Assessing the odds of Uniswap recovering from Solana’s ‘flippening’

The flippening debate in the crypto-space has, by and large, revolved around Bitcoin and Ethereum. Bitcoin maximalists, on one hand, believe that no alt can dethrone it. On the other hand, Ethereum proponents outrightly advocate that the flippening is only a matter of when and not if.

This debate aside, the crypto-space witnessed yet another flippening recently. Uniswap, one of the industry’s largest DeFi protocols, was overthrown by Solana a few days back. Notably, UNI is no more a part of the prerogative top 10 crypto-assets.

At the time of writing, CMC’s data highlighted that Solana’s value had appreciated by more than 76% over the past week while Uniswap’s price slumped by over 2%. Ergo, the larger question at this stage remains – Can Uniswap recover from this flippening?

Signs of a reversal

Well, at the time of writing, the general sentiment of the market towards Uniswap was fairly neutral, indicating the token’s recovery. The MVRV ratio, for starters, dropped down to 103% when the flippening happened. However, it has gradually been able to rise back over the last couple of days. The same shared a value of 126.65%, at the time of writing.

This hike essentially means that Uniswap HODLers are currently earning more money in the market than during the 17-18 August period.

The number of large transactions (>$100,000 each) also parallelly witnessed an increase from 159 to 231 over the past week. In terms of volume, the number rose from 1.22 million tokens to 8.3 million tokens.

Curiously, this data, when coupled with the 2% weekly drop in price, suggested that there have been more trades on the sell-side over the past few days.

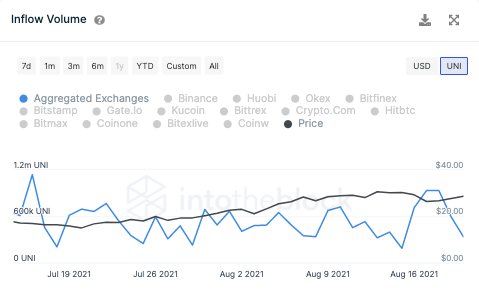

However, the aforementioned trend seemed to be reversing, with the same underlined by the drop in exchange inflow volume. Yesterday, the aggregative inflow volume had a value of 591.3k UNI tokens. At the time of writing, however, the same stood at merely 334.1k.

Usually, when the inflows reduce on exchange platforms it is inferred that tokens are moving into private wallets or cold storage. The same is indicative of a rise in demand or buy-side pressure. This essentially has the tendency to push UNI’s price up in the coming days.

UNI’s funding rate has risen over the past 24 hours as well. The same was visible on exchanges like Binance and Phemex that recorded upticks from 0.02% and 0.01% to 0.05% and 0.03%, respectively.

This was a sign of traders being mostly bullish about the foreseeable prospects of the crypto.

Can the flippening reverse itself?

Well, at this stage, anything can happen. As can be seen from the attached chart, the market cap difference has gradually been narrowing down. Even though the functionality of both these projects is different, their respective utility and use cases are quite robust.

Hence, it would be interesting to wait and watch how things unfold in the coming days.