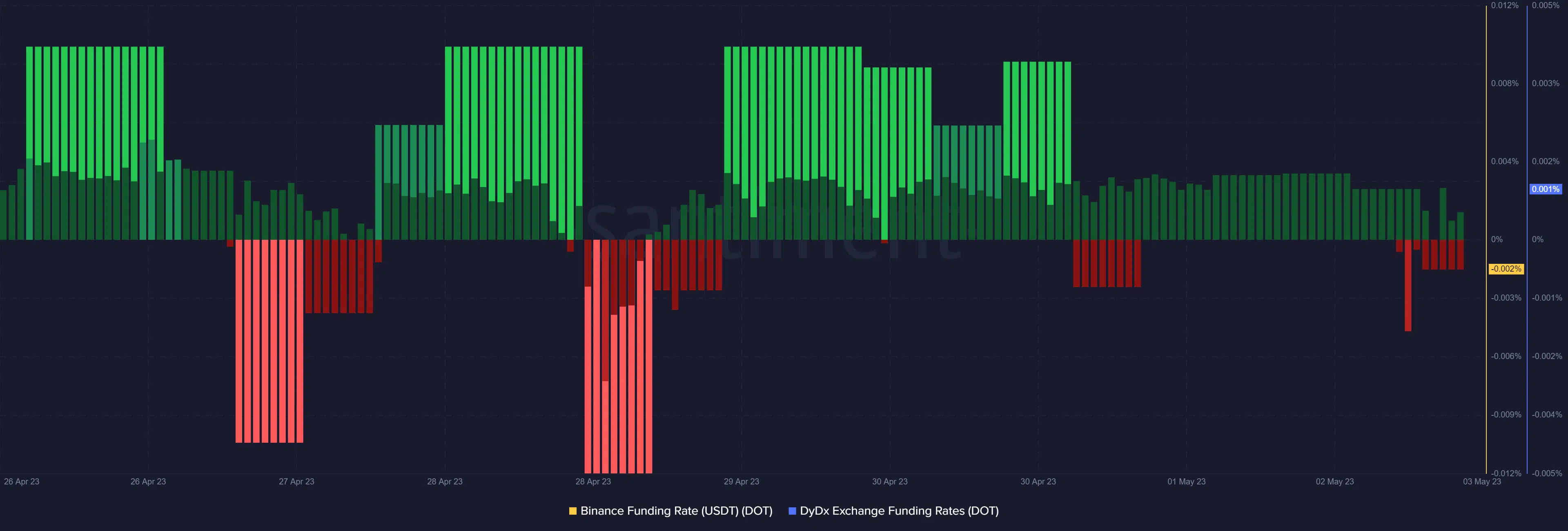

Both the weighted sentiment and development activity demonstrated some recovery after bouncing back slightly from their four-week lows. But will these findings have an impact on the demand for DOT? Binance and DYDX funding rates registered a drop into negative territory in the last 24 hours.

A key reason for this shift is that DOT kicked off the first day of May with a surge in long liquidations which ensured a bearish outcome. Aside from overall sell pressure, over $600,000 worth of long positions were liquidated compared to just slightly below $9,000 short liquidations.

As a result, more traders embraced short positions in an effort to take advantage of the subsequent downside as seen on Coinglass.

How many are 1,10,100 DOTs worth today

Note that the liquidations only account for just six popular exchanges, hence it does not provide the full scope of the potential liquidations. Nevertheless, the selling pressure in the last few days ensured sub $6 prices. DOT traded at $5.73 at press time.

DOT’s latest price underscores the push and pull that has been going on between the bulls and the bears since the last week of April. In other words, Polkadot’s social metrics have not had much of an impact on DOT’s price action.